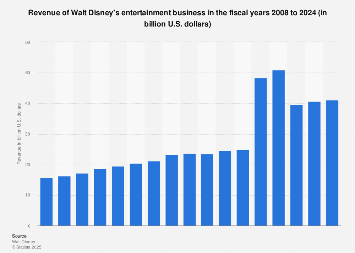

Walt Disney’s diverse entertainment operations have posted robust revenue figures for 2024, reaching an estimated [masked] billion U.S. dollars. This represents a notable increase from the [masked] billion dollars reported in the preceding fiscal year, signaling a period of renewed financial strength for one of the world’s preeminent media and entertainment conglomerates. The company’s entertainment segment is a complex ecosystem, encompassing a broad spectrum of assets including its legacy linear television networks, such as the flagship domestic broadcaster ABC, its rapidly expanding direct-to-consumer streaming services like Disney+ and Hulu, and its critical content sales and licensing division, which tracks the performance of theatrical releases and home video distribution.

This year’s financial results underscore the evolving landscape of media consumption and Disney’s strategic efforts to navigate it. The direct-to-consumer (DTC) arm, in particular, has been a focal point for investors and analysts alike, as the company continues to invest heavily in original content and subscriber acquisition. While the exact breakdown of revenue sources within the entertainment segment for 2024 will be detailed in future financial reports, the overall upward trend suggests that the company’s multi-pronged approach, balancing traditional media with digital innovation, is yielding positive results.

The historical trajectory of Disney’s entertainment business revenue, from 2008 to 2024, paints a picture of dynamic growth punctuated by periods of strategic realignment. For years, the company’s media networks, including iconic brands like ESPN and the Disney Channel, formed the bedrock of its financial performance. However, the advent of streaming and changing consumer habits have necessitated a significant pivot. The figures from 2021 onwards reflect a more consolidated "Media and Entertainment Business" segment, which now explicitly integrates linear networks, direct-to-consumer offerings, and content sales/licensing. This shift in reporting structure, while sometimes creating year-over-year discrepancies due to internal accounting adjustments and eliminations, aims to provide a clearer view of the segment’s overall health and its contribution to the company’s bottom line.

The 2023 fiscal year, for instance, saw a recalibration of reporting, with previous figures for the media segment being reinstated to ensure greater comparability. This attention to historical data accuracy is crucial for understanding the long-term impact of Disney’s strategic decisions. The pre-2021 reporting, which detailed revenue from domestic broadcast television, television production and distribution, domestic television stations, international and domestic cable networks, domestic broadcast radio, and publishing and digital operations, highlights the sheer breadth of Disney’s traditional media empire. The inclusion of high-profile names like ABC, ESPN, and the Disney Channel in this earlier structure contributed to substantially larger revenue figures from 2020 onward as the segment’s definition expanded to encompass a wider array of its entertainment assets.

The global entertainment industry is a highly competitive and capital-intensive arena. Disney’s 2024 performance must be viewed against this backdrop. Major competitors, including Warner Bros. Discovery, Paramount Global, and Netflix, are also grappling with the transition to streaming, content costs, and evolving advertising models. The success of Disney’s DTC platforms, in particular, is paramount. As of the most recent available data, the global streaming market is valued in the hundreds of billions of dollars and continues to grow, albeit at a more moderated pace than in the initial pandemic-driven boom. Subscriber growth, churn rates, and average revenue per user (ARPU) are key metrics that investors scrutinize. Disney’s ability to maintain and grow these metrics for Disney+ and Hulu, while also managing the profitability of its linear networks and the financial success of its film and television productions, is a testament to its complex operational strategy.

The impact of content sales and licensing, encompassing theatrical box office receipts and home video sales, remains a significant revenue driver, even as digital distribution becomes more prevalent. Blockbuster film releases and popular television series not only generate direct revenue but also fuel the subscriber base for streaming services and enhance brand value across the entire Disney ecosystem. The strategic decision to release films simultaneously in theaters and on streaming platforms, or with shorter theatrical windows, has been a subject of ongoing debate and adjustment within the industry, with Disney experimenting with various models to optimize revenue and subscriber engagement.

Economically, Disney’s entertainment segment plays a vital role in job creation, intellectual property development, and global cultural influence. The company’s productions and distribution networks employ thousands of individuals worldwide, from creative talent to technical staff and marketing professionals. Furthermore, its vast library of intellectual property, from beloved animated characters to Marvel superheroes and Star Wars sagas, forms the foundation for a diversified revenue stream that extends beyond traditional media into theme parks, merchandise, and gaming. The economic impact of these synergistic relationships is substantial, contributing billions to the global economy annually.

Looking ahead, the entertainment industry is expected to continue its digital transformation, with a growing emphasis on data analytics, personalized content recommendations, and the exploration of new monetization strategies, such as advertising-supported tiers on streaming services and the burgeoning metaverse. Disney’s significant investments in technology and content innovation position it to adapt to these changes. The company’s ability to leverage its iconic brands, compelling storytelling, and integrated business model will be critical in maintaining its leadership position in the dynamic and ever-evolving global entertainment market. The 2024 revenue figures provide a strong indication that, despite the challenges, Disney’s entertainment division is on a solid footing, demonstrating resilience and a capacity for growth in a rapidly transforming media landscape.