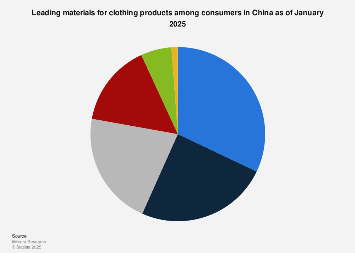

As of early 2025, cotton remains the undisputed king of textile materials for apparel purchases in China, a testament to its enduring appeal and versatility. A comprehensive survey conducted in January 2025, encompassing 1,722 respondents reached via online channels, revealed that a significant majority of Chinese consumers prioritize cotton for their clothing needs. While the exact percentage remains proprietary data, industry analysis suggests this figure comfortably surpasses the threshold of many other natural and synthetic alternatives, underscoring cotton’s foundational role in the vast Chinese fashion market.

The dominance of cotton is not surprising. Its inherent qualities – breathability, softness, hypoallergenic properties, and affordability – align perfectly with the everyday comfort and practicality sought by a broad spectrum of consumers. In a market as large and diverse as China, where the middle class continues to expand and disposable incomes rise, the consistent demand for reliable, comfortable fabrics like cotton provides a stable bedrock for the apparel industry. Furthermore, advancements in cotton cultivation and processing technologies, including organic and sustainable cotton initiatives, are likely contributing to its sustained popularity, appealing to a growing segment of environmentally conscious consumers.

However, the landscape of preferred materials is far from monolithic. Emerging from the survey data, synthetic fibers and silk/satin have solidified their positions as the second and third most favored material categories. Each of these segments captured the preference of over a substantial portion of respondents, indicating a significant and growing market share. This dual rise highlights distinct consumer drivers and market trends.

Synthetic fibers, a broad category encompassing polyester, nylon, spandex, and their various blends, owe their increasing appeal to a confluence of factors. Modern synthetic textiles offer enhanced performance characteristics that are increasingly valued by Chinese consumers. Durability, wrinkle resistance, ease of care, and rapid drying capabilities make them ideal for activewear, athleisure, and garments designed for demanding lifestyles. Moreover, technological innovations in synthetic fiber production have led to improved texture, drape, and comfort, effectively blurring the lines between synthetics and natural fibers in terms of feel. The affordability of many synthetic options also makes them accessible to a wider consumer base, particularly in fast fashion segments. Global market data indicates a steady increase in the production and consumption of synthetic fibers worldwide, and China, as a major manufacturing and consumption hub, is at the forefront of this trend. The sheer volume of polyester production, for instance, globally dwarfs that of most natural fibers, and its application in apparel continues to expand.

The inclusion of silk and satin among the top three materials signals a persistent demand for luxury, elegance, and traditional aesthetics. Silk, historically a symbol of prestige and refined taste in Chinese culture, continues to hold a special place in the consumer psyche. Its lustrous sheen, smooth texture, and natural hypoallergenic properties make it a desirable choice for higher-end apparel, formal wear, and intimate garments. Satin, often made from silk, polyester, or nylon, offers a similar glossy finish and luxurious feel, making it a popular choice for evening wear, lingerie, and decorative elements in clothing. The growing disposable income of Chinese consumers, particularly in urban centers, has fueled a demand for premium and luxury goods, and textiles like silk and satin are direct beneficiaries of this trend. Globally, the luxury fashion market, heavily reliant on premium materials, has shown remarkable resilience, and China represents a critical growth engine for this sector.

While cotton, synthetics, and silk/satin command the top positions, the broader apparel material market in China likely encompasses a diverse range of other fibers, each catering to specific niches and consumer preferences. Wool, known for its warmth and natural insulation, remains a staple for winter clothing, particularly in colder regions of China. Linen, prized for its breathability and natural texture, sees demand during warmer months. Rayon and other regenerated cellulosic fibers offer a balance of silk-like drape and cotton-like absorbency at a more accessible price point, making them popular for various apparel types. Blended fabrics, combining the strengths of different fibers, are also prevalent, allowing manufacturers to fine-tune performance and cost. For example, cotton-polyester blends offer the comfort of cotton with the durability and wrinkle-resistance of polyester.

The implications of these material preferences for the Chinese apparel industry are profound. For cotton producers and suppliers, the sustained high demand ensures a robust market. However, the industry faces ongoing challenges related to sustainability, water usage, and ethical sourcing, pushing for innovation in more eco-friendly cultivation and processing methods. For manufacturers of synthetic fibers, the increasing preference presents opportunities for growth, particularly in developing high-performance and sustainable alternatives. Investment in research and development for advanced synthetics, such as recycled polyester and bio-based polymers, is likely to be a key strategy. The luxury segment, driven by silk and satin, will continue to focus on premium quality, craftsmanship, and brand storytelling to cater to discerning consumers.

Economically, the material preferences directly influence sourcing, manufacturing, and retail strategies. China’s significant textile manufacturing base is equipped to handle the production of all these materials, but shifts in demand can necessitate adjustments in production capacities and technological investments. The dominance of cotton implies a continued reliance on its global supply chain, while the rise of synthetics aligns with China’s strong petrochemical industry. The burgeoning demand for luxury materials like silk could see a renewed focus on traditional silk production regions and the development of high-value silk-based products.

Looking ahead, the interplay between comfort, performance, luxury, and sustainability will likely shape the future of textile preferences in China. While cotton’s reign is unlikely to be challenged in the immediate future, the continued growth of synthetics, driven by technological advancements and performance demands, and the persistent allure of luxury fibers like silk, suggest a dynamic and evolving market. The industry’s ability to innovate, adapt to changing consumer values, and embrace sustainable practices will be crucial in navigating this complex and ever-changing textile landscape. The January 2025 survey provides a snapshot, but continuous monitoring of consumer sentiment and market trends will be essential for all stakeholders within China’s vast and influential apparel sector.