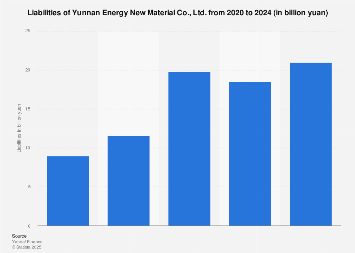

The intricate web of corporate finance is undergoing significant evolution in 2024, and Yunnan Energy New Material Co., Ltd. finds itself at a critical juncture, its financial health and strategic trajectory intrinsically linked to its evolving liability profile. As a key player in the burgeoning new energy materials sector, the company’s ability to manage its debt obligations is paramount not only for its own operational stability but also for the broader ecosystem of suppliers, investors, and downstream industries it serves. Understanding the nuances of its liabilities in the current economic climate provides a crucial lens through which to assess its future prospects and its impact on the global energy transition narrative.

The current financial reporting period reveals a complex picture of Yunnan Energy New Material Co., Ltd.’s indebtedness. While precise figures are often proprietary and accessible only through specialized financial data platforms, an analysis of related indicators and industry trends suggests a dynamic environment for the company. The new energy materials industry, characterized by rapid technological advancement and substantial capital expenditure requirements, inherently necessitates significant investment, often financed through a combination of equity and debt. For companies like Yunnan Energy, which are at the forefront of developing and manufacturing materials crucial for batteries, solar panels, and other renewable energy technologies, maintaining a healthy balance between growth ambitions and prudent debt management is a constant challenge.

Global macroeconomic forces are significantly shaping the cost and availability of capital for businesses worldwide. Persistent inflation, fluctuating interest rates set by central banks, and geopolitical uncertainties contribute to a more volatile borrowing environment. For companies with substantial outstanding liabilities, such as Yunnan Energy, this translates into increased servicing costs and potentially tighter access to new credit lines. This environment demands sophisticated treasury management and a clear strategic vision for deleveraging or optimizing existing debt structures. The cost of capital is not a static number; it’s a fluid metric influenced by credit ratings, market sentiment, and the overall economic outlook, all of which can impact a company’s bottom line and its capacity for future investment.

The nature of liabilities within the new energy sector often includes long-term debt associated with large-scale manufacturing facilities, research and development financing, and potentially supply chain financing initiatives. Yunnan Energy’s specific mix of short-term and long-term obligations, along with the terms and conditions of these instruments, will dictate its liquidity position and its resilience to economic shocks. For instance, a high proportion of short-term debt could create immediate liquidity pressures if cash flows are inconsistent, while significant long-term debt, if structured with favorable interest rates and repayment schedules, can be a sustainable means of funding expansion. Analyzing the company’s debt-to-equity ratio, interest coverage ratio, and current ratio provides deeper insights into its financial leverage and its ability to meet its financial commitments.

The strategic implications of Yunnan Energy’s liability management are far-reaching. A robust financial footing, characterized by manageable debt levels, enhances the company’s ability to attract further investment, both from strategic partners and public markets. It also signals a degree of operational efficiency and financial discipline to potential customers, which is crucial in forging long-term supply agreements. Conversely, an overburdened debt structure can stifle innovation, limit operational flexibility, and even lead to credit rating downgrades, making future borrowing more expensive and difficult. This can have a cascading effect, impacting the company’s ability to scale production to meet the accelerating demand for new energy materials.

Comparisons with industry peers and global leaders in the new energy materials space are also instructive. Companies that have successfully navigated periods of rapid growth and market volatility often demonstrate a proactive approach to debt management, employing strategies such as refinancing at opportune moments, optimizing their capital structure, and maintaining strong relationships with financial institutions. Examining the financial statements of competitors, where publicly available, can provide benchmarks for acceptable debt levels and effective debt servicing strategies within the sector. The global nature of the new energy materials market means that companies are not only competing for market share but also for access to capital in a global financial arena.

Furthermore, the regulatory environment plays a significant role. Government incentives, subsidies, and policies aimed at promoting the adoption of new energy technologies can indirectly influence a company’s financial health by boosting demand and potentially providing access to more favorable financing options. However, shifts in these policies can also introduce uncertainty, necessitating a flexible financial strategy. Yunnan Energy, like many in its field, operates within a complex interplay of market forces and policy directives, making its liability management a critical component of its strategic planning.

The ongoing demand for advanced battery materials, for example, driven by the exponential growth of the electric vehicle (EV) market and the expansion of renewable energy storage solutions, presents a significant opportunity for Yunnan Energy. However, capitalizing on this demand requires substantial investment in research, development, and manufacturing capacity. The company’s ability to secure the necessary funding, whether through equity or debt, will be directly contingent on its perceived financial stability and its capacity to service any new obligations. Analysts will be closely watching its debt-to-asset ratio, its working capital management, and its cash conversion cycle to gauge its operational efficiency and financial resilience.

In conclusion, while specific financial disclosures for Yunnan Energy New Material Co., Ltd. in 2024 may require specialized access, the broader economic context and industry dynamics underscore the critical importance of its liability management. The company’s strategic decisions regarding its debt profile will not only determine its own financial sustainability but also influence its capacity to contribute to and benefit from the ongoing global transition to cleaner energy sources. As the new energy materials sector continues its rapid ascent, the prudent and strategic management of corporate liabilities will remain a defining characteristic of success for companies like Yunnan Energy.