The landscape of American consumer finance is facing a potential paradigm shift as political rhetoric pivots toward a direct intervention in the trillion-dollar credit card market. At the center of this burgeoning debate is a proposal to implement a federal cap on credit card interest rates, a move that has sent ripples through the boardrooms of major financial institutions and sparked a heated discourse among economists, policymakers, and consumer advocates. While the promise of lower rates offers immediate populist appeal in an era of persistent inflation, the structural implications for the banking sector—and the broader availability of credit—remain a subject of intense scrutiny and concern.

For decades, the American credit card industry has operated under a deregulated framework that allows issuers to set interest rates based on market conditions, funding costs, and individual risk profiles. However, as the national average annual percentage rate (APR) hovers near record highs of 24% to 25%, the political pressure to provide relief to debt-burdened households has intensified. The proposal to mandate a 10% ceiling on these rates represents one of the most significant challenges to bank profitability and risk management strategies in the modern era.

The potential impact of such a policy is perhaps most acutely felt by institutions like Capital One, which has carved out a substantial market share by catering to a wide spectrum of borrowers, including those in the near-prime and subprime categories. Unlike premium lenders that focus almost exclusively on high-net-worth individuals who pay their balances in full each month, Capital One’s business model relies heavily on interest income generated from revolving balances. The bank’s pending acquisition of Discover Financial Services further complicates this picture, as it seeks to create a vertically integrated payments giant that could be uniquely exposed to drastic changes in the regulatory environment.

Market analysts suggest that a hard cap on interest rates would fundamentally break the risk-reward calculus that currently governs the credit industry. When banks lend money via credit cards, they are essentially providing unsecured loans. To account for the statistical certainty of defaults—particularly among lower-score borrowers—banks charge higher interest rates to offset potential losses. If a 10% cap were instituted, the "spread" between the cost of funds (what banks pay to borrow money) and the return on lending would shrink to a margin that might not cover the operational costs and default risks associated with millions of customers.

The immediate consequence of such a policy, according to economic impact studies, would likely be a significant "credit crunch." If banks cannot price for risk, they are historically inclined to stop lending to anyone perceived as a marginal risk. This could result in millions of Americans losing access to their credit lines or being denied new cards entirely. For the "unbanked" or "underbanked" populations, who rely on credit cards as a critical safety net for emergency expenses, the removal of this financial tool could drive them toward even less regulated and more predatory lending alternatives, such as payday loans or title pawning services.

From a macroeconomic perspective, the credit card industry is a massive engine of the U.S. economy. As of the latest data from the Federal Reserve, total outstanding credit card debt in the United States has surpassed the $1.1 trillion mark. The interest generated from this debt is a primary revenue driver for the "Big Four" issuers—JPMorgan Chase, Citigroup, Capital One, and Bank of America. A mandated reduction in APRs would likely result in a multi-billion dollar hit to annual earnings across the sector. Stock market volatility often follows such proposals, as investors recalibrate the long-term valuation of financial stocks in an environment of capped returns.

However, proponents of the cap argue that the current system allows for "excessive" profits at the expense of the working class. They point to the fact that while the Federal Reserve’s benchmark interest rate has fluctuated, credit card APRs have remained disproportionately high, often failing to track downward when the cost of borrowing for banks decreases. Consumer advocacy groups argue that a cap would force banks to become more efficient and stop relying on high-interest "revolvers"—customers who carry a balance—to subsidize the rewards and perks enjoyed by "transactors" who pay in full.

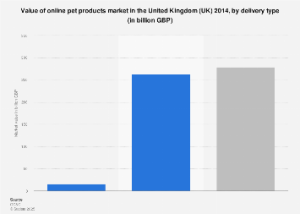

The debate also invites global comparisons. In many European jurisdictions and parts of the United Kingdom, interest rates on consumer credit are subject to stricter oversight or cultural norms that keep them significantly lower than U.S. averages. However, these markets also tend to have lower credit utilization rates and more stringent entry requirements for borrowers. The American model, by contrast, is characterized by high accessibility and high volume, fueled by a sophisticated credit-scoring infrastructure that allows for granular risk pricing.

Legal and constitutional hurdles to a federal interest rate cap are also substantial. Since the landmark 1978 Supreme Court decision in Marquette National Bank of Minneapolis v. First of Omaha Service Corp, nationally chartered banks have been allowed to "export" the interest rates of their home states to customers across the country. This led to a concentration of credit card operations in states like South Dakota and Delaware, which have little to no usury limits. Overturning this established order would likely require an Act of Congress rather than executive action alone, setting the stage for a protracted legislative battle and inevitable litigation from the banking lobby.

Furthermore, the banking industry is already grappling with a suite of other regulatory pressures. The Consumer Financial Protection Bureau (CFPB) has recently moved to slash credit card late fees from an average of $32 down to $8, a move the agency estimates will save consumers $10 billion annually. When combined with the proposed "Credit Card Competition Act," which aims to reduce interchange fees paid by merchants, the cumulative effect on bank revenue is profound. Industry executives argue that the combination of lower fees and capped interest rates would leave them with no choice but to eliminate popular rewards programs, cashback incentives, and free fraud protection services that consumers have come to expect.

In terms of market data, the credit card delinquency rate—the percentage of accounts 30 days or more past due—has been on a gradual upward trajectory over the past 24 months. This trend signals that consumers are already feeling the pinch of high rates and inflation. Banks have responded by increasing their loan-loss provisions, essentially setting aside billions of dollars to cover anticipated defaults. A forced reduction in interest income would happen at a time when banks are already bracing for a potential downturn in credit quality, creating a "perfect storm" for balance sheet instability.

Expert insights from the fintech sector suggest that a federal cap might accelerate the adoption of "Buy Now, Pay Later" (BNPL) services. These platforms, which often offer interest-free installments, have already begun to eat into the market share of traditional credit cards. If credit cards become less available due to banking restrictions, BNPL providers—who often operate under different regulatory frameworks—could see an unprecedented surge in users, further fragmenting the consumer lending market.

As the political cycle progresses, the rhetoric surrounding credit card rates will likely remain a centerpiece of economic platforms. For the average consumer, the allure of a 10% interest rate is undeniable, promising a faster path to debt freedom and more disposable income. For the financial sector, however, the proposal represents an existential threat to a long-standing profit engine and a disruption of the fundamental mechanics of the credit markets.

Ultimately, the resolution of this issue will depend on the balance between populist economic policy and the maintenance of a stable, liquid financial system. Whether a federal cap becomes reality or remains a potent campaign talking point, its mere discussion has forced a national reckoning over the cost of credit in America. As banks like Capital One navigate these turbulent waters, the outcome will define the future of consumer spending, the health of the banking industry, and the accessibility of the American Dream for the millions who rely on plastic to bridge the gap between their income and their aspirations.