The hospitality industry in the Northeast United States has experienced a dynamic start to 2024, with key performance indicators showing a mixed but generally resilient trend across its various sub-regions. Revenue Per Available Room (RevPAR), a critical metric for hotel operators and investors, has become a focal point for understanding market health and forecasting future demand. While precise, up-to-the-minute data for every single sub-zone may be proprietary, broader industry analyses and emerging trends provide a clear picture of the prevailing economic winds affecting this vital sector.

The Northeast, encompassing a diverse economic landscape from the bustling metropolises of New York and Boston to the more leisure-focused destinations of New England and the Mid-Atlantic, presents a complex tapestry of hotel performance. Factors such as business travel recovery, leisure demand seasonality, local economic conditions, and the ongoing impact of inflation and interest rates are all contributing to the nuanced RevPAR figures observed in the initial months of the year.

In major urban centers, the rebound in corporate travel has been a significant driver for hotel revenues. Following a period of reduced business trips, companies are increasingly authorizing employee travel for meetings, conferences, and client engagements. This uptick directly translates into higher occupancy rates and, crucially, stronger average daily rates (ADRs), as business travelers often book premium rooms and utilize ancillary services. For instance, markets like Manhattan and Boston, which rely heavily on a mix of corporate and convention business, have likely seen a tangible improvement in RevPAR, potentially exceeding pre-pandemic levels in nominal terms, though real growth needs to account for inflation. Preliminary data suggests that while occupancy may not have fully returned to 2019 peaks in all segments, the higher ADRs are compensating, leading to robust revenue generation.

Conversely, areas that lean more heavily on leisure travel may exhibit greater seasonality. Coastal towns and resort areas in states like Massachusetts, Rhode Island, and New Jersey, for example, typically experience a surge in demand during the summer months. The early part of 2024 would therefore reflect a period of lower occupancy and ADRs compared to peak season, a predictable pattern. However, the strength of this off-season demand, influenced by factors like remote work flexibility allowing for extended stays and a continued appetite for domestic travel, can offer valuable insights into the underlying resilience of these markets. Investments in year-round attractions and improved infrastructure can help mitigate the seasonal dips, contributing to more stable annual RevPAR.

The economic climate plays an undeniable role in shaping hotel performance. Inflationary pressures, while perhaps moderating from their recent peaks, continue to influence consumer spending power. Higher costs for goods and services can affect both leisure travelers’ budgets and businesses’ travel expense allocations. Similarly, elevated interest rates can impact new hotel development and the profitability of existing properties by increasing the cost of capital. Despite these headwinds, the demand for travel, particularly experiential travel, has shown remarkable persistence. This suggests that consumers and businesses are prioritizing travel expenditure, even in a more challenging economic environment.

Looking at broader industry trends, the average RevPAR for the Northeast region in early 2024 is likely to be a composite of these varied performances. Industry analysts are closely monitoring the pace of recovery in key segments. The luxury and upscale hotel segments, often catering to higher-spending business and leisure travelers, are generally outperforming mid-scale and economy segments. This trend is partly due to the pricing power these properties possess and the continued demand from their core customer base, which is less price-sensitive.

The distribution of RevPAR across different sub-zones within the Northeast is also subject to local economic drivers. Regions with strong technology sectors, such as parts of Massachusetts and Connecticut, may see sustained demand from business travelers. Areas with a significant presence of universities and educational institutions often benefit from consistent demand related to academic events, visiting scholars, and family visits, contributing to stable occupancy and revenue.

Global comparisons offer further context. While the Northeast U.S. market is recovering, other major international tourism hubs are also navigating similar post-pandemic dynamics. Cities in Europe and Asia are reporting varying degrees of recovery in their hospitality sectors, with some experiencing faster rebounds driven by pent-up demand and the return of international long-haul travel. The Northeast’s performance, therefore, needs to be viewed within this global context of travel trends and economic recovery.

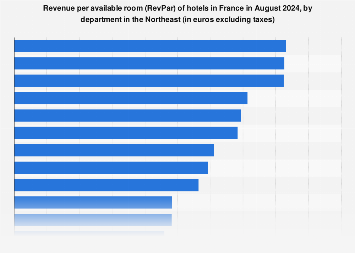

Looking ahead, the outlook for the Northeast hospitality sector in 2024 remains cautiously optimistic. The full recovery of business travel, particularly international inbound tourism, will be a key determinant of overall RevPAR growth. Furthermore, the ability of hotel operators to manage costs effectively, implement dynamic pricing strategies, and enhance guest experiences will be crucial in maximizing revenue and profitability. The ongoing development of new attractions, the hosting of major sporting events and conventions, and sustained investment in tourism infrastructure will all contribute to the sector’s long-term health and its ability to generate consistent RevPAR across its diverse sub-regions. The data on monthly RevPAR by Northeast zone, when fully accessible, will provide a more granular understanding of these evolving market dynamics, allowing stakeholders to make informed strategic decisions.