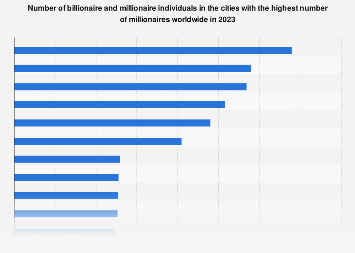

As of 2023, New York City stands as the undisputed global leader in accumulating high-net-worth individuals, boasting the highest concentration of millionaires and billionaires worldwide. This financial powerhouse outpaces all other metropolises, attracting and nurturing an unparalleled ecosystem for wealth creation and preservation. The city’s dominance in this regard is not a new phenomenon but rather a continuation of its long-standing status as a preeminent global financial hub.

The landscape of global wealth is increasingly concentrated in a select few urban centers, with New York City at the apex. Data from various wealth intelligence reports consistently place the Big Apple at the forefront, underscoring its magnetic pull for the world’s affluent. This concentration is a multifaceted phenomenon, driven by a unique confluence of factors including its robust financial services sector, extensive opportunities in technology and innovation, thriving real estate market, and a dense network of multinational corporations. These elements collectively create an environment where substantial wealth can be generated, managed, and expanded.

Beyond New York, other prominent cities also command significant attention in the global wealth hierarchy. London, a historical financial capital, consistently ranks among the top contenders, benefiting from its established banking infrastructure and its role as a gateway to European markets. Tokyo, despite recent economic shifts, retains a strong presence, underpinned by its advanced manufacturing, technology sectors, and a deeply ingrained culture of savings and investment. Singapore, a rapidly ascending financial center in Asia, is increasingly recognized for its business-friendly policies, political stability, and strategic location, attracting substantial foreign investment and a growing number of high-net-worth individuals. Hong Kong, while facing its own set of challenges, remains a crucial nexus for capital flows into and out of mainland China, securing its position among the world’s leading wealth hubs. Los Angeles, driven by its entertainment industry and burgeoning tech scene, and San Francisco, synonymous with Silicon Valley’s innovation engine, also feature prominently, showcasing the diverse drivers of wealth accumulation.

The economic implications of such wealth concentration are profound and far-reaching. Cities that attract a high density of millionaires and billionaires often experience a ripple effect across their economies. These individuals, and the companies they lead, contribute significantly to local tax revenues, funding public services, infrastructure development, and social programs. Furthermore, their presence stimulates demand for high-end goods and services, creating jobs and opportunities in sectors ranging from luxury retail and hospitality to private banking and specialized legal services. The concentration of venture capital and private equity firms in these cities also fuels innovation and entrepreneurship, creating a virtuous cycle of economic growth.

However, this concentration of wealth can also present challenges. Rising housing costs, often exacerbated by the demand from affluent residents and investors, can lead to affordability crises for lower and middle-income populations, potentially increasing income inequality and social stratification. The strain on public infrastructure, from transportation to utilities, can also become more pronounced as the population of affluent individuals and their associated consumption patterns grow. Managing these dualities – fostering wealth creation while ensuring equitable access to resources and opportunities – is a critical governance challenge for these leading global cities.

Examining the trends in millionaire and billionaire migration offers further insights into the evolving global economic landscape. While established financial centers like New York and London continue to hold sway, emerging economic powerhouses in Asia and the Middle East are witnessing a steady influx of wealthy individuals. This shift reflects a broader global rebalancing of economic power and a growing diversification of wealth creation centers. Factors such as favorable tax regimes, economic growth prospects, and quality of life are increasingly influencing where the ultra-wealthy choose to reside and invest. For instance, Dubai has emerged as a significant magnet for high-net-worth individuals seeking a dynamic business environment and a high standard of living. Similarly, cities in Australia and Canada are attracting a growing number of affluent immigrants.

The metrics used to define and count millionaires and billionaires themselves are subject to ongoing refinement. Typically, a millionaire is defined as an individual with net assets of US$1 million or more, excluding their primary residence. Billionaires, of course, possess net assets of US$1 billion or more. These definitions are crucial for tracking wealth trends and understanding the scale of economic disparity. While precise numbers fluctuate based on market conditions, currency exchange rates, and the methodologies employed by different research firms, the consistent ranking of certain cities highlights their enduring appeal and economic resilience. The aggregation of financial expertise, capital, and innovation within these urban enclaves creates a self-reinforcing mechanism that perpetuates their status as global wealth epicenters.

The future trajectory of wealth concentration will likely be shaped by a complex interplay of geopolitical events, technological advancements, and evolving economic policies. While the dominance of traditional financial centers may persist, the rise of new economic powers and the increasing mobility of capital and talent suggest that the global map of wealth is subject to continuous redrawing. Cities that can adapt to these changes, foster inclusive growth, and maintain a competitive edge in innovation and governance are best positioned to attract and retain the world’s wealthiest individuals and their significant economic contributions. The ongoing evolution of these urban wealth ecosystems offers a compelling barometer for understanding the broader shifts in the global economy.