The global market for flavors and fragrances is projecting a period of robust expansion in 2024, driven by a confluence of evolving consumer tastes, increasing demand from end-use industries, and technological advancements in ingredient development. This sector, often operating behind the scenes, plays a critical role in the consumer experience, shaping the appeal of everything from food and beverages to personal care products and household goods. Industry analysts anticipate a sustained upward trajectory, fueled by both emerging market opportunities and established market maturity in developed economies.

The intrinsic value of flavors and fragrances lies in their ability to enhance sensory appeal and create distinct brand identities. In the food and beverage sector, the demand for novel taste profiles, natural ingredients, and reduced sugar or salt content is reshaping product development. Consumers are increasingly seeking authentic and exotic flavors, mirroring global culinary trends and a desire for more adventurous eating experiences. This has led to a surge in demand for natural and nature-identical flavorings, moving away from purely synthetic compounds. For instance, the market for plant-based ingredients and botanical extracts is experiencing significant growth, driven by health-conscious consumers and a growing awareness of sustainability. According to market research firm Grand View Research, the global flavors and fragrances market size was valued at USD 31.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This projection suggests a market value well exceeding the current figures by 2024.

In the fragrance segment, the landscape is equally dynamic. Perfume houses and consumer goods manufacturers are responding to a growing demand for personalized scents and fragrances that align with individual lifestyles and values. The trend towards "clean beauty" and natural ingredients is extending into the fragrance industry, with consumers seeking products free from parabens, phthalates, and synthetic musks. This has spurred innovation in the development of sustainable sourcing practices for raw materials, such as ethically harvested essential oils and biodegradable aroma chemicals. Furthermore, the rise of niche perfumery and artisanal fragrances continues to capture consumer attention, offering unique olfactory experiences that differentiate themselves from mass-market offerings. Social media influence and the accessibility of online retail have also played a pivotal role in amplifying the reach of both established and emerging fragrance brands.

The industrial applications of flavors and fragrances are also a significant contributor to market growth. Beyond consumer products, these compounds are integral to the efficacy and appeal of industrial goods. In the pharmaceutical sector, flavors are used to mask unpleasant tastes in medications, improving patient compliance, particularly for pediatric formulations. Fragrances are incorporated into industrial cleaning products, air fresheners, and even functional materials to enhance user experience and mask undesirable odors. The demand for specialized aroma chemicals in technical applications, such as polymers and coatings, is also on the rise, indicating a diversified growth trajectory for the sector.

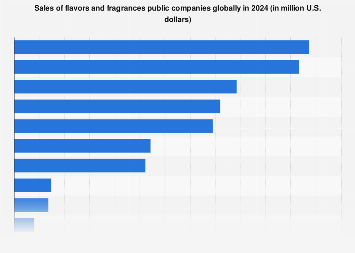

Key players in the flavors and fragrances industry, including Givaudan, Firmenich, IFF (International Flavors & Fragrances), and Symrise, are actively investing in research and development to stay ahead of market trends. These investments are focused on areas such as biotechnology for novel ingredient discovery, encapsulation technologies for enhanced longevity and controlled release of scents and tastes, and digital tools for consumer insights and product co-creation. Mergers and acquisitions also continue to be a strategic avenue for these companies to expand their product portfolios, geographical reach, and technological capabilities. For example, the merger of IFF and DuPont’s Nutrition & Biosciences business created a formidable entity with a broad spectrum of offerings, aiming to capitalize on synergies and market demand.

The economic impact of the flavors and fragrances industry extends beyond its direct market value. It supports a complex global supply chain, encompassing agriculture for raw material cultivation, chemical manufacturing for synthesis, and sophisticated R&D and marketing operations. The industry’s growth directly translates into job creation across these diverse sectors. Moreover, the innovation within flavors and fragrances often drives growth in adjacent industries, such as packaging, marketing, and retail. The ability to differentiate products through sensory appeal is a powerful competitive advantage, enabling brands to command premium pricing and build strong customer loyalty.

Geographically, Asia-Pacific is emerging as a significant growth engine for the flavors and fragrances market. Rapid urbanization, a burgeoning middle class with increasing disposable income, and a growing adoption of Western consumer lifestyles are driving demand for a wider range of flavored foods, beverages, and scented personal care products. Countries like China, India, and Southeast Asian nations present substantial untapped potential. However, regulatory landscapes and varying consumer preferences across different regions necessitate localized strategies for market penetration. North America and Europe remain mature markets with consistent demand, driven by innovation and a focus on premium and sustainable products.

Looking ahead, the industry faces certain challenges. Volatility in raw material prices, particularly for natural ingredients affected by climate change and agricultural yields, can impact profitability. Stringent regulatory frameworks regarding ingredient safety and labeling across different jurisdictions require continuous adaptation and compliance. Furthermore, the increasing consumer demand for transparency regarding ingredient sourcing and manufacturing processes puts pressure on companies to adopt ethical and sustainable practices throughout their value chains. The ongoing digital transformation, including the use of artificial intelligence in flavor and fragrance creation and consumer analytics, presents both opportunities and the need for strategic adaptation. The ability of companies to navigate these complexities, coupled with their capacity for innovation and responsiveness to evolving consumer desires, will be critical for sustained success in the global flavors and fragrances market throughout 2024 and beyond.