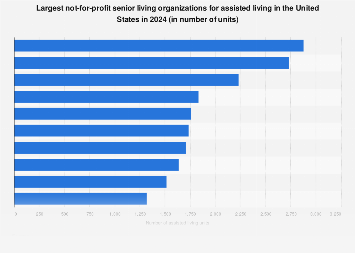

In the evolving landscape of senior care, non-profit organizations play a pivotal role in providing a continuum of services designed to meet the diverse needs of an aging population. As of 2024, the United States’ non-profit senior living sector is characterized by a few dominant players, each contributing significantly to the availability of assisted living units. Presbyterian Homes and Services, Evangelical Lutheran Good Samaritan Society, and Cassia stand out as the top three organizations in this segment, according to industry data, showcasing their substantial capacity to support seniors requiring varying levels of care.

Presbyterian Homes and Services emerged as the leader in terms of total assisted living units, although a closer examination reveals that independent living units constitute the largest portion of its overall senior living portfolio. This indicates a strategic approach to offering a comprehensive range of housing options, from active independent living to more supportive assisted living environments, catering to residents as their needs change over time. The sheer scale of Presbyterian Homes and Services’ operations underscores its commitment to serving a broad demographic within the senior community.

The Evangelical Lutheran Good Samaritan Society, another significant entity, also commands a considerable number of assisted living units. Its presence signifies the continued strength and reach of faith-based organizations within the non-profit senior care sector, often characterized by a mission-driven approach focused on compassionate care and community building. Similarly, Cassia has established itself as a substantial provider, contributing to the overall supply of assisted living accommodations across the nation.

While the precise number of units for these top organizations is proprietary information, their ranking signifies a substantial operational footprint. The aggregate number of assisted living units managed by these leading non-profits represents a critical component of the nation’s senior housing infrastructure. This infrastructure is increasingly vital as the Baby Boomer generation continues to age, driving demand for specialized care and supportive living arrangements. The growth in demand for assisted living is projected to continue robustly, fueled by demographic shifts and an increasing awareness of the benefits of structured support for seniors seeking to maintain independence while receiving necessary assistance.

The non-profit senior living sector, in general, operates with a distinct philosophy compared to its for-profit counterparts. Often reinvesting surplus revenue back into their services, facilities, and resident care programs, these organizations prioritize mission over shareholder returns. This focus can translate into a more resident-centered approach, with an emphasis on holistic well-being, social engagement, and spiritual support, where applicable. The stability and long-term vision often associated with non-profit governance can also be a significant advantage in an industry that requires substantial capital investment and long-range planning.

Globally, the demand for senior living solutions is a growing trend across developed economies. Countries like Japan, Germany, and Canada are also grappling with aging populations and are investing heavily in expanding their senior care sectors. The U.S. model, particularly the strength of its non-profit sector, offers valuable insights into how to balance community service with operational sustainability. The scale of organizations like Presbyterian Homes and Services is not unique to the U.S., but the specific organizational structures and regulatory environments can vary significantly, impacting the pace of development and the nature of services offered.

Market data suggests that the assisted living segment within the broader senior housing market is experiencing sustained growth. Factors influencing this growth include advancements in healthcare that allow individuals to live longer, the desire for social interaction and reduced isolation among seniors, and the increasing recognition by families of the benefits of professional care. The COVID-19 pandemic, while presenting unprecedented challenges, also highlighted the essential nature of senior living communities and spurred innovation in areas such as infection control, resident engagement, and telehealth services. Post-pandemic, there is a renewed focus on creating resilient and vibrant living environments.

The economic impact of these large non-profit senior living organizations extends beyond the provision of care. They are significant employers, generating jobs across a wide spectrum of roles, from direct care staff and healthcare professionals to administrative, culinary, and maintenance personnel. Furthermore, their substantial real estate holdings and capital expenditures contribute to local economies through construction, property taxes, and the procurement of goods and services. The ongoing development and expansion of senior living facilities are therefore key drivers of economic activity.

The operational model of these leading non-profits often involves a multi-site strategy, allowing for economies of scale in management, purchasing, and the implementation of best practices. This distributed approach also enables them to serve a wider geographic area, reaching more seniors in need. The emphasis on a continuum of care, where residents can transition seamlessly between independent living, assisted living, and skilled nursing care within the same organization or network, is a hallmark of successful non-profit senior living providers. This integrated approach not only benefits residents by providing familiar surroundings and consistent care but also offers families peace of mind.

Looking ahead, the trajectory for non-profit senior living organizations in the U.S. appears to be one of continued growth and adaptation. Challenges such as rising operational costs, workforce recruitment and retention, and navigating complex regulatory environments will persist. However, the intrinsic value proposition of non-profit senior living – its mission-driven ethos and commitment to resident well-being – positions these organizations favorably to meet the escalating demand for quality senior care. The insights gleaned from the leading providers in 2024 offer a glimpse into the strategic priorities and operational strengths that will likely shape the future of senior living in the United States and beyond. The ability to innovate, maintain financial health while adhering to a non-profit mission, and consistently deliver high-quality care will be paramount for these organizations as they continue to serve an increasingly large and diverse senior population.