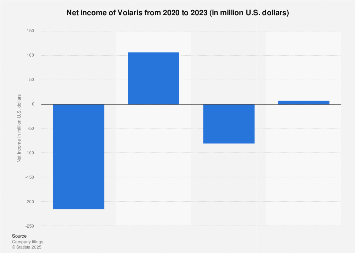

Mexican low-cost carrier Volaris has announced a significant surge in its net income for the fiscal year 2023, signaling a robust recovery and expansion within the competitive Latin American aviation market. While specific figures often require premium access for detailed statistical breakdowns, preliminary reports and industry analyses indicate a remarkably strong financial year for the airline, underscoring its strategic positioning and operational efficiency. This performance is a testament to Volaris’s ability to navigate post-pandemic travel demand, manage costs effectively, and capitalize on its extensive route network across Mexico, the United States, and Central America.

The airline’s success in 2023 can be attributed to a confluence of factors. Firstly, the persistent appetite for air travel, particularly in the leisure and VFR (Visiting Friends and Relatives) segments, has provided a strong tailwind. Volaris, with its inherently low-cost structure, is exceptionally well-placed to cater to these price-sensitive demographics. The demand for affordable travel solutions has remained resilient, even amidst broader economic uncertainties and inflationary pressures affecting global consumers. This sustained demand translates directly into higher passenger volumes and improved load factors, key metrics for airline profitability.

Secondly, Volaris has demonstrated adeptness in managing its operational costs. In an industry where fuel prices, labor, and aircraft maintenance are significant expenditures, the airline’s lean operating model and focus on fleet efficiency have been crucial. By optimizing aircraft utilization, maintaining a relatively young fleet, and negotiating favorable terms with suppliers, Volaris has managed to keep its cost per available seat mile (CASM) competitive. This cost discipline is paramount for a low-cost carrier aiming to offer attractive fares while maintaining healthy profit margins. Industry observers have noted Volaris’s consistent efforts to streamline operations and leverage technology to enhance efficiency, a strategy that appears to be yielding substantial dividends.

Furthermore, the airline’s strategic network expansion and route optimization have played a pivotal role. Volaris has consistently focused on high-growth, underserved markets, particularly within Mexico and between Mexico and the United States. This strategy allows them to capture market share and build a loyal customer base without directly engaging in price wars on established, highly competitive long-haul routes. The airline’s presence in a diverse range of cities, from major international hubs to smaller regional airports, provides a broad revenue base and mitigates risks associated with over-reliance on a single market. The resumption of international travel, coupled with strong domestic demand, has allowed Volaris to fully leverage its network capabilities throughout 2023.

The economic impact of Volaris’s strong performance extends beyond the airline itself. A thriving aviation sector is a significant contributor to economic growth, facilitating tourism, trade, and job creation. For Mexico, a country heavily reliant on tourism and remittances, airlines like Volaris serve as vital conduits. Increased passenger traffic supports hotels, restaurants, and other hospitality businesses, while the direct and indirect employment generated by the airline and its associated industries bolsters local economies. The airline’s ability to offer affordable international travel also makes it easier for families to connect, contributing to the vital flow of remittances from the United States to Mexico, a significant source of foreign currency for the Mexican economy.

Comparatively, Volaris’s 2023 performance stands out within the Latin American aviation landscape. While many regional carriers have faced challenges in the aftermath of the pandemic, Volaris has not only recovered but has demonstrated a clear growth trajectory. Competitors have also seen demand rebound, but Volaris’s specialized low-cost model, coupled with its targeted market strategy, has seemingly given it an edge in converting this demand into tangible profits. The broader Latin American airline market is characterized by significant growth potential, driven by a growing middle class and increasing disposable incomes. Volaris’s proactive approach to capturing this growth positions it favorably against both established legacy carriers and other low-cost competitors in the region.

Looking ahead, the outlook for Volaris appears cautiously optimistic. While the airline industry remains susceptible to external shocks, such as geopolitical instability, fluctuating fuel prices, and potential economic downturns, Volaris’s inherent strengths provide a degree of resilience. The continued expansion of its fleet, with deliveries of new, fuel-efficient aircraft, is expected to further enhance its cost structure and environmental performance. Moreover, the airline’s ongoing investment in digital transformation and customer experience initiatives are likely to solidify its market position and attract new passengers. The airline’s focus on operational efficiency and a clear understanding of its target market segments are likely to remain key drivers of its profitability.

The specific financial details, once fully disclosed, will provide a more granular understanding of Volaris’s revenue streams, operating expenses, and profit margins. However, the overarching narrative of a highly successful 2023 for the airline is clear. It reflects a strategic vision executed with operational discipline, capitalizing on robust travel demand and a well-defined market niche. As the aviation industry continues to evolve, Volaris’s approach offers a compelling case study in sustained profitability and strategic growth within the dynamic Latin American market. The company’s ability to consistently deliver value to its customers while managing its bottom line effectively underscores its importance as a key player in the region’s economic and travel infrastructure. The strength of its 2023 results is likely to embolden its strategic initiatives and further solidify its position as a leading low-cost carrier in the Americas.