The relationship between the executive branch and the upper echelons of Wall Street has reached a historic inflection point as President Donald Trump announced his intention to initiate a major lawsuit against JPMorgan Chase. This legal escalation centers on allegations of "debanking," a practice where financial institutions terminate services for clients based on perceived political risks or ideological affiliations. In a statement that has sent ripples through the financial markets, the President asserted that the nation’s largest bank inappropriately shuttered his accounts following the events of January 6, 2021, marking a significant escalation in his long-standing grievance with the American banking establishment.

The impending litigation, which the President indicated would be filed within a two-week window, seeks to challenge the discretionary power of private financial institutions to curate their client lists. At the heart of the dispute is the claim that JPMorgan Chase and other major lenders, including Bank of America, engaged in discriminatory practices that marginalized political figures and their families. This move follows a series of policy maneuvers by the administration, most notably a comprehensive executive order signed in August that explicitly prohibits banks from denying financial services to individuals based on their religious or political beliefs.

The phenomenon of "debanking" has emerged as a flashpoint in global financial discourse, transcending the domestic American political landscape. In the United Kingdom, similar controversies involving high-profile figures like Nigel Farage and the private bank Coutts led to a national debate over the "right to a bank account" and the ethical boundaries of corporate risk management. In the United States, the debate has taken on a more partisan character, with the Trump administration arguing that access to the financial system is a fundamental necessity for participating in modern society and should be treated with the same neutrality as a public utility.

JPMorgan Chase has consistently maintained that its internal policies do not allow for the closure of accounts based on political leanings. However, the bank, led by Chairman and CEO Jamie Dimon, has remained largely silent regarding specific client matters, citing privacy and regulatory constraints. Bank of America has echoed this sentiment, though it has notably called for clearer regulatory frameworks to help institutions navigate the increasingly complex intersection of compliance, reputational risk, and political neutrality. The lack of clarity in current banking regulations has created a vacuum where institutional risk departments often err on the side of caution, sometimes resulting in the severance of ties with "politically exposed persons" (PEPs) to avoid potential regulatory scrutiny or public relations backlash.

The economic implications of this legal battle are substantial, particularly as the administration ramps up pressure on the banking sector through other policy avenues. The banking industry is currently grappling with a Presidential demand to cap credit card interest rates at 10%, a proposal that has already impacted market valuations. Shares of JPMorgan Chase, for instance, saw a 5% decline in a single week despite posting fourth-quarter earnings that surpassed analyst expectations. Market analysts suggest that the combination of potential litigation and aggressive interest rate caps is creating a climate of uncertainty for financial stocks, as investors weigh the risks of direct executive intervention in commercial banking operations.

The President’s friction with Jamie Dimon adds a layer of personal and institutional drama to the conflict. Recent reports suggested that the White House had previously considered Dimon as a potential successor to Federal Reserve Chairman Jerome Powell, whose term is set to expire on May 15. However, the President has vehemently denied these reports, using his social media platforms to underscore his reservations about Dimon and the institutional culture of JPMorgan. This public falling out marks a sharp departure from earlier periods where Dimon was seen as a pragmatic bridge between the corporate world and the populist wing of the Republican party.

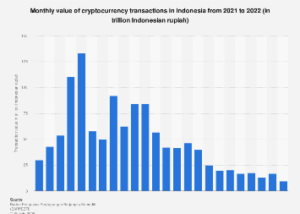

The Trump family’s grievances with the banking sector have also served as a catalyst for their foray into the burgeoning cryptocurrency industry. Donald Trump Jr. has publicly stated that the family’s difficulties in maintaining traditional banking relationships were a primary driver behind the launch of their digital asset ventures. By positioning cryptocurrency as a "necessity" rather than a mere investment, the Trumps have tapped into a broader movement of "parallel economy" fintech firms that aim to provide financial services insulated from the perceived ideological biases of Wall Street’s "too big to fail" institutions.

Legal experts suggest that a lawsuit against a private entity like JPMorgan Chase for debanking will face significant hurdles in court. Under current U.S. law, private banks generally have broad discretion to choose their customers, provided they do not violate specific civil rights statutes regarding race, religion, or national origin. Expanding these protections to include political affiliation would represent a landmark shift in commercial law. The administration’s legal team is expected to argue that large, systemically important financial institutions enjoy federal backstops and regulatory privileges that should carry a reciprocal obligation to serve all citizens regardless of their political standing.

The broader economic impact of this confrontation extends to the stability of the U.S. financial system. If the administration succeeds in reclassifying banking services as a protected right, it could fundamentally alter how banks conduct risk assessments. Conversely, if the banks successfully defend their right to "de-risk" their portfolios, it could accelerate the migration of political figures and organizations toward alternative financial networks, further fragmenting the domestic economy along ideological lines.

As the Jan. 20 deadline for compliance with the credit card rate cap approaches, the banking sector is bracing for a period of intense regulatory and legal volatility. The outcome of the threatened lawsuit against JPMorgan Chase will likely serve as a bellwether for the future of executive influence over private capital. If the President moves forward with the litigation, it will not only be a test of his administration’s executive order but also a referendum on the autonomy of the American banking system in an era of heightened political polarization.

In the coming weeks, the financial world will be watching closely to see if the White House follows through on its promise to bring JPMorgan Chase before a judge. With Jerome Powell’s departure from the Federal Reserve looming and the administration’s populist economic agenda gaining momentum, the stakes for Wall Street have never been higher. The battle over debanking is no longer just a grievance aired on social media; it has evolved into a high-stakes legal and economic struggle that could redefine the relationship between the Oval Office and the giants of global finance for decades to come.

The tension is further exacerbated by the diverging views on the events of early 2021. While the banking industry viewed its actions as a necessary step to mitigate reputational and legal risks associated with a period of intense civil unrest, the President views these actions as a coordinated effort to disenfranchise a political movement. This fundamental disagreement over the role of corporate responsibility versus individual rights is the engine driving the current crisis. As the legal filings are prepared, the financial community remains on high alert, recognizing that a victory for the administration could lead to a massive overhaul of how every bank in America manages its client relationships and assesses the risks of the political landscape.