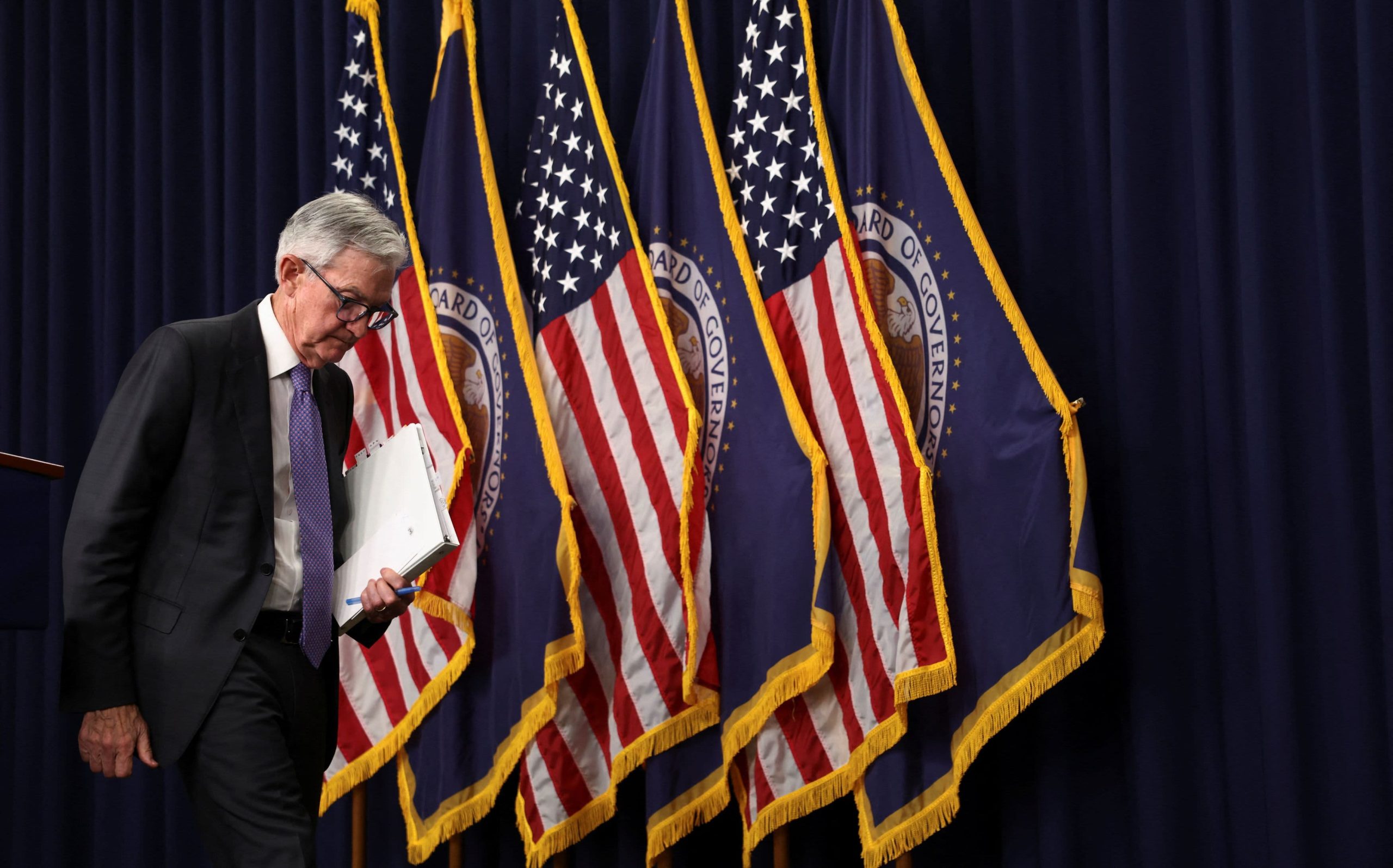

As the sun sets on the current leadership cycle of the world’s most influential central bank, a singular question has begun to dominate the corridors of power in Washington and the trading floors of Wall Street: What happens to Jerome Powell on May 15, 2026? While that date marks the official conclusion of his second four-year term as Chair of the Federal Reserve, it does not legally mandate his departure from the institution. Powell’s underlying 14-year term as a member of the Board of Governors does not expire until January 31, 2028. His refusal to clarify whether he will serve out those final two years as a regular governor has triggered a wave of speculation that touches on the very survival of the Federal Reserve’s century-old independence.

During the Federal Open Market Committee (FOMC) press conference in December, Powell remained characteristically enigmatic. When pressed on his post-chairmanship plans, he deflected with the practiced neutrality of a man who understands that every syllable he utters can move trillions of dollars in global assets. "I’m focused on my remaining time as chair," Powell stated. "I haven’t got anything new on that to tell you." This "no comment" is far more than a personal preference for privacy; it is a tactical positioning in an increasingly volatile political environment where the executive branch is seeking unprecedented influence over monetary policy.

