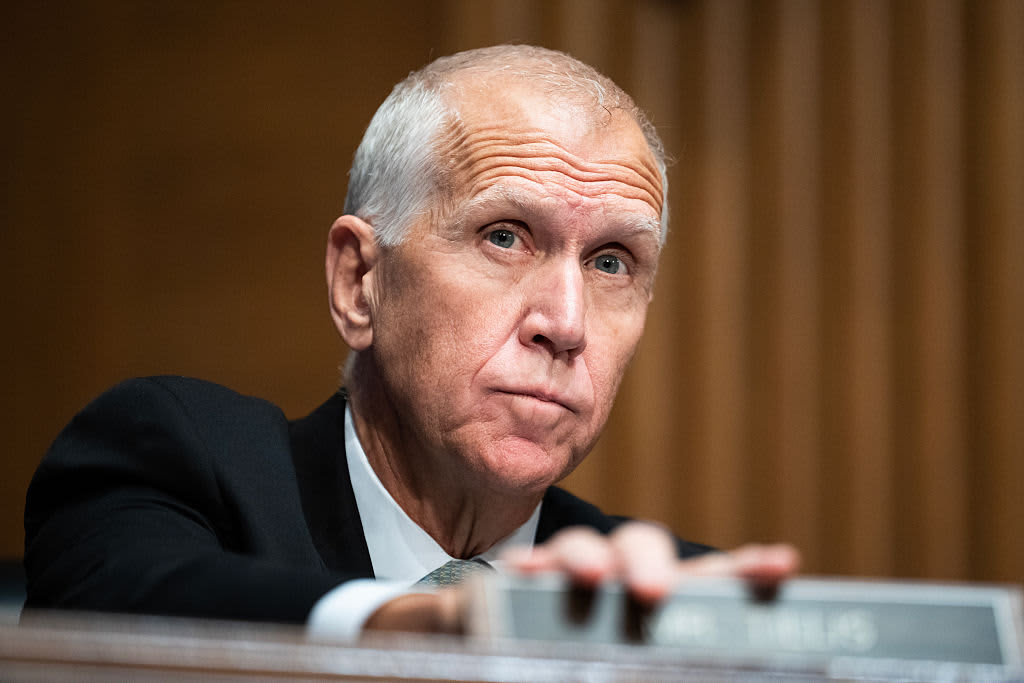

The delicate equilibrium between executive authority and the independence of the United States Federal Reserve has reached a historic breaking point, as Senator Thom Tillis (R-N.C.) announced a decisive blockade against all upcoming White House nominees to the central bank. This legislative maneuver, emerging from one of the President’s own party members, signals a profound constitutional and economic standoff that threatens to decapitate the leadership of the world’s most influential financial institution at a moment of heightened global volatility. The catalyst for this friction is a burgeoning Department of Justice (DOJ) investigation into sitting Fed Chair Jerome Powell, an inquiry that critics argue is less about legal merit and more about a systematic effort to erode the wall separating monetary policy from partisan politics.

Senator Tillis, a key member of the Senate Banking Committee, articulated his position with a gravity that underscores the stakes for global markets. By vowing to oppose any nominee—including a successor for the Chair position—until the DOJ’s probe into Powell is resolved, Tillis has effectively created a legislative bottleneck. The math of the Senate Banking Committee is unforgiving; with a narrow 13-11 Republican majority, a single GOP defection creates a 12-12 stalemate, effectively killing any nomination before it can reach the Senate floor. Tillis, who is not seeking re-election, appears to be leveraging his "lame duck" status to act as a self-appointed guardian of the Fed’s technocratic autonomy.

The investigation into Powell, led by U.S. Attorney Jeanine Pirro, centers on allegations of perjury related to previous congressional testimony. However, the timing and the personnel involved have invited intense scrutiny from economic historians and legal scholars alike. Powell has publicly characterized the probe as a "pretext" designed to facilitate a White House takeover of interest-rate policy. This sentiment was echoed by Tillis, who suggested that the very "independence and credibility of the Department of Justice" are now under a cloud of suspicion. For the broader economy, the prospect of a politically motivated DOJ being used to clear the way for a more compliant Fed Chair represents a "black swan" event for institutional stability.

