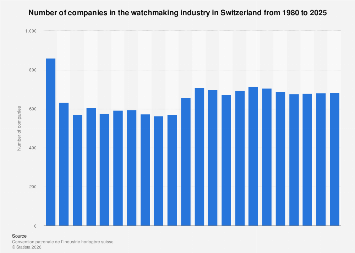

The Swiss watchmaking industry, a global bastion of precision, luxury, and heritage, has experienced a profound transformation in the number of its constituent companies over the past four decades. From the early 1980s to the projected landscape of 2025, the sector has navigated significant economic shifts, technological advancements, and evolving consumer demands, leading to a discernible trend of industry consolidation. While precise figures for the most recent years remain proprietary, historical data and expert analyses suggest a substantial reduction in the sheer volume of independent watchmaking entities, even as the sector’s overall economic footprint and global market dominance have largely endured, and in many segments, strengthened.

The period spanning 1980 to the mid-1990s was a watershed moment for Swiss watchmaking, often referred to as the "Quartz Crisis." The advent of affordable, battery-powered quartz watches, primarily from Japan, threatened to decimate the traditional mechanical watch industry. Many smaller, less adaptable Swiss manufacturers succumbed to the pressure, unable to compete with the cost-effectiveness and perceived accuracy of quartz movements. This era marked the first significant wave of consolidation, as larger, more resilient companies either acquired struggling rivals or saw them disappear from the market altogether. The emphasis shifted from mass production of mechanical timepieces to a renewed focus on high-end mechanical craftsmanship, innovation in materials, and the leveraging of brand heritage and prestige as key differentiators.

By the dawn of the 21st century, the industry had largely weathered the quartz storm. The remaining Swiss companies, having redefined their value proposition, began to experience a renaissance. The market for luxury mechanical watches grew, fueled by increasing disposable incomes in emerging economies and a global appreciation for artisanal quality and lasting value. However, this period also saw the emergence of new challenges and competitive pressures. Globalization meant increased competition from other luxury goods sectors, and the rise of smartwatches in the latter half of the 2010s presented a novel threat, albeit one that the Swiss industry has, in many ways, learned to coexist with, and even leverage.

The data, where accessible, points to a continued, albeit potentially decelerating, trend of fewer companies operating within the Swiss watchmaking ecosystem. Projections for 2025, based on available statistical trends, indicate a further decrease in the total number of registered watchmaking firms compared to the figures observed in 2019. This ongoing contraction is not necessarily a sign of weakness, but rather an indicator of the industry’s maturation and the economic realities of operating in a highly competitive and capital-intensive sector. The barriers to entry for establishing a new, independent watch brand capable of competing on a global scale are substantial, requiring significant investment in design, engineering, manufacturing capabilities, marketing, and distribution.

Several factors contribute to this persistent consolidation. Firstly, the increasing complexity and cost of research and development in horology necessitate significant financial resources. Innovations in materials science, intricate complications, and miniaturization demand constant investment. Larger, established groups possess the financial muscle to undertake these ambitious projects, while smaller, independent entities may find it increasingly difficult to keep pace. This is particularly evident in the high-complication segment, where technical prowess and historical expertise are paramount.

Secondly, marketing and distribution channels have become more sophisticated and globalized. Reaching a discerning international clientele requires substantial expenditure on brand building, digital marketing, and establishing a presence in key luxury markets worldwide. The cost of maintaining a global retail network, whether through owned boutiques or partnerships with authorized dealers, is considerable. Companies that can achieve economies of scale in these areas often gain a competitive advantage.

Thirdly, the pressure to maintain rigorous quality standards and certifications, such as the "Swiss Made" label, adds another layer of operational complexity and cost. Ensuring compliance with stringent regulations regarding manufacturing processes, component origins, and assembly requires meticulous attention to detail and ongoing investment in quality control.

Moreover, the rise of major luxury conglomerates has played a significant role. Groups such as Swatch Group, Richemont, and LVMH have strategically acquired a portfolio of iconic Swiss watch brands. This strategy allows them to benefit from brand synergies, share resources, and exert greater influence over the market. The financial stability and brand recognition of these conglomerates enable them to weather economic downturns and invest in long-term growth strategies, often absorbing smaller brands that might otherwise struggle independently. For example, Swatch Group, a diversified giant, encompasses a wide spectrum of brands from accessible to ultra-luxury, providing a unique business model that allows for cross-pollination of technologies and market strategies. Richemont, similarly, boasts a stable of prestigious names, each with a distinct heritage and market position, fostering a collaborative yet competitive internal environment.

The economic impact of this consolidation is multifaceted. While the number of companies may be declining, the overall value and export revenue generated by the Swiss watchmaking industry have seen remarkable growth. This suggests that the remaining companies are, on average, larger, more productive, and more successful in capturing higher-value market segments. The industry remains a significant contributor to the Swiss economy, providing high-skilled employment and generating substantial trade surpluses. The concentration of expertise and manufacturing within a smaller number of entities can also lead to greater efficiency and specialization, further enhancing the industry’s competitive edge.

Global comparisons highlight the enduring dominance of Swiss watchmaking. Despite the rise of sophisticated smartwatches and growing competition from other luxury markets, Swiss mechanical watches continue to command a premium and a significant share of the global luxury watch market. Countries like Japan and Germany also have strong watchmaking traditions and produce excellent timepieces, but Switzerland has successfully cultivated a unique brand identity built on centuries of craftsmanship, innovation, and perceived exclusivity.

The trend of consolidation is unlikely to reverse in the near future. The economic realities of the luxury goods market, coupled with the high costs of innovation and global marketing, favor larger, well-capitalized entities. However, this does not preclude the existence and success of niche, independent watchmakers. A select few, often built around exceptional craftsmanship, unique design, or a compelling brand narrative, continue to thrive by catering to collectors and enthusiasts willing to pay a premium for rarity and artistry. These independents often operate outside the mainstream, focusing on limited production runs and direct engagement with their clientele.

Looking ahead to 2025 and beyond, the Swiss watchmaking industry will likely continue to be characterized by a core group of dominant luxury brands and conglomerates, supported by a smaller, albeit vital, ecosystem of highly specialized independent manufacturers. The narrative is not one of decline, but of adaptation and refinement. The industry’s ability to maintain its reputation for excellence, coupled with strategic investments in innovation and marketing, will be crucial in navigating future economic cycles and evolving consumer preferences, ensuring that the allure of Swiss timepieces endures for generations to come.