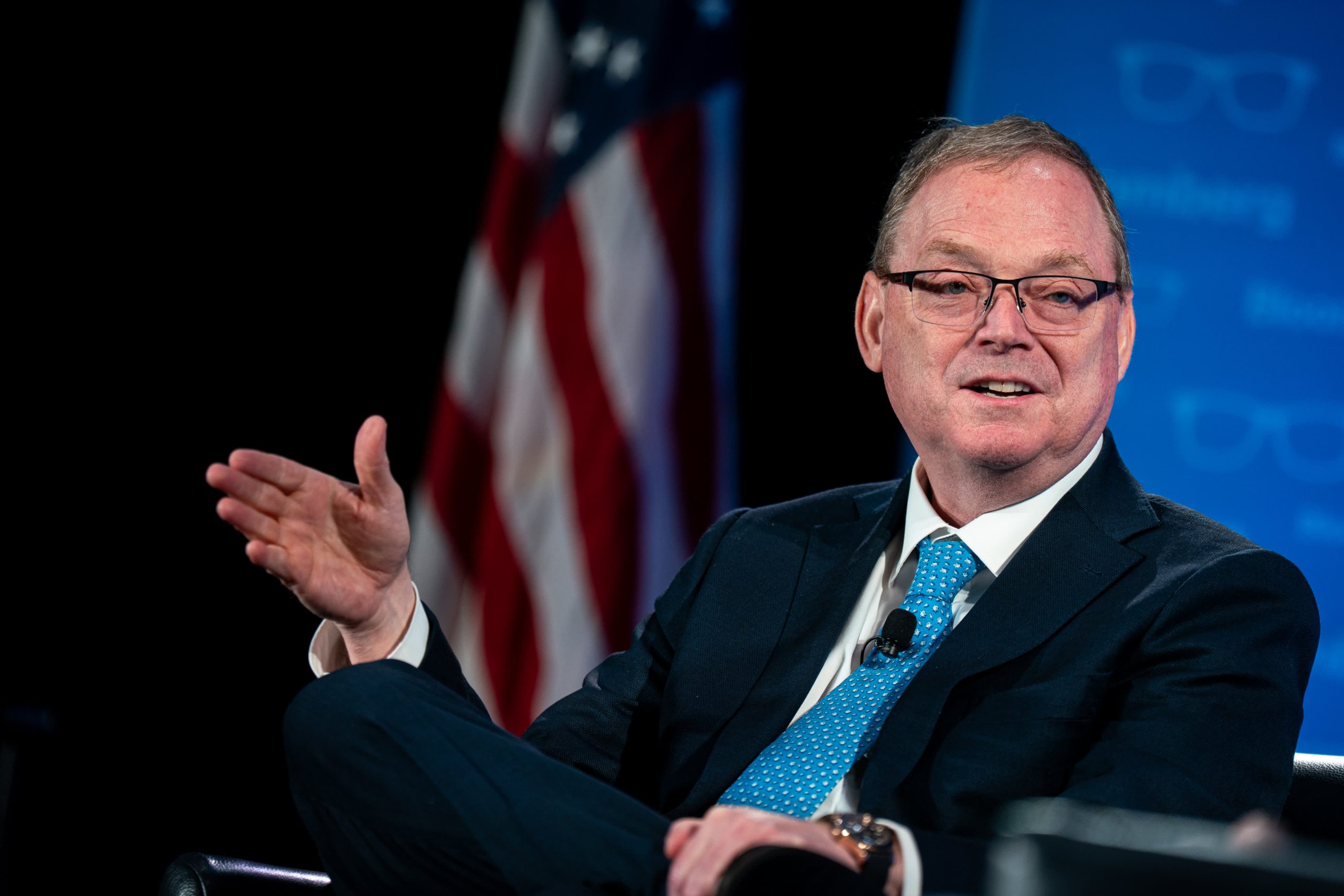

The traditional friction between populist economic policy and the pragmatic realities of the global banking sector has entered a new chapter as the White House signals a strategic shift in its approach to consumer lending. Kevin Hassett, Director of the National Economic Council, recently articulated a nuanced pivot from the administration’s previously aggressive stance on interest rate caps, introducing the concept of "Trump cards." This proposed initiative seeks to bridge the gap between the executive branch’s desire for affordable credit and the financial industry’s insistence on risk-based pricing, potentially redefining how millions of underserved Americans access the modern economy.

This strategic evolution follows a period of intense volatility in the dialogue between Washington and Wall Street. Just weeks ago, the administration sent shockwaves through the financial markets by proposing a hard 10% ceiling on credit card interest rates. In a high-inflation environment where the average annual percentage rate (APR) on credit cards often exceeds 21%, such a cap would represent a seismic shift in the profitability and operational models of major lenders like JPMorgan Chase, Citigroup, and Capital One. Industry leaders and lobbyists responded with a unified warning: a mandatory 10% cap would not lower costs for most, but would instead trigger a massive credit contraction, forcing banks to shutter accounts for millions of subprime and even "near-prime" borrowers to mitigate risk.

Recognizing the potential for a self-inflicted economic wound, Hassett’s recent comments suggest the administration is exploring a more collaborative, "voluntary" framework. The "Trump card" concept targets a specific demographic—the "credit invisible" or underserved individuals who possess stable income and financial responsibility but lack the traditional credit history required to access competitive revolving debt. By encouraging banks to develop specific products for this "sweet spot" of the population, the administration hopes to fulfill its populist promise of financial empowerment without the legislative gridlock or market disruption inherent in a federal usury law.

The economic logic behind this pivot centers on the concept of financial inclusion as a driver of macroeconomic growth. According to data from the Consumer Financial Protection Bureau (CFPB), approximately 26 million Americans are considered "credit invisible," meaning they do not have a credit record with a nationwide consumer reporting agency. An additional 19 million are "unscorable" due to thin or stale credit files. By incentivizing the private sector to bring these individuals into the formal financial system, the administration aims to stimulate consumer spending and provide a pathway to homeownership and small business formation.

However, the transition from mandatory caps to voluntary cooperation is fraught with complexity. For the banking sector, the primary challenge remains the cost of capital and the price of risk. Credit cards are unsecured