Central bank independence is not merely a bureaucratic preference; it is a fundamental pillar of modern macroeconomics. The logic, supported by decades of empirical data, is that elected officials face a natural incentive to demand lower interest rates to stimulate short-term growth and employment, often at the expense of long-term price stability. When a central bank loses its ability to say "no" to a sitting President, inflation expectations often become unanchored. Historical precedents, such as the pressure President Richard Nixon exerted on Fed Chair Arthur Burns in the early 1970s, serve as a cautionary tale; that era’s erosion of Fed autonomy contributed to the "Great Inflation," a decade of economic stagnation that was only broken by the painful, high-interest-rate regime of Paul Volcker.

The current impasse comes at a precarious time for the Federal Reserve’s leadership structure. Jerome Powell’s term as Chair is set to expire in May, though his term as a Governor extends until 2028. Beyond the Chairmanship, the board is facing significant churn. Governor Stephen Miran’s term concludes in January, and rumors of early retirements—including Vice Chair Philip Jefferson—have circulated through Washington’s financial corridors. If Tillis maintains his blockade, the Fed could be forced to operate with a skeleton crew of governors, or under an "acting" chair, a scenario that would likely inject significant "uncertainty premiums" into the U.S. Treasury market.

The reaction from the other side of the aisle has been equally pointed, albeit from an unlikely source. Senator Elizabeth Warren (D-Mass.), a frequent and vocal critic of Powell’s regulatory record, has found herself in an unusual alignment with Tillis. While Warren previously labeled Powell a "dangerous man" for his stance on bank deregulation, she has reacted with alarm to the DOJ’s criminal probe. Warren accused the administration of attempting to turn the Fed into a "sock puppet" and using the Justice Department as a tool of executive overreach. This bipartisan concern, though rooted in different ideologies, suggests a growing consensus in the Senate that the sanctity of the Fed’s structure outweighs individual policy disagreements.

Global markets have begun to price in the risk of this institutional friction. The "Fed independence premium"—the trust investors place in the U.S. dollar and Treasuries because they believe the Fed will fight inflation regardless of political pressure—is a cornerstone of the dollar’s status as the world’s reserve currency. If that trust is compromised, the cost of borrowing for the U.S. government could rise as international investors demand higher yields to compensate for the risk of a politically managed currency. Comparisons are already being drawn to emerging markets where central bank independence was dismantled, such as Turkey or Argentina, where such moves were followed by currency devaluations and runaway inflation.

The White House, meanwhile, has been moving forward with a shortlist of five candidates to replace Powell, signaling an intent to announce a nominee by the end of the month. Potential candidates are reportedly being vetted not just for their economic acumen, but for their alignment with the administration’s broader economic philosophy of aggressive growth and domestic industrial revitalization. However, any nominee, no matter how qualified, now faces a gauntlet in the Senate Banking Committee that may be impossible to navigate so long as the DOJ investigation remains active.

The legal dimension of this conflict adds a layer of complexity rarely seen in American economic governance. The use of a criminal probe to target a sitting Fed Chair is unprecedented in the post-war era. If the investigation proceeds, it could lead to a protracted legal battle that keeps the Fed’s leadership in a state of suspended animation. Powell has signaled he does not intend to resign quietly, noting that "no one is above the law" but framing the investigation as part of a "broader context of ongoing pressure" from the executive branch. This sets the stage for a constitutional showdown over whether a President can effectively remove a Fed Chair "for cause" via the indirect route of a criminal investigation.

The economic impact of a leaderless or politically compromised Fed cannot be overstated. The central bank is currently navigating a "soft landing" for the U.S. economy, attempting to bring inflation down to its 2% target without triggering a recession. This requires precise, data-driven calibrations of the federal funds rate. If the market perceives that rate decisions are being made to satisfy the White House’s political calendar rather than economic data, the Fed’s forward guidance—a key tool in its arsenal—becomes useless.

As the May deadline for the Chairmanship approaches, the pressure on the Senate Banking Committee will only intensify. Senator Tillis’s stance has placed him at the center of a storm that involves the future of the American economy, the limits of executive power, and the integrity of the judicial system. His insistence on resolving the legal matter before proceeding with confirmations creates a cooling-off period that the administration likely did not anticipate. Whether this leads to a compromise or a total breakdown in the nomination process will determine the trajectory of U.S. monetary policy for the next decade.

In the final analysis, the standoff is a reminder that the "independence" of the Federal Reserve is not a self-executing law, but a set of norms protected by the legislative branch. By breaking ranks, Tillis has signaled that those norms are under threat and that the Senate remains the final check on the politicization of the nation’s money supply. For investors, policymakers, and the public, the coming months will be a masterclass in the friction between political will and institutional stability, with the credibility of the U.S. financial system hanging in the balance.