The Islamic Republic of Iran has signaled a paradigm shift in its international trade strategy by officially offering its advanced military hardware and defense systems for sale in exchange for cryptocurrency. This move, which marks a significant escalation in the use of decentralized finance to circumvent Western-led economic restrictions, underscores Tehran’s growing sophistication in navigating the "shadow" global economy. By decoupling its defense exports from the traditional US dollar-denominated financial system, Iran is attempting to neutralize the impact of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) disconnection and the long-standing "maximum pressure" campaign orchestrated by Washington.

The decision to accept digital assets for high-end weaponry—ranging from sophisticated unmanned aerial vehicles (UAVs) to precision-guided missile systems—is not merely a tactical maneuver but a strategic realignment of Iran’s military-industrial complex. For years, the Iranian defense sector has operated under the heavy shadow of secondary sanctions, which penalize any third-party entity or state that engages in financial transactions with Tehran. By utilizing blockchain technology, Iran can facilitate peer-to-peer transfers that bypass the centralized oversight of global clearinghouses, effectively creating a "dark" marketplace for state-level defense procurement.

The Economic Rationale Behind the Crypto-Defense Nexus

The economic impetus for this shift is rooted in Iran’s chronic shortage of hard currency and the extreme volatility of the Iranian rial. Since the United States’ withdrawal from the Joint Comprehensive Plan of Action (JCPOA) in 2018, Iran has faced unprecedented barriers to the global financial system. Inflation rates in the country have frequently hovered between 40% and 50%, eroding the purchasing power of the state and making traditional trade nearly impossible for many potential partners who fear the long-arm jurisdiction of the US Treasury’s Office of Foreign Assets Control (OFAC).

Cryptocurrencies, particularly stablecoins pegged to the US dollar like Tether (USDT), provide a stable medium of exchange that does not require the permission of a central bank. For Iran, the defense sector represents one of its few competitive export industries. The "Shahed" series of kamikaze drones, for instance, has gained global notoriety for its cost-effectiveness and efficacy in modern theater operations. By allowing buyers to pay in crypto, Tehran is lowering the barrier to entry for non-aligned nations or non-state actors who wish to modernize their arsenals without triggering automated alerts in the international banking system.

A New Frontier in Asymmetric Warfare

The integration of digital assets into the arms trade represents a new frontier in asymmetric warfare. Historically, the arms trade was a highly regulated environment dominated by a few major powers. However, the democratization of blockchain technology has allowed "pariah states" to engage in high-value commerce with minimal transparency. Security analysts suggest that this move could catalyze a surge in defense proliferation across the Middle East, Africa, and Eastern Europe, as the trail of "digital breadcrumbs" left by a crypto transaction is significantly harder to trace than a traditional wire transfer.

Furthermore, Iran has invested heavily in domestic cryptocurrency mining as a way to convert its vast, sanctioned energy reserves into liquid digital capital. By using subsidized electricity from its oil and gas fields to power massive mining farms, the Iranian government effectively "manufactures" the currency it then uses to fund its defense research or accept as payment. This circular economy—turning natural gas into Bitcoin, and Bitcoin into missile components—represents a sophisticated form of sanctions evasion that traditional economic tools are ill-equipped to combat.

Global Implications and the Erosion of Dollar Hegemony

The broader geopolitical implications of Tehran’s crypto-for-weapons policy extend far beyond the borders of the Middle East. It feeds into a growing global trend of "de-dollarization," where nations such as Russia, China, and North Korea are increasingly seeking alternatives to the greenback. If Iran successfully establishes a robust framework for crypto-based defense sales, it provides a blueprint for other sanctioned regimes to follow.

This development poses a direct challenge to the effectiveness of economic sanctions as a tool of foreign policy. For decades, the US has leveraged the dollar’s status as the world’s reserve currency to enforce international norms. However, as the volume of illicit crypto-transactions grows—with some estimates suggesting that billions of dollars in digital assets are moved annually by sanctioned entities—the "financial weapon" of the US Treasury may be losing its edge. The decentralized nature of blockchain means there is no central authority to "freeze" a wallet in the same way a bank account can be seized.

The Role of Stablecoins and the Regulatory Blind Spot

While Bitcoin is often the most discussed digital asset, industry experts believe that stablecoins will be the primary vehicle for Iran’s defense transactions. The price volatility of Bitcoin makes it a risky asset for multi-million dollar contracts. In contrast, stablecoins offer the speed of blockchain with the price predictability of fiat currency. Reports from blockchain analytics firms have already indicated a high volume of Tether moving through Iranian-linked exchanges, suggesting that the infrastructure for this "crypto-arms" market is already well-established.

The regulatory response from the West has been a game of cat-and-mouse. While OFAC has blacklisted specific digital wallet addresses associated with the Iranian Revolutionary Guard Corps (IRGC), the speed at which new wallets can be generated makes enforcement a daunting task. Moreover, the use of "mixers" and "tumblers"—services that obscure the origin of digital funds—further complicates the efforts of intelligence agencies to monitor the flow of capital into Tehran’s defense coffers.

