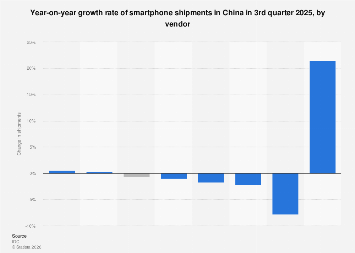

The landscape of China’s colossal smartphone market is set for a significant recalibration in the coming years, with projections indicating a dynamic shift in vendor market share leading up to 2025. While the overall market has demonstrated remarkable resilience and growth potential, the competitive intensity among the leading players is expected to intensify, leading to a redistribution of influence and sales volumes. This evolving scenario presents both challenges and opportunities for domestic manufacturers and international brands alike, underscoring the strategic importance of innovation, pricing, and market penetration in the world’s largest mobile consumer base.

Historically, China’s smartphone sector has been characterized by rapid innovation and fierce competition, often seeing a rapid ascent and descent of various brands. However, recent trends suggest a consolidation of power among a few dominant domestic players, alongside the enduring presence of global giants. Projections for the period through 2025 anticipate this trend to continue, with certain vendors potentially capturing a larger slice of the market pie, while others may face increasing pressure to maintain their current standing. Understanding the underlying drivers of these shifts is crucial for stakeholders looking to navigate this complex and fast-paced environment.

Several key factors are expected to shape vendor performance in the Chinese smartphone market. Firstly, the ongoing technological evolution, particularly in areas like 5G integration, artificial intelligence-powered features, and advanced camera capabilities, will remain a critical differentiator. Consumers in China are often early adopters of new technologies, and vendors that can successfully integrate these innovations into compelling and affordably priced devices are likely to gain a competitive edge. The push towards foldable phones, for instance, represents a nascent but potentially significant growth segment that could see market leaders emerge.

Secondly, the pricing strategies employed by manufacturers will continue to play a pivotal role. China’s market encompasses a wide spectrum of consumers, from budget-conscious individuals to premium segment buyers. Vendors capable of offering a tiered product portfolio that caters to diverse economic strata, while maintaining brand loyalty and perceived value, will be well-positioned. The intense competition at the mid-range and budget segments, where a vast majority of sales occur, necessitates a delicate balance between feature sets and cost. Any misstep in pricing can lead to a rapid erosion of market share.

Thirdly, the intricate ecosystem of online and offline distribution channels in China cannot be overstated. While e-commerce platforms have revolutionized smartphone sales, the importance of physical retail, particularly in lower-tier cities and for hands-on product experience, remains substantial. Brands that can master a multi-channel strategy, effectively leveraging both online marketplaces and brick-and-mortar stores, will have a distinct advantage. Furthermore, strategic partnerships with telecom operators for bundled deals and network compatibility remain a potent tool for market penetration.

Market data and expert analyses suggest that leading Chinese brands, such as Huawei (despite geopolitical challenges impacting its international presence, it retains significant domestic strength and innovation capabilities), Xiaomi, Oppo, and Vivo, are likely to continue their dominance, potentially expanding their collective market share. These companies have demonstrated a keen understanding of local consumer preferences, an agile supply chain, and a robust R&D investment. Their ability to quickly iterate on designs, incorporate popular features, and build strong brand communities has been instrumental in their success.

Xiaomi, for example, has consistently focused on delivering high-value propositions, blending competitive pricing with advanced technology and a strong online community engagement strategy. Oppo and Vivo, on the other hand, have often emphasized design aesthetics, camera innovation, and a premium user experience, carving out significant segments of the market. While Huawei’s future international trajectory remains uncertain, its domestic market share is projected to be influenced by its ability to overcome supply chain constraints and continue its innovation in chip technology and software, particularly its HarmonyOS ecosystem.

The role of Apple in the premium segment of the Chinese market is also noteworthy. The iPhone continues to command a loyal following, particularly among aspirational consumers and those seeking a seamless integrated ecosystem. Projections indicate that Apple will likely maintain a strong presence in the high-end category, though its overall market share growth might be constrained by the aggressive pricing and feature innovation from domestic competitors in lower and mid-tier segments. The ongoing development of Apple’s services ecosystem within China will be crucial for its sustained appeal.

Emerging trends, such as the growing demand for foldable smartphones, could also introduce new dynamics. While currently a niche market, foldable devices represent a significant technological leap. The vendor that can successfully crack the code on durability, affordability, and user experience for foldable phones could potentially unlock a substantial new revenue stream and establish itself as a leader in this next-generation category. Initial offerings from Samsung and Huawei have paved the way, and other players are expected to follow suit, intensifying competition in this premium segment.

Furthermore, the impact of evolving consumer preferences beyond just hardware specifications cannot be ignored. Software experience, ecosystem integration, and brand narrative are increasingly important. Chinese consumers are not just buying a device; they are investing in a digital lifestyle. Brands that can offer compelling app stores, integrated services, and a strong sense of community are likely to foster greater brand loyalty and command higher customer lifetime value. The emphasis on privacy and data security, though perhaps less vocalized than in Western markets, is also a growing concern that manufacturers will need to address.

Economically, the projected shifts in vendor market share have broader implications for China’s technology sector and its global standing. A strong domestic smartphone industry contributes significantly to job creation, research and development investment, and intellectual property generation. The continued success of Chinese brands in their home market can also serve as a springboard for global expansion, provided they can adapt their strategies to diverse international markets. Conversely, any significant disruption or decline in the performance of key players could have ripple effects on the supply chain, component manufacturers, and the broader economic ecosystem.

Looking ahead, the period leading up to 2025 is poised to be a fascinating case study in market evolution. The Chinese smartphone market, driven by its sheer scale and discerning consumer base, will continue to be a bellwether for global trends. Vendors will need to remain agile, innovative, and deeply attuned to the nuances of consumer demand to thrive in this intensely competitive arena. The winners will be those who can effectively blend technological prowess with astute market strategy, delivering compelling value propositions that resonate with the diverse needs and aspirations of China’s vast mobile user population.