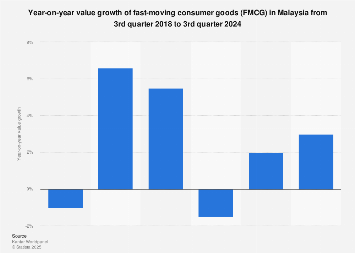

Malaysia’s Fast-Moving Consumer Goods (FMCG) sector is anticipated to experience a moderate expansion in value terms throughout 2024, reflecting a complex interplay of economic headwinds, evolving consumer preferences, and strategic industry responses. While precise figures remain proprietary, market intelligence suggests a trajectory of growth that, while not explosive, signifies resilience and adaptation within one of Southeast Asia’s most dynamic consumer markets. This projected uptick underscores the fundamental importance of FMCG products in the Malaysian economy and the ongoing efforts by manufacturers and retailers to navigate a challenging but opportunity-rich landscape.

The Malaysian FMCG market, a critical barometer of consumer spending power and daily life, encompasses a broad spectrum of products, from essential food and beverages to personal care items and household necessities. These are goods characterized by their high sales volume and relatively low cost, making them sensitive to fluctuations in disposable income, inflation, and consumer confidence. In 2024, the sector is operating within an environment shaped by several key economic forces. Global inflationary pressures, while potentially easing in some regions, continue to exert pressure on production costs and, consequently, retail prices. This dynamic forces consumers to make more considered purchasing decisions, often prioritizing value and essential items.

Despite these challenges, the underlying demographic and economic fundamentals of Malaysia provide a solid foundation for FMCG demand. The nation boasts a growing population and a burgeoning middle class, particularly in urban centers, which continues to drive consumption. Furthermore, government initiatives aimed at stimulating economic activity and supporting household incomes, where successful, can provide a much-needed boost to consumer spending. The resilience of the FMCG sector is also a testament to its non-discretionary nature; regardless of economic conditions, consumers will continue to purchase essential goods.

Within the broader FMCG landscape, certain segments are likely to exhibit stronger growth than others. The food and non-alcoholic beverage categories, forming the bedrock of consumer spending, are expected to remain robust. Consumers are increasingly seeking convenience, healthier options, and products that offer enhanced taste experiences. This trend is driving innovation in product formulation, packaging, and distribution. For instance, the demand for ready-to-eat meals, plant-based alternatives, and fortified beverages is on the rise, presenting opportunities for brands that can align with these evolving dietary habits and lifestyle choices.

The personal care and cosmetics segments are also poised for continued expansion, albeit with a nuanced focus. While basic toiletries remain a staple, there is a growing segment of consumers willing to spend more on premium skincare, beauty products, and wellness-oriented items. Factors such as increased digitalization, social media influence, and a greater awareness of personal grooming are contributing to this trend. Brands that can leverage digital marketing channels, emphasize natural ingredients, and offer personalized solutions are likely to capture a larger market share.

Conversely, the tobacco segment, while a significant contributor to FMCG revenue in many markets, faces unique regulatory and health-driven pressures. While data might indicate value growth due to price adjustments, volume growth in this category is often stagnant or declining in the face of public health campaigns and stricter controls.

The strategic responses of industry players are crucial to understanding the projected growth. Manufacturers are investing in supply chain optimization to mitigate rising input costs and enhance efficiency. This includes exploring local sourcing where feasible, adopting advanced manufacturing technologies, and improving logistics networks to ensure timely product availability. Retailers, in turn, are focusing on enhancing the in-store and online shopping experience, offering promotions and loyalty programs to retain customers, and expanding their private label offerings to provide more affordable alternatives. The ongoing digitalization of retail, with a significant surge in e-commerce and omnichannel strategies, is fundamentally reshaping how consumers access FMCG products. This digital transformation allows for greater data collection, enabling businesses to better understand consumer behavior and tailor their offerings more precisely.

Global comparisons offer valuable context. Many emerging markets in Southeast Asia are experiencing similar FMCG growth patterns, driven by demographic expansion and rising incomes. However, Malaysia’s relatively developed economy and sophisticated consumer base present a more mature market where differentiation and value proposition are paramount. Competition is intense, not only among established multinational corporations but also from agile local brands that possess a deep understanding of the Malaysian consumer.

The economic impact of the FMCG sector on Malaysia cannot be overstated. It is a significant employer, supporting jobs across manufacturing, distribution, retail, and agriculture. Its performance directly influences upstream industries, such as agriculture and packaging, and contributes substantially to the nation’s gross domestic product (GDP). A healthy FMCG sector translates to robust consumer spending, which is a vital engine for overall economic growth.

Looking ahead, the trajectory of Malaysia’s FMCG market in 2024 will be closely watched. While challenges persist, the inherent demand for everyday necessities, coupled with the industry’s capacity for innovation and adaptation, suggests a path of sustained, albeit measured, growth. The ability of businesses to effectively manage costs, respond to evolving consumer demands for convenience, health, and sustainability, and leverage digital channels will be key determinants of success in this dynamic marketplace. The market’s resilience will be tested, but its fundamental importance to the Malaysian economy ensures its continued relevance and a projected positive, though perhaps modest, expansion in value terms for the year.