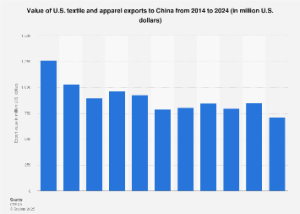

The financial sector across dynamic emerging economies, particularly in India, is grappling with a significant structural imbalance: a robust and accelerating demand for credit juxtaposed against a noticeably more subdued growth in deposit mobilization. This widening divergence has pushed the banking system’s incremental Credit-Deposit (CD) ratio—a critical metric tracking fresh loans relative to new deposits over a specific period—to an unprecedented 102% in 2025, a substantial leap from 79% just a year prior. Such a ratio, exceeding the 100% threshold, signals that financial institutions are extending more credit than they are able to attract through new deposits, compelling them to explore alternative, often more expensive, funding avenues to meet the burgeoning demand for capital.

This paradoxical situation underscores a fundamental shift in the funding dynamics for banks. While loan portfolios expand, fueled by economic recovery, corporate expansion, and a buoyant retail credit segment, the traditional bedrock of banking—low-cost, stable deposits—is proving increasingly elusive. As of mid-December 2025, credit off-take surged by approximately 11.7% year-on-year, a clear indicator of economic vitality and increased business and consumer confidence. In stark contrast, deposit growth lagged significantly, registering below 10% during the same period. This persistent gap necessitates a strategic pivot in how banks manage their balance sheets, impacting everything from funding costs and profitability to the broader transmission mechanism of monetary policy and the stability of bond markets.

The challenge of attracting deposits stems from multiple factors. Firstly, despite competitive pressures, the real returns on bank deposits have been less attractive compared to other investment avenues. Even as the Reserve Bank of India (RBI) implements policy rate adjustments, banks find themselves in a bind. They cannot drastically lower deposit rates without risking further erosion of inflows, as investors actively seek higher yields elsewhere. The weighted average domestic term deposit rates, for instance, saw a marginal uptick to 5.59% in November 2025 from 5.57% a month prior, though notably lower than the 6.47% recorded a year earlier. This indicates that while overall rates may have softened, banks are forced to maintain a floor on deposit rates due to intense competition.

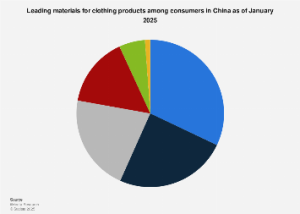

This competitive landscape for funds is further intensified by evolving investor preferences. A growing segment of the population, particularly retail savers, is diversifying their portfolios away from traditional bank deposits towards instruments perceived to offer superior returns or better liquidity. Mutual funds, direct equity investments, corporate bonds, government-backed small savings schemes, and even real estate have emerged as compelling alternatives, drawing capital that might traditionally have flowed into bank accounts. This "flight to alternatives" is a structural shift, reflecting increased financial literacy, broader market access, and a more sophisticated investor base seeking to optimize returns in a dynamic economic environment.

To bridge the funding gap, banks are increasingly resorting to a combination of strategies. A primary method involves tapping into capital markets through instruments like Certificates of Deposit (CDs). As Prakash Agarwal, a partner at Gefion Capital, highlighted, the reliance on such market-based instruments inevitably raises short-term funding costs for banks, which in turn contributes to elevated market rates across the board. These borrowings, while effective in securing immediate liquidity, come at a premium, directly impacting the banks’ cost of funds and, consequently, their net interest margins.

Another significant avenue for funding has been the strategic liquidation of excess Statutory Liquidity Ratio (SLR) holdings. Under regulatory mandates, banks are required to maintain a certain percentage of their Net Demand and Time Liabilities (NDTL) in specified liquid assets, primarily government securities (G-secs). While the current regulatory requirement stands at 18%, banks historically maintained higher holdings, often as a buffer or for investment purposes. As of the end of November 2025, banks’ SLR holdings were at a comfortable 26.2%. The ability to divest a portion of these excess holdings provides a readily available source of liquidity without directly impacting deposit rates or requiring immediate market borrowing.

However, this strategy is not without its repercussions. The continuous selling of government securities by banks to fund credit growth creates downward pressure on bond prices and, conversely, upward pressure on yields. A senior private sector bank official noted that even a 2% change in the CD ratio signifies a substantial quantum of G-secs being sold off without repurchase. This dynamic has a tangible impact on the broader fixed-income market. For instance, the yield on the benchmark 10-year government bond stood at 6.61%, marking an 11-basis-point increase since the RBI’s recent 25-basis-point repo rate cut. This counterintuitive movement underscores the significant influence of bank funding needs on government bond yields, potentially increasing borrowing costs for the government itself.