Technological Proliferation and Market Expansion

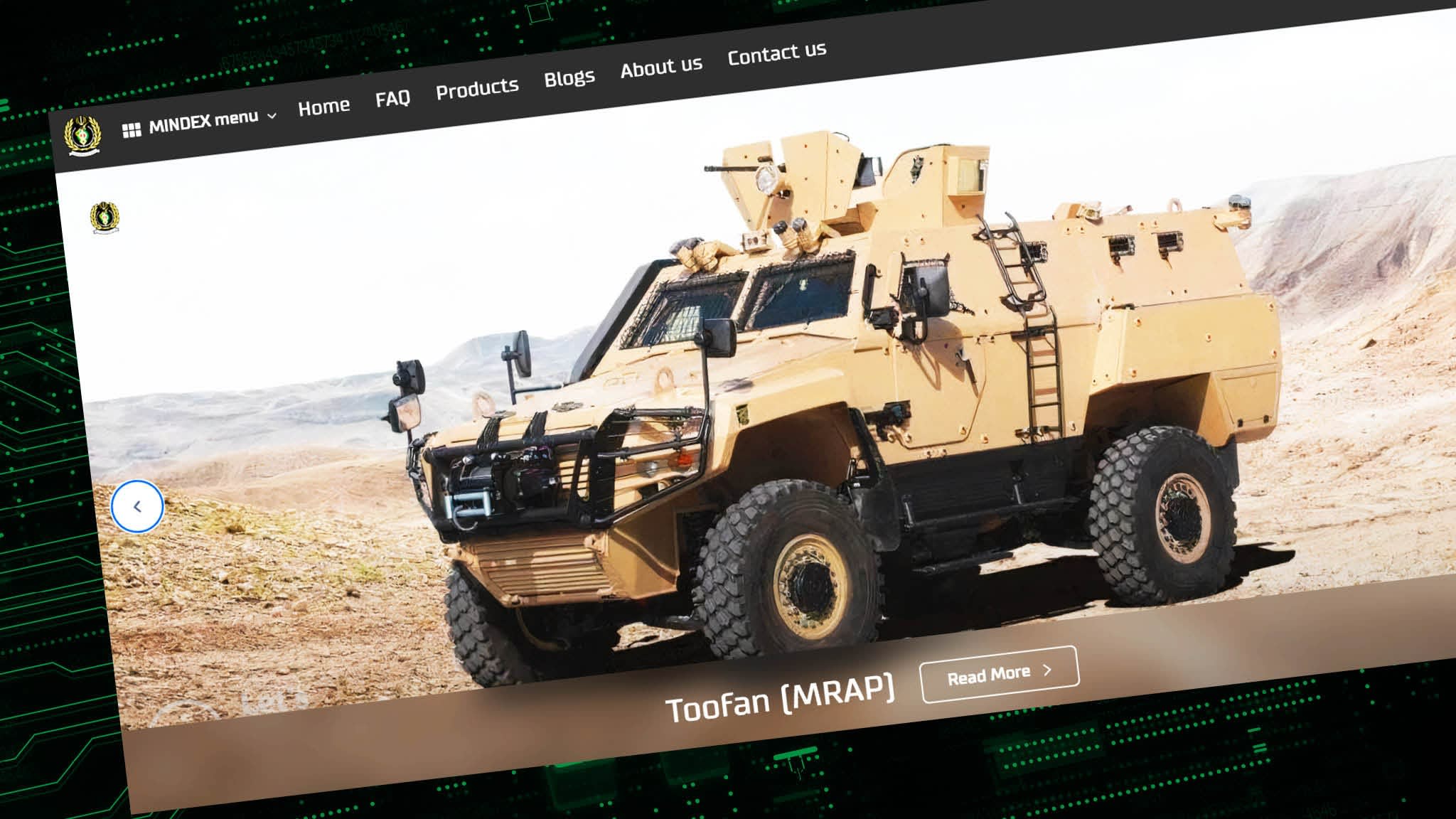

Iran’s offering includes some of its most prized technological achievements. Beyond the well-documented UAV programs, Tehran is reportedly marketing its air defense systems, electronic warfare suites, and anti-tank guided missiles (ATGMs). The "customer base" for these systems is expanding. Countries that are currently under arms embargoes or those that wish to maintain a degree of plausible deniability in their military build-ups find the crypto-payment option particularly attractive.

This market expansion is also driven by the relative affordability of Iranian systems compared to Western or even Russian alternatives. A Shahed-136 drone costs a fraction of a cruise missile but can achieve similar strategic objectives. When this cost-effectiveness is combined with the anonymity of cryptocurrency, the Iranian defense industry becomes a highly disruptive force in the global arms market.

Economic Impact on the Iranian Domestic Front

Internally, the success of this initiative could provide a vital lifeline to the Iranian government. The revenue generated from crypto-based defense exports can be funneled back into the domestic economy to stabilize the rial or fund social programs, thereby mitigating the internal pressure caused by the economic crisis. It also incentivizes the further development of Iran’s domestic tech sector, as the demand for blockchain developers and cybersecurity experts grows in tandem with the "crypto-defense" initiative.

However, this path is not without risks for Tehran. The transparency of the public ledger, while difficult to link to specific individuals, still provides a permanent record of transactions. If Western intelligence agencies can successfully deanonymize key wallets, they can map out the entire network of Iran’s global procurement and sales. Additionally, the reliance on digital assets exposes the Iranian state to the risks of the crypto market itself, including potential hacks and the collapse of specific stablecoin ecosystems.

The Future of Sovereign Digital Trade

As the world watches Tehran’s experiment with digital defense sales, the precedent being set is clear: the era of absolute financial control by central banks is under threat. The move by Iran to sell advanced weapons for crypto is a signal that the global financial architecture is fragmenting. We are entering a period where sovereign states will increasingly use decentralized protocols to conduct high-stakes diplomacy and trade.

The international community now faces a critical junction. The traditional methods of monitoring arms proliferation—tracking shipping manifests and bank transfers—are becoming obsolete in the face of digital assets. To counter this, global powers may need to develop new forms of "blockchain diplomacy" or more aggressive cyber-interdiction strategies. Regardless of the outcome, Iran’s pivot to a crypto-funded military-industrial complex ensures that the intersection of finance, technology, and warfare will remain the primary battlefield of the 21st century.