The world’s appetite for agricultural commodities is projected to expand robustly over the next decade, with demand for key food staples set to rise considerably by 2034. This forecast, underscored by demographic shifts and changing dietary patterns across the globe, paints a picture of both opportunity and challenge for the international agricultural sector, food processors, and governments tasked with ensuring food security. The anticipated growth trajectory suggests a sustained upward pressure on prices and a critical need for enhanced productivity, sustainable practices, and resilient supply chains.

At the heart of this burgeoning demand is the inexorable rise of the global population. Projections from leading demographic institutions indicate that the world will host nearly 8.5 billion people by 2034, an increase of approximately 700 million from current estimates. This sheer expansion in human numbers directly translates into a greater need for basic foodstuffs. Grains, such as wheat, rice, and corn, which form the bedrock of diets for billions, are expected to experience a substantial uptick in consumption. Rice, in particular, is anticipated to see demand grow by an estimated 15-20% in key Asian markets where it remains a primary caloric source. Similarly, wheat consumption, vital for bread and other baked goods, is projected to rise by over 10% globally, with significant growth anticipated in Africa and the Middle East, regions often facing supply deficits.

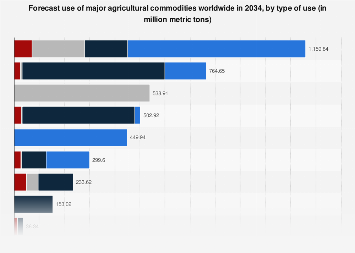

Beyond mere population growth, evolving dietary preferences are also acting as a powerful catalyst for increased commodity use. As incomes rise in emerging economies, particularly in Asia and sub-Saharan Africa, there is a discernible shift towards more diversified and protein-rich diets. This translates into higher demand not only for staple grains but also for oilseeds, such as soybeans and palm oil, which are integral to both food production and the burgeoning processed food industry. Soybeans, a crucial source of protein and oil, are expected to witness demand growth exceeding 25% by 2034, driven by increased consumption of meat and dairy products, as well as the expanding use of soy-based alternatives and ingredients. Palm oil, despite ongoing sustainability debates, is projected to maintain its status as the world’s most widely consumed vegetable oil, with demand expected to climb by roughly 18-23%, fueled by its versatility in food products and industrial applications.

The livestock sector, a significant consumer of agricultural commodities, is also a key driver of this demand surge. As middle-class populations expand, so does their consumption of meat, poultry, and dairy products. This trend necessitates a proportional increase in the feed grains and oilseeds required to support livestock populations. For instance, the global demand for animal feed, largely composed of corn and soybeans, is projected to rise in tandem with meat production, potentially increasing by 20-25% over the forecast period. This creates a multiplier effect, where an increase in meat consumption leads to a disproportionately larger increase in the demand for the feed commodities that produce it.

The economic implications of this projected demand growth are multifaceted. For agricultural producers, it presents a significant opportunity for revenue generation and market expansion. Countries with substantial agricultural output, such as the United States, Brazil, Argentina, and Australia for grains and oilseeds, and Indonesia and Malaysia for palm oil, are well-positioned to benefit from increased global demand. However, this opportunity is accompanied by the challenge of scaling up production efficiently and sustainably. Rising input costs, including fertilizers, energy, and labor, could temper profit margins for farmers if not offset by commensurate increases in commodity prices. Market analysts predict that the sustained demand will likely lead to a gradual but consistent upward trend in the prices of key agricultural commodities, although volatility will remain a characteristic feature due to weather patterns, geopolitical events, and trade policies.

Global comparisons highlight the uneven distribution of both demand growth and production capacity. While developed nations may see more moderate increases in staple food consumption, their demand for higher-value agricultural products and processed foods, which rely on a wider array of commodities, is expected to remain strong. Conversely, the most significant increases in demand for basic food staples will originate from developing regions. Sub-Saharan Africa, with its rapidly growing population and increasing urbanization, is projected to be a major growth market for grains and edible oils. Similarly, South Asia and Southeast Asia will continue to be critical demand centers, driven by their large populations and the ongoing transition towards more diversified diets.

The challenge of meeting this escalating demand sustainably is paramount. Climate change poses a significant threat, with unpredictable weather patterns, increased frequency of extreme events like droughts and floods, and rising temperatures impacting crop yields and livestock health. This necessitates a greater focus on climate-resilient agricultural practices, including the development of drought-tolerant crop varieties, improved water management techniques, and precision agriculture technologies. Furthermore, concerns over land use, deforestation, and water scarcity require innovative solutions and responsible stewardship of natural resources. The agricultural sector will need to achieve higher yields on existing land rather than expanding into ecologically sensitive areas.

Technological advancements are poised to play a crucial role in addressing these challenges. Precision agriculture, utilizing data analytics, sensors, and automation, can optimize resource use, improve crop yields, and reduce environmental impact. Biotechnology, including genetic modification and gene editing, offers the potential to develop crops that are more resistant to pests, diseases, and environmental stresses, thereby enhancing productivity and reducing reliance on chemical inputs. The adoption of these technologies, however, will require significant investment, knowledge transfer, and supportive policy frameworks, particularly in developing countries.

The role of international trade and policy will also be critical. Ensuring smooth and predictable trade flows for agricultural commodities is essential to balance supply and demand across regions. Protectionist measures or trade disputes can disrupt supply chains, lead to price spikes, and exacerbate food insecurity in import-dependent nations. International cooperation on issues such as food safety standards, agricultural subsidies, and trade liberalization will be vital to foster a stable global food market. Furthermore, governments will need to implement policies that support smallholder farmers, promote sustainable land management, and invest in rural infrastructure to enhance agricultural productivity and resilience.

In conclusion, the outlook for agricultural commodity use through 2034 is one of sustained and significant growth. This expansion, driven by fundamental demographic forces and evolving consumer behaviors, presents a complex landscape of economic opportunities and considerable environmental and societal challenges. Navigating this future will require a concerted effort from producers, policymakers, researchers, and consumers worldwide to foster innovation, embrace sustainability, and ensure that the world’s growing population can be nourished reliably and equitably. The choices made today in agricultural investment, policy, and practice will shape the global food system for decades to come.