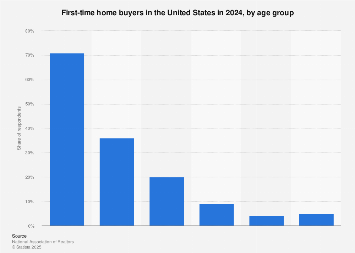

The demographic contours of the U.S. housing market are undergoing a significant transformation, with younger generations, particularly Millennials and Gen Z, increasingly defining the profile of the first-time homebuyer. In 2024, a substantial portion of individuals aged 26 to 34 entering the property market were making their inaugural purchase, representing a key cohort for aspiring homeowners. Concurrently, the 35 to 44 age bracket also demonstrated a notable percentage of first-time buyers, indicating a broadening window for individuals to achieve homeownership. While specific aggregate figures vary, these age segments collectively underscore a generational shift in the path to property acquisition.

The prevailing economic realities for both Gen Z (typically defined as those born between 1997 and 2012) and Millennials (born between 1981 and 1996) place them squarely in the primary phase of their first-time homebuying journey. Many within these cohorts are either navigating the early stages of their professional lives, pursuing higher education, or grappling with the persistent burden of student loan debt. This financial backdrop often necessitates a protracted period of saving to accumulate the requisite down payment, a critical hurdle in a market characterized by escalating property values. Data from various financial institutions consistently highlight the significant portion of income that younger individuals allocate towards debt servicing, thereby extending the timeline for accumulating substantial savings for a home purchase. The average down payment for a first-time buyer, which historically hovered around 10-20%, now often requires a more considerable outlay, especially in metropolitan areas with robust job markets but higher cost of living.

This extended period of homeownership for first-time buyers has a tangible impact on the broader housing market dynamics. Unlike previous generations who might have purchased and resold homes at a more rapid pace, today’s younger homeowners tend to remain in their initial properties for a longer duration. This trend is driven by a combination of factors, including the financial commitment involved in moving, the desire for stability in a fluctuating market, and the increasing costs associated with property transactions. Consequently, the pool of existing homeowners looking to "trade up" – to purchase a larger or more premium residence – is often comprised of older demographics who have had more time to build equity and increase their earning potential.

The concept of a "trade-up" home, while appealing, represents a distinct financial leap. The capital required for such a purchase typically exceeds that of a starter home, not only in terms of the down payment but also in ongoing costs such as property taxes, insurance, and maintenance. Homeowners typically aspire to trade up once they have established a foothold in the market, potentially improved their career trajectory, and consequently, their income. This progression is a natural evolution in the housing lifecycle, but for the current generation of first-time buyers, achieving that initial ownership milestone is often the more immediate and pressing financial objective.

Globally, the challenges faced by first-time homebuyers in the U.S. are not unique. Many developed economies are experiencing similar trends of rising housing costs outpacing wage growth, particularly in urban centers. Countries like Canada, Australia, and the United Kingdom, for instance, have seen significant increases in property prices, making it increasingly difficult for younger generations to enter the market. Government policies aimed at incentivizing homeownership, such as first-time buyer grants or stamp duty reductions, are common across these nations, reflecting a shared concern about intergenerational equity and housing affordability. However, the effectiveness of these measures can be limited by the sheer magnitude of price increases.

The economic implications of this generational shift in homeownership are far-reaching. A robust first-time homebuyer market is crucial for the health of the construction industry, real estate services, and a wide array of ancillary businesses, from furniture retailers to mortgage lenders. When a larger proportion of the population delays or is unable to achieve homeownership, it can lead to a slowdown in new construction, reduced consumer spending on home-related goods and services, and potentially, a less dynamic economy overall. Furthermore, homeownership has historically been a significant wealth-building tool for households, and its delayed attainment can impact long-term financial security for a substantial segment of the population.

Analyzing the age distribution of first-time homebuyers also provides insights into broader societal trends. The longer average age for first-time buyers in many developed nations, including the U.S., is often correlated with increased educational attainment and later entry into the workforce. It also reflects evolving lifestyle choices, with some individuals prioritizing experiences or further education over immediate property acquisition. However, the underlying economic pressures, such as the cost of housing and student debt, remain primary drivers.

The future trajectory of first-time homeownership will likely be shaped by a complex interplay of economic factors. Interest rate fluctuations, inflation levels, wage growth, and government housing policies will all play a critical role. If affordability challenges persist, we may see further innovation in housing models, such as co-living arrangements, a greater reliance on rental markets, or a continued outward migration from expensive urban centers to more affordable regions. Conversely, a sustained period of economic growth coupled with targeted interventions to address housing affordability could pave the way for a more accessible housing market for younger generations, ensuring that the dream of homeownership remains within reach. The demographic data from 2024 serves as a critical snapshot, highlighting the ongoing evolution of who is buying homes, and when, in the dynamic American real estate landscape.