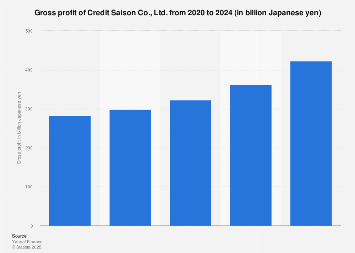

Credit Saison Co., Ltd., a prominent player in Japan’s diverse financial services landscape, is navigating a complex economic environment as it looks towards its 2024 fiscal year, with gross profit figures serving as a critical indicator of its operational efficiency and market resilience. While specific, up-to-the-minute gross profit data for 2024 remains under proprietary access, an examination of the company’s historical performance, industry trends, and strategic initiatives provides a robust framework for understanding its potential trajectory. Gross profit, the revenue remaining after deducting the cost of goods sold (or, in the case of a service company like Credit Saison, the direct costs associated with providing its services), offers a fundamental insight into how effectively the company manages its core operations before accounting for overheads, interest, and taxes.

The broader Japanese financial sector, which Credit Saison actively participates in through its extensive consumer credit, leasing, and credit card operations, has been characterized by a prolonged period of low interest rates and a shifting consumer spending landscape. While this environment has historically presented challenges in terms of net interest margins, it has also spurred innovation and a greater focus on fee-based income and specialized lending products. Credit Saison, with its established brand recognition and broad customer base, is strategically positioned to capitalize on these evolving market dynamics. Its diversified business model, encompassing unsecured loans, credit cards, and even venturing into areas like overseas markets and fintech solutions, allows it to mitigate risks associated with any single product line.

Globally, financial institutions are grappling with a confluence of factors: persistent inflation, rising interest rate environments in many developed economies (though Japan has maintained a more accommodative stance), and the accelerating digital transformation of financial services. These forces directly impact the cost of capital, the pricing of credit, and the operational expenses of companies like Credit Saison. The cost of funds, a significant component of the direct costs for a lending institution, is particularly sensitive to monetary policy shifts. As central banks worldwide have tightened their belts to combat inflation, the cost of borrowing for financial firms has inevitably increased, putting pressure on gross profit margins if not offset by higher revenue generation or improved operational efficiencies.

For Credit Saison, the ability to maintain or expand its gross profit will hinge on several key levers. Firstly, the volume of its lending and credit card transactions is paramount. An increase in the number of active customers and a higher average transaction value directly translate to increased revenue. This, in turn, depends on the company’s success in customer acquisition and retention strategies, as well as its ability to offer competitive products and services that meet evolving consumer demands. The company’s investment in digital platforms and user-friendly interfaces is crucial in this regard, aiming to streamline the application process and enhance the overall customer experience.

Secondly, the pricing power of Credit Saison’s offerings plays a vital role. While operating in a competitive market, the company must balance competitive pricing with the need to generate sufficient revenue to cover its direct costs and contribute to profitability. This involves a sophisticated understanding of risk assessment and pricing methodologies, particularly in its unsecured lending segments where default risk is a primary concern. Effective risk management not only minimizes potential losses but also enables the company to command appropriate interest rates, thereby bolstering gross profit.

Thirdly, the efficiency of its operational processes directly influences the cost of sales. This includes the expenses associated with loan origination, servicing, collections, and the operational costs of its credit card platforms. Investments in automation, artificial intelligence, and data analytics are increasingly critical for financial institutions to streamline these processes, reduce manual intervention, and thereby lower their direct cost base. By optimizing these back-office functions, Credit Saison can protect and potentially enhance its gross profit margins, even in the face of rising input costs.

Statistics on profitability KPIs, balance sheet KPIs, cash flow KPIs, and productivity KPIs, which are often tracked by companies and analysts, provide a more granular view of Credit Saison’s financial health. For instance, a strong performance in asset quality metrics, such as a low non-performing loan ratio, would indicate effective risk management and fewer write-offs, directly benefiting gross profit. Similarly, efficient capital allocation, reflected in balance sheet KPIs, can ensure that the company’s resources are deployed in ways that generate the highest returns. Cash flow KPIs are essential for understanding the liquidity and solvency of the company, which underpins its ability to fund its operations and growth initiatives.

Looking ahead, Credit Saison’s strategic focus on expanding its international presence, particularly in Southeast Asia, presents both opportunities and challenges. Emerging markets often offer higher growth potential and a less saturated competitive landscape, but they also come with unique regulatory frameworks, economic volatilities, and currency risks. Successful expansion into these regions will require careful market analysis, robust risk mitigation strategies, and the ability to adapt its business models to local conditions. The revenue generated from these international operations, net of their direct operating costs, will be a significant contributor to the company’s overall gross profit.

Furthermore, the fintech landscape continues to evolve at a rapid pace. Credit Saison’s engagement with fintech, whether through in-house innovation or strategic partnerships, is crucial for staying competitive. The integration of new technologies can unlock new revenue streams, improve customer engagement, and drive operational efficiencies. For example, the use of blockchain technology could potentially streamline cross-border transactions and reduce associated costs, while AI-powered credit scoring models can enhance the accuracy of risk assessments and optimize lending decisions, both of which can positively impact gross profit.

The competitive environment in Japan’s consumer finance sector remains intense, with traditional banks, other non-bank lenders, and increasingly, fintech startups vying for market share. Credit Saison’s ability to differentiate itself through superior customer service, innovative product development, and a strong brand reputation will be key to maintaining its market position and, consequently, its gross profit generation. The company’s historical performance, which has demonstrated resilience through various economic cycles, suggests a solid foundation upon which to build. However, the dynamic nature of the financial services industry necessitates continuous adaptation and strategic foresight.

In conclusion, while precise 2024 gross profit figures for Credit Saison Co., Ltd. are not publicly disseminated without subscription, an analysis of its operational context, industry dynamics, and strategic priorities reveals a company actively working to optimize its financial performance. The interplay of revenue generation from its diverse financial products, the management of its cost of funds and operational expenses, and its strategic investments in digital transformation and international expansion will collectively determine its gross profit trajectory. As the financial landscape continues its rapid evolution, Credit Saison’s ability to navigate these complexities with agility and strategic acumen will be paramount to its sustained success and profitability. The company’s long-term outlook will undoubtedly be shaped by its capacity to balance aggressive growth ambitions with prudent risk management and a relentless pursuit of operational excellence.