The corridors of power in Washington, D.C., are once again echoing with the complex terminology of distributed ledger technology as lawmakers prepare to break a long-standing legislative stalemate over the future of digital assets. This week, a critical pivot point arrives for the American financial sector as the Senate Agriculture and Banking Committees convene to breathe new life into a sweeping market structure bill known as the Clarity Act. After a year of stagnation and shifting political winds, the push to establish a definitive federal framework for the multi-trillion-dollar cryptocurrency industry has reached a "now or never" juncture. The outcome of these deliberations will not only determine how digital assets are traded within the United States but will also signal to the global financial community whether the world’s largest economy is ready to provide the regulatory certainty that institutional investors have long demanded.

At the heart of the Clarity Act is an ambitious attempt to resolve the jurisdictional tug-of-war that has plagued the industry for nearly a decade. For years, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have operated in a gray zone, often clashing over which agency holds authority over specific tokens. By creating more rigid definitions for token classifications, the bill seeks to provide a roadmap for compliance that moves beyond the "regulation by enforcement" model that many industry participants claim has stifled domestic innovation. The objective is clear: to create a standardized environment where crypto brokerages, decentralized exchanges, and custody providers can operate with the same legal clarity as traditional brokerage houses.

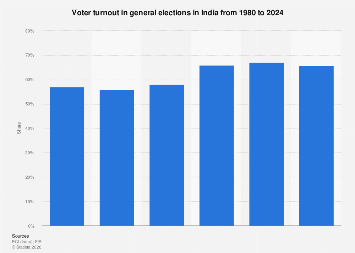

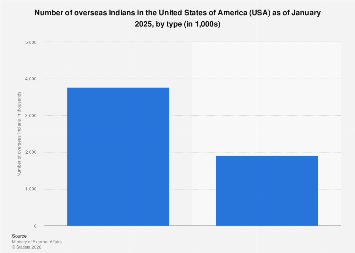

The economic stakes of this legislative push are immense. According to recent industry data, the lack of a cohesive federal framework has historically driven significant portions of the crypto economy to offshore jurisdictions like Dubai, Singapore, and the European Union. However, the tide has begun to turn. Market analysts note a visible "onshoring" trend, with digital asset firms increasingly seeking to establish roots in the U.S. in anticipation of a more favorable administrative stance. Proponents of the bill argue that formalizing these guardrails will act as a catalyst for this movement, potentially injecting billions of dollars into the domestic tech sector and fostering a new wave of high-skilled job creation. Summer Mersinger, CEO of the Blockchain Association, emphasizes that while the current administration’s receptiveness has encouraged firms to return, that momentum remains fragile without the permanence of codified law.

However, the path to consensus is blocked by several high-stakes hurdles, chief among them being the treatment of stablecoins. In the wake of last year’s Genius Act—which prohibited dollar-pegged tokens from offering interest-bearing yields—a new conflict has emerged regarding "stablecoin rewards." Traditional banking institutions, represented by groups like the American Bankers Association, have voiced concerns that crypto firms are exploiting loopholes to offer yield-like incentives that mimic high-yield savings accounts. These traditional lenders argue that such products create an uneven playing field, drawing liquidity away from the regulated banking system and into the shadow of the digital asset market. For negotiators on Capitol Hill, finding a middle ground that allows for stablecoin innovation while protecting the stability of the broader banking sector remains the most volatile part of the discussion.

Equally contentious is the regulation of Decentralized Finance (DeFi). Unlike centralized exchanges that have a clear corporate structure, DeFi platforms operate via autonomous smart contracts, often with no central intermediary to hold accountable. The Clarity Act must grapple with the existential question of how to apply anti-money laundering (AML) and "know your customer" (KYC) requirements to software code. Advocacy groups, such as the DeFi Education Fund, are lobbying intensely to ensure that software developers are not held legally liable for how third parties use their open-source protocols. The fear within the developer community is that overly broad liability could effectively ban DeFi in the U.S., driving the most cutting-edge blockchain research to Europe, where the Markets in Crypto-Assets (MiCA) regulation has already established a more defined, albeit strict, path for decentralized protocols.

The debate also carries a significant ethical dimension, as some lawmakers push for stringent conflict-of-interest rules. Senator Elizabeth Warren and other prominent Democrats have signaled that they will not support a bill that allows elected officials to profit from digital asset ventures while in office. This issue has taken on a partisan edge, particularly following the launch of various crypto-related projects linked to high-profile political figures, including President Donald Trump. While House Republicans previously opted to sidestep the issue of official involvement in crypto ventures to ensure the bill’s passage, Senate Democrats appear unwilling to "punt" on what they view as a fundamental matter of public trust and institutional integrity.

Beyond the domestic debate, the U.S. is facing increasing pressure to align its standards with international norms. The European Union’s MiCA framework, which begins full implementation this year, has set a global benchmark for crypto-asset service providers. If the U.S. fails to pass the Clarity Act, it risks becoming a "regulatory island," where the rules of the road are fundamentally different from those in other major financial hubs. Such a divergence could complicate cross-border transactions and make it difficult for U.S. firms to scale globally. Market data suggests that institutional adoption—specifically from pension funds and large-scale asset managers—is contingent on the U.S. matching the regulatory maturity seen in other G20 nations.

The timeline for these legislative maneuvers is compressed by the looming 2026 midterm elections. Legislative experts suggest that the "key window" for passing a complex market structure bill is rapidly closing. If the Senate Agriculture and Banking Committees cannot produce a unified draft that satisfies both the pro-innovation wing of the Republican party and the consumer-protection-focused wing of the Democratic party by the end of this quarter, the bill risks being swallowed by the noise of the campaign cycle. The process of merging two distinct committee drafts into a single piece of legislation for a full Senate floor vote is notoriously arduous, often requiring weeks of debate and hundreds of amendments.

The broader economic impact analysis of the bill suggests a potential windfall for the U.S. Treasury. By bringing crypto exchanges into a formal registration system, the government could significantly improve tax compliance within the digital asset space. Currently, the "tax gap" attributed to unreported crypto gains is estimated to be in the billions. A clear regulatory framework would provide the infrastructure necessary for more accurate reporting, potentially providing a non-partisan incentive for lawmakers looking to address the federal deficit. Furthermore, by securing the U.S. as a hub for blockchain development, the bill supports the long-term goal of ensuring that the "internet of value" is built upon American standards of transparency and security, rather than those of geopolitical rivals.

As the hearings commence this Thursday, the financial world will be watching for signals of compromise. The stakes extend far beyond the price of individual tokens; they involve the fundamental architecture of the future financial system. If the Clarity Act succeeds, it could mark the end of the era of uncertainty and the beginning of a new chapter where digital assets are integrated into the fabric of the global economy. If it fails, the U.S. may find itself watching from the sidelines as the next great wave of financial technology takes root elsewhere. For now, the focus remains on a few key rooms in the Capitol, where the language of the law is being written to meet the realities of a digital age.