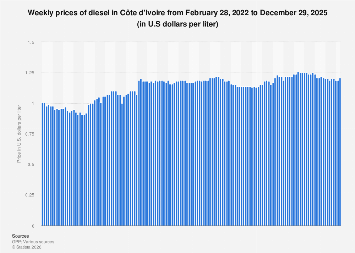

The price of diesel fuel in Côte d’Ivoire, a crucial commodity for transportation, industry, and agriculture across West Africa, has shown a period of relative stability nearing the end of 2025, according to recent market observations. As of December 29, 2025, the retail price of diesel stood at approximately $0.95 U.S. dollars per liter. This figure translates to roughly 570 West African CFA francs (XOF), reflecting the dominant currency in the West African Economic and Monetary Union (WAEMU).

This sustained price point represents a significant period of consistency. For much of 2025, specifically from March 31st onwards, the local currency equivalent had remained unchanged at an estimated 580 XOF per liter. However, a slight downward adjustment occurred in the latter half of the year, with prices easing to approximately 575 XOF per liter from September 1, 2025, before settling at the year-end figure.

The trajectory of diesel prices in Côte d’Ivoire, and by extension, its impact on regional economic activity, is a complex interplay of global crude oil markets, local refining capacities, government subsidies or taxes, and currency exchange rates. While specific figures for the entire period from February 28, 2022, to December 29, 2025, are subject to proprietary data access, the available information points to a dynamic pricing environment that has recently found a more settled footing.

Global Influences and Local Realities

Globally, diesel prices are intrinsically linked to the benchmark prices of crude oil. Fluctuations in Brent and West Texas Intermediate (WTI) crude, influenced by geopolitical events, OPEC+ production decisions, global demand trends, and the pace of the energy transition, directly filter down to refined product prices. For a net oil importing nation like Côte d’Ivoire, these international price movements are a primary driver. However, domestic policies and infrastructure play a crucial role in mediating these effects.

The West African CFA franc (XOF) is pegged to the Euro, meaning its value relative to the U.S. dollar is influenced by the Euro’s performance on foreign exchange markets. Currency depreciation against the dollar can make imported fuels more expensive in local currency terms, even if dollar-denominated crude prices remain stable. Conversely, a stronger Euro could help dampen imported fuel costs. The period observed, particularly the latter half of 2025, suggests a period where these currency dynamics, combined with stable international oil prices, contributed to the relative price consistency.

Economic Implications for Côte d’Ivoire and the Region

Diesel fuel is the lifeblood of many economic sectors in Côte d’Ivoire. Its price directly impacts:

- Transportation and Logistics: The cost of moving goods via trucks and other diesel-powered vehicles is a significant component of supply chain expenses. Stable diesel prices can lead to more predictable logistics costs, benefiting businesses and potentially consumers through more stable prices for goods. Conversely, volatility can create uncertainty and increase the cost of doing business.

- Agriculture: Many agricultural operations rely on diesel for tractors, irrigation pumps, and transportation of produce. Predictable fuel costs are essential for farmers to manage their input expenses and plan their planting and harvesting cycles effectively.

- Industry and Manufacturing: Factories and industrial facilities often use diesel generators as backup power or in areas where grid electricity is unreliable. Stable fuel prices are crucial for operational cost management.

- Fisheries and Maritime Activities: Coastal economies heavily dependent on fishing fleets, which predominantly use diesel engines, also feel the direct impact of fuel prices.

- Public Services: Public transportation, waste management, and emergency services often operate on diesel, making fuel prices a factor in municipal budgets and the cost of public services.

The stability observed in late 2025 offers a degree of predictability that is valuable for economic planning. Businesses can better forecast operating expenses, and the government can potentially implement more effective fiscal policies related to fuel subsidies or taxes without facing drastic price shifts.

Comparative Perspective: Regional and Global Trends

While specific comparative data for neighboring countries in 2025 is not detailed, Côte d’Ivoire’s diesel prices are generally in line with those seen in other WAEMU member states and indeed, many sub-Saharan African nations. Prices in these regions are often higher than in developed economies due to factors such as import reliance, logistical challenges in distribution, and varying levels of taxation and subsidies.

Globally, diesel prices can vary significantly. In early 2025, for instance, while Côte d’Ivoire was experiencing relative stability, other regions might have faced higher prices due to geopolitical tensions affecting oil supply routes, or increased demand during peak seasons. Conversely, periods of global economic slowdown can lead to decreased demand and lower prices worldwide.

The Ivorian government, like many in the region, faces the challenge of balancing the need to keep fuel prices affordable for its population and economy against the fiscal burden of subsidies and the imperative to align with international market realities. Decisions regarding fuel pricing policies, including the management of the fuel price equalization fund, are critical in mitigating volatility and ensuring economic stability.

Looking Ahead: Factors to Watch

As the world moves beyond 2025, several factors will continue to shape diesel prices in Côte d’Ivoire and the broader West African region:

- Global Energy Transition: The pace of adoption of electric vehicles and alternative fuels will gradually impact diesel demand, though its role in heavy-duty transport and industrial applications will likely persist for some time.

- Geopolitical Stability: Any disruption to major oil-producing regions or key shipping lanes can lead to rapid price spikes.

- Refining Capacity: Investments in local refining infrastructure, or conversely, the closure of refineries, can influence the availability and cost of refined products.

- Government Policy: Fiscal policies, including fuel subsidies, taxes, and import duties, will remain a significant determinant of the final pump price.

- Economic Growth: Strong economic growth in Côte d’Ivoire and its trading partners typically translates to higher energy demand, potentially putting upward pressure on prices.

The period of price stabilization observed in Côte d’Ivoire towards the end of 2025 provides a welcome respite, offering a foundation for more predictable economic planning. However, the inherent volatility of global energy markets and the specific economic and policy landscape of West Africa mean that close monitoring of these trends will remain essential for businesses, policymakers, and consumers alike. The ability to manage these fluctuations effectively will continue to be a key determinant of economic resilience and growth in the region.