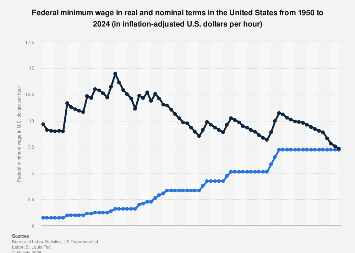

As of December 2024, the nominal federal minimum wage in the United States stands at $7.25 per hour. While this figure represents the stated minimum compensation mandated by federal law, its real value, adjusted for inflation, tells a starkly different story. Since its last increase in 2009, the purchasing power of the federal minimum wage has significantly diminished, representing a decline of approximately 20 percent in real terms. This erosion of value has profound implications for low-wage workers, economic inequality, and the broader economic landscape.

The federal minimum wage, established to provide a basic standard of living, has struggled to keep pace with the rising cost of goods and services. When examined through the lens of inflation, the $7.25 hourly rate in 2024 is substantially less valuable than it was even a decade ago. The Consumer Price Index (CPI) for All Urban Consumers, a common measure of inflation, has steadily climbed over the years, meaning that the same amount of money buys fewer goods and services than it did previously. This disconnect between the nominal wage and its real purchasing power is a critical economic challenge.

Tracing the historical trajectory of the federal minimum wage reveals a pattern of stagnation in its real value over extended periods. While nominal figures may fluctuate or remain static, the impact of inflation is a constant force that devalues accumulated earnings. In 1968, for instance, the federal minimum wage, when adjusted for inflation to 2024 dollars, would have been considerably higher than the current $7.25. This historical perspective underscores the long-term decline in the real minimum wage and its potential consequences for the economic well-being of American workers.

The implications of a declining real minimum wage extend beyond individual households. For businesses, particularly those in labor-intensive sectors, the discrepancy between nominal and real wages can influence hiring decisions, labor costs, and overall profitability. A stagnant real minimum wage might initially appear to offer businesses cost stability, but it can also lead to reduced consumer spending among low-income populations, who tend to have a higher propensity to spend their earnings on essential goods and services. This, in turn, can dampen aggregate demand and hinder economic growth.

Economists and policymakers have long debated the optimal level for the minimum wage. Proponents of raising the minimum wage argue that it can alleviate poverty, reduce income inequality, and stimulate the economy through increased consumer spending. They often point to studies that suggest modest increases have minimal negative employment effects, while significantly improving the lives of low-wage workers. Conversely, opponents express concerns that substantial hikes could lead to job losses, increased prices for consumers, and reduced competitiveness for businesses, especially small enterprises.

The United States is not alone in grappling with the issue of minimum wage policy. Many developed nations have minimum wage levels that are significantly higher in real terms than that of the U.S. For example, countries in Western Europe, such as France and Germany, often have statutory minimum wages that provide a more robust income floor. These international comparisons highlight that a $7.25 federal minimum wage is relatively low on a global scale when considering purchasing power parity and the cost of living in comparable economies. This suggests that the U.S. policy may be falling behind international benchmarks for worker compensation.

Furthermore, the impact of the federal minimum wage is not uniform across the country. Many states and cities have enacted their own minimum wage laws, often setting rates higher than the federal minimum. This creates a patchwork of wage regulations across the nation, with some workers in higher-cost-of-living areas benefiting from more generous local mandates, while others in states that adhere strictly to the federal minimum remain at a significant disadvantage. The discrepancy between federal and state-level minimum wages can exacerbate regional economic disparities.

The debate over the federal minimum wage is intrinsically linked to broader discussions about economic fairness, social mobility, and the future of work. As automation and technological advancements continue to reshape industries, the role of a minimum wage in ensuring a living wage becomes even more critical. Without adjustments that account for inflation and productivity gains, the federal minimum wage risks becoming increasingly out of step with the economic realities faced by a substantial segment of the American workforce.

The data on the real value of the federal minimum wage serves as a potent indicator of the challenges faced by low-wage workers in maintaining a decent standard of living. The continued erosion of its purchasing power underscores the persistent need for a policy re-evaluation that considers not only nominal figures but also the sustained impact of inflation and the evolving economic landscape. The decisions made regarding the federal minimum wage in the coming years will have significant repercussions for millions of Americans and the overall health of the U.S. economy.