The tension surrounding Powell’s decision is amplified by the unique political landscape of the second Trump administration. President Donald Trump has been vocal about his desire to have a more direct hand in interest rate decisions, frequently criticizing the Fed’s tightening cycles and suggesting that the president should have a "say" in the cost of borrowing. This has created a fundamental friction between the White House’s desire for "ultra-low" rates to stimulate growth and service a burgeoning national debt, and the Fed’s statutory mandate to maintain price stability and maximum employment.

In the world of central banking, precedent usually dictates a graceful exit. For decades, outgoing chairs have opted to resign from the Board of Governors entirely upon the expiration of their leadership terms. Ben Bernanke and Janet Yellen both followed this path, transitioning into academia, think tanks, or other government roles rather than remaining as "rank-and-file" governors. To find a different path, one must look back to 1948, when Marriner Eccles, the architect of the modern Fed, was demoted from the chairmanship by President Harry Truman but chose to remain on the board. Eccles used his remaining time to champion the 1951 Treasury-Fed Accord, which fundamentally separated the Fed’s monetary policy from the Treasury Department’s debt-management needs. Many institutionalists wonder if Powell sees himself in a similar "Ecclesian" role—a final guardian of the gate.

The mathematical reality of the seven-member Board of Governors makes Powell’s decision a zero-sum game for the Trump administration. Currently, the board features three Trump appointees. If Powell were to vacate his seat in May 2026, it would provide the President with an immediate opportunity to appoint a fourth member, potentially securing a loyalist majority. Such a shift could fundamentally alter the FOMC’s voting patterns. While the 12 regional Fed bank presidents also vote on interest rates on a rotating basis, the seven governors hold permanent votes and wield significant influence over the regulatory and administrative machinery of the central bank.

Market analysts are particularly concerned about the "fiscal dominance" argument. With the U.S. national debt surpassing $34 trillion and interest payments now rivaling the defense budget, the pressure on the Fed to keep rates artificially low is immense. If the Fed were to lose its independence and become an arm of the Treasury, inflation expectations could become "unanchored." Historically, when central banks lose autonomy, long-term bond yields often spike as investors demand a higher "inflation risk premium," potentially neutralizing the very benefits of the low rates the politicians sought in the first place.

The legal stakes are equally high, centered on the ongoing controversy surrounding Federal Reserve Governor Lisa Cook. The Trump administration’s attempt to remove Cook over disputed allegations has moved to the Supreme Court, with oral arguments scheduled for late January. The outcome of this case could redefine the "for cause" removal protections that have historically shielded Fed governors from political firing. If the Supreme Court rules that the President has broad authority to remove governors at will, Powell’s decision to stay or go might be rendered moot, as he would likely be the next target for removal. However, if the court upholds the Fed’s independence, Powell’s presence on the board could serve as a critical buffer against radical policy shifts.

Beyond the legalities, there is a profound human element to this saga. Jerome Powell, a 71-year-old lawyer and former private equity executive, has spent 13 years at the Federal Reserve. He has navigated the global economy through a once-in-a-century pandemic, the highest inflation in 40 years, and a relentless barrage of personal and professional attacks from the very man who first appointed him to the chair. Friends and associates describe him as a man who enjoys the simpler aspects of life—playing guitar, golfing, and spending time with his grandchildren. After over a decade of high-stakes crisis management, the allure of civilian life is undoubtedly strong.

Yet, Powell’s deep-seated loyalty to the Federal Reserve as an institution cannot be overstated. Throughout his tenure, he has been a staunch defender of the "non-political" Fed, often citing the importance of making decisions based on data rather than the electoral calendar. Some observers suggest that Powell is using his silence as a form of leverage. By keeping the White House in the dark about his intentions, he may be signaling that his departure is contingent on the quality of his successor. If the administration nominates a mainstream, qualified economist, Powell may feel comfortable stepping down. If the nominee is seen as a political partisan intended to dismantle the Fed’s autonomy, Powell might choose to stay as a dissenting voice and a procedural roadblock.

The global implications of this domestic struggle are vast. The U.S. dollar’s status as the world’s primary reserve currency is built on the foundation of the Federal Reserve’s credibility. International investors hold U.S. Treasuries because they believe the Fed will protect the value of the dollar from being eroded by political whim. If that trust is compromised, the "exorbitant privilege" of the dollar could be threatened, leading to higher borrowing costs for all Americans and a shift in the global financial order. Comparisons are often drawn to the Central Bank of the Republic of Turkey, where political interference led to hyperinflation and a collapsing currency, serving as a grim cautionary tale for those who would politicize monetary policy.

As the May 2026 deadline approaches, the "Powell Watch" will only intensify. His decision will not merely be a footnote in his biography; it will be a defining moment for the American economy. If he stays, he risks being viewed as a political actor, potentially drawing the Fed deeper into the partisan fray he seeks to avoid. If he goes, he leaves the door open for a potential transformation of the central bank into a tool of executive power. For now, Powell remains the "Sphinx of 20th and C Streets," holding his cards close to his vest and reminding the world that while presidents come and go, the laws governing the Federal Reserve—and the people who uphold them—remain the final line of defense for economic stability.