Canada, a long-standing titan in the global uranium supply chain, is experiencing a renewed focus on its mining sector as international interest in nuclear energy intensifies. The nation, home to some of the world’s richest uranium deposits, particularly in the Athabasca Basin of Saskatchewan, is strategically positioned to capitalize on a projected uptick in demand for this critical mineral. While specific production figures by individual mine for 2024 are often proprietary and subject to commercial agreements, the overarching trend indicates a sector preparing for significant activity, driven by a global energy transition that increasingly views nuclear power as a vital component of a low-carbon future.

The impetus for this renewed interest is multifaceted. Geopolitical shifts, coupled with ambitious climate targets set by numerous nations, are compelling governments and energy providers to re-evaluate their energy portfolios. Nuclear power, with its consistent baseload generation capabilities and significantly lower carbon emissions compared to fossil fuels, is emerging as a more attractive option. This paradigm shift is directly impacting the demand for uranium, the essential fuel for nuclear reactors. According to various industry forecasts, the global demand for uranium is expected to climb steadily over the next decade, creating a fertile ground for established producers like Canada to expand their operations and explore new prospects.

Canada’s position in the global uranium market is historically robust. The country has consistently ranked among the top producers, known for its high-grade ore bodies that contribute to lower extraction costs and a competitive edge. The Athabasca Basin, in particular, is renowned for its exceptional uranium concentrations, making it a prime location for exploration and development. Mines in this region have historically been some of the most productive globally, and while operational specifics are often guarded, the underlying geological advantages remain a significant asset. The concentration of high-grade deposits means that even with fewer mining operations compared to some other resource-rich nations, Canada can maintain substantial output.

The economic implications of a revitalized uranium sector for Canada are substantial. Beyond the direct revenue generated from mining and export, the industry supports a considerable number of high-skilled jobs, particularly in resource-dependent regions like Saskatchewan. This includes employment in exploration, mining, processing, transportation, and ancillary services. Furthermore, the increased activity can stimulate investment in infrastructure, research and development, and advanced technologies related to uranium extraction and processing. For communities heavily reliant on resource extraction, a resurgence in uranium mining can translate into significant economic diversification and improved living standards.

Globally, the landscape of nuclear energy is undergoing a transformation. While the sector faced challenges in the aftermath of incidents like Chernobyl and Fukushima, a new wave of investment and development is underway. Countries like China, India, and several in Eastern Europe are expanding their nuclear fleets, while others, such as the United Kingdom and France, are committed to maintaining or increasing their reliance on nuclear power. The development of Small Modular Reactors (SMRs) is also gaining traction, promising more flexible and potentially cost-effective nuclear power generation, which could further boost uranium demand. These SMRs, while smaller in scale, still require a consistent supply of nuclear fuel, underscoring the ongoing importance of countries like Canada in the global supply chain.

However, the uranium industry is not without its complexities and challenges. Environmental stewardship and regulatory compliance are paramount. Uranium mining, like any extractive industry, requires stringent adherence to environmental protection protocols to minimize impact on land, water, and air. Canada’s regulatory framework is well-established and aims to ensure responsible mining practices, but ongoing vigilance and investment in sustainable technologies are crucial. Public perception and social license to operate also play a significant role, necessitating transparent communication and engagement with local communities and stakeholders.

Market dynamics present another layer of complexity. Uranium prices are subject to global supply and demand fluctuations, influenced by geopolitical events, reactor construction schedules, and government policies. While current trends suggest an upward trajectory, the market can be volatile. Companies operating in the sector must navigate these price uncertainties while making long-term investment decisions. The concentration of global uranium production in a few key countries, including Canada, Kazakhstan, and Australia, also means that supply chain disruptions in any of these regions can have a ripple effect on global prices and availability.

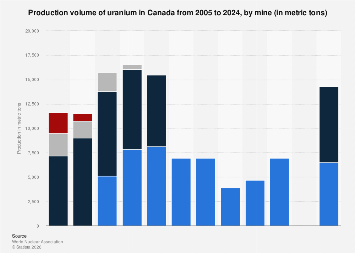

In Canada, the operational status of key mines is a critical indicator of production levels. Companies like Cameco, a major player in the Canadian uranium landscape, operate several significant mines, including McArthur River/Key Lake and Cigar Lake, which are known for their high-grade operations. The strategic decisions made by these companies regarding production levels, exploration investments, and mine restarts directly influence Canada’s overall output. The decision to restart or ramp up production at certain mines is often contingent on favorable market conditions, including sustained uranium prices that justify the significant capital expenditure involved.

Beyond large-scale mining operations, exploration activities are also crucial for the long-term health of Canada’s uranium sector. Junior exploration companies are actively surveying and assessing new potential deposits across the country, particularly in Saskatchewan and Ontario. While the success rate for exploration is inherently low, these efforts are vital for discovering future mines and ensuring a sustained supply of uranium for decades to come. Government support for geological surveys and a streamlined, yet rigorous, permitting process can foster a more dynamic exploration environment.

The international context for Canadian uranium is also shaped by trade agreements and non-proliferation treaties. Canada is a signatory to numerous international agreements that govern the peaceful use of nuclear energy and the export of nuclear materials. Maintaining strong relationships with countries that operate nuclear power programs, and ensuring adherence to international safety and security standards, are critical for Canada’s continued role as a reliable global supplier.

In conclusion, while precise mine-by-mine production data for 2024 remains within the commercial domain, the broader economic and geopolitical forces at play signal a period of potential growth and resurgence for Canada’s uranium sector. The global pivot towards cleaner energy sources, coupled with Canada’s inherent geological advantages, positions the nation to play a pivotal role in supplying the world with this essential nuclear fuel. Navigating the environmental, market, and regulatory landscapes will be key to unlocking the full potential of this strategically important industry.