The implications for bank profitability, specifically Net Interest Margins (NIMs), are considerable. Brokerage firm Elara Securities expressed caution regarding deposit trends, noting that weaker flows at the industry level and persistently high incremental CD ratios could lead to "potential pressure on net interest margins of banks going forward." Even with healthy loan growth, if the cost of acquiring funds rises disproportionately, the profitability of lending activities diminishes. This scenario challenges banks to innovate not only in loan origination but also in their deposit products and customer engagement strategies to attract and retain stable funding.

Furthermore, the widening credit-deposit gap complicates the transmission of monetary policy. When the central bank cuts policy rates to stimulate economic activity, the expectation is that banks will follow suit, reducing lending rates for businesses and consumers. However, if banks are simultaneously struggling with deposit growth and facing higher funding costs from market borrowings, their ability to pass on these rate cuts to borrowers is constrained, except perhaps for loans directly linked to external benchmarks. This can dilute the effectiveness of monetary policy in influencing aggregate demand and investment.

Looking ahead, analysts anticipate these pressures to persist. Motilal Oswal Financial Services, in a January 2 report, projected system credit growth to remain robust, exceeding 12% year-on-year in FY26 and potentially rising to 13% in FY27. Conversely, deposit growth is forecast to remain steady at around 10% year-on-year for FY26. This outlook suggests that the funding gap is unlikely to narrow significantly in the near term, meaning banks will continue to rely on market instruments and their balance sheet buffers to sustain lending momentum.

However, a contrarian perspective suggests that the incremental CD ratio, while concerning, may not be the sole or definitive indicator of a bank’s liquidity health in the modern financial landscape. Neeraj Gambhir, Executive Director at Axis Bank, argued that the CD ratio is "a bit dated metric" because liquidity management at banks has evolved significantly, aligning with Basel-III liquidity norms such as the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). These comprehensive frameworks assess a bank’s ability to meet its short-term and long-term funding obligations under stress scenarios, taking into account a broader range of assets and liabilities beyond just deposits and loans.

Gambhir further explained that if banks are effectively able to raise resources through diversified channels other than traditional deposits, the CD ratio will naturally rise. This indicates a strategic shift in funding mix rather than an inherent liquidity crisis, as banks utilize these alternative resources to meet loan demand and compensate for deposit shortfalls. He also linked the rising CD ratio to the "higher institutionalization of deposits and its interplay with LCR rules," suggesting that as retail depositors diversify, institutional funding sources and sophisticated liquidity management become more pivotal.

This evolving dynamic is not unique to India. Many rapidly developing economies experience periods where credit demand outstrips the growth of traditional, low-cost deposits, particularly as financial markets deepen and alternative investment avenues proliferate. Countries like Vietnam or Indonesia, which have seen rapid economic expansion, have also faced similar challenges in balancing robust loan growth with stable funding. Regulators globally are increasingly focused on holistic liquidity frameworks like Basel III to ensure financial stability, recognizing that traditional metrics alone may not capture the full picture of a bank’s funding resilience.

For the Indian banking sector, this structural shift necessitates continued innovation in deposit mobilization, perhaps through digital-first strategies, personalized product offerings, and deeper financial inclusion efforts to tap into unbanked or underbanked populations. Simultaneously, banks must optimize their capital market access and enhance their treasury functions to manage funding costs effectively. The Reserve Bank of India also plays a crucial role in monitoring systemic liquidity, guiding banks through policy measures, and ensuring that the financial system remains robust amidst these evolving funding pressures.

In essence, the elevated incremental CD ratio signals a period of significant adaptation for Indian banks. It reflects a banking system that is both agile in responding to credit demand and challenged by the changing landscape of savings and investments. While traditional funding sources are under pressure, the sector’s ability to leverage diverse funding mechanisms, combined with a robust regulatory framework focused on comprehensive liquidity metrics, will be crucial in ensuring continued financial stability and supporting the nation’s economic growth trajectory. The ongoing challenge lies in striking a delicate balance between aggressive credit expansion and the imperative to secure sustainable, cost-effective funding in an increasingly competitive and dynamic financial ecosystem.