The wholesale electricity market in the Czech Republic is navigating a complex landscape, with projections indicating a period of relative stabilization following significant price volatility. While precise figures for future wholesale electricity prices remain subject to market dynamics and global energy trends, available forecasts suggest a moderate upward trend through 2026. Industry analysts point to a confluence of factors, including energy transition policies, geopolitical influences, and supply chain adjustments, that will shape the trajectory of electricity costs for consumers and businesses alike.

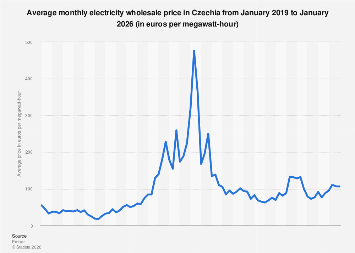

Historical data reveals a dramatic surge in Czech electricity prices, peaking in August 2022, a period characterized by heightened global energy insecurity. This surge was largely attributed to the ripple effects of the conflict in Ukraine, which disrupted natural gas supplies and sent shockwaves through international energy markets. The interconnectedness of European energy grids meant that price spikes experienced in one region often translated to others, impacting countries like Czechia that rely on a diverse energy mix. The subsequent decline from these peaks, while welcomed, has left many stakeholders scrutinizing the underlying causes and seeking greater predictability.

Looking ahead, preliminary projections for the latter half of 2025 and into 2026 offer a glimpse into the anticipated market conditions. While specific month-by-month figures are typically proprietary data, broader market analyses suggest that the average wholesale electricity price in December 2025, for instance, is expected to settle within a range that reflects a more balanced supply and demand equilibrium compared to the extreme highs of 2022. This projected moderation is underpinned by several key developments.

One significant driver is the ongoing expansion of renewable energy sources across Europe, including in Czechia. Investments in solar, wind, and other clean energy technologies are gradually increasing the share of non-fossil fuel generation, which can help to decouple electricity prices from the volatile global markets for coal and natural gas. While the transition is not without its challenges, such as grid integration and intermittency, the long-term trend points towards a more diversified and potentially less price-sensitive energy supply.

Furthermore, efforts to bolster energy security and diversify import sources are playing a crucial role. European nations, including Czechia, have been actively seeking alternative suppliers for natural gas and other essential energy commodities. Strategic investments in liquefied natural gas (LNG) terminals and the development of new pipeline infrastructure are aimed at reducing over-reliance on any single source, thereby mitigating the risk of supply-driven price shocks.

The European Union’s ambitious climate agenda, particularly the Green Deal, also continues to influence the energy market. Policies aimed at decarbonization, energy efficiency, and the promotion of sustainable energy production are creating a framework that, while potentially leading to short-term adjustments, is designed to foster long-term price stability and environmental sustainability. The phasing out of coal, a significant component of Czechia’s current energy mix, represents a substantial undertaking that will require careful management to ensure a smooth transition without compromising energy security or affordability.

Economic analysts emphasize that while the overall trend may be towards stabilization, regional and global economic conditions will remain critical determinants of electricity prices. A slowdown in global economic growth could dampen energy demand, potentially leading to lower prices. Conversely, a robust economic recovery, particularly in major energy-consuming regions, could exert upward pressure on prices. The ongoing evolution of energy trading mechanisms and the increasing sophistication of market forecasting tools are also contributing to a more nuanced understanding of these complex interdependencies.

The impact of these price dynamics extends beyond the wholesale market, directly influencing industrial consumers and households. Businesses, particularly those with high energy intensity, face ongoing pressure to manage their energy expenditures. This can manifest in decisions regarding production levels, investment in energy-efficient technologies, or even relocation to regions with more favorable energy cost structures. For households, electricity bills represent a significant portion of disposable income, and fluctuations in wholesale prices can have a tangible effect on living costs. Governments and regulatory bodies are thus tasked with striking a delicate balance between market liberalization, consumer protection, and the strategic imperative of ensuring a secure and sustainable energy future.

Comparisons with other European nations highlight the shared challenges and diverse approaches to energy market management. While some countries have a higher penetration of renewable energy, others are more reliant on fossil fuels or nuclear power, each presenting unique price dynamics and transition pathways. The European Network of Transmission System Operators for Electricity (ENTSO-E) plays a vital role in coordinating cross-border electricity flows and ensuring grid stability across the continent, further illustrating the interconnected nature of European energy markets.

The projected figures for 2026, while indicating a move away from the extreme volatility of recent years, underscore the continued importance of strategic energy policy. Investments in grid modernization, the acceleration of renewable energy deployment, and the prudent management of existing energy infrastructure will be crucial in navigating the path towards a more predictable and affordable energy future for Czechia and the wider European region. The ongoing commitment to energy diversification and the pursuit of climate objectives will continue to shape the contours of this essential market for years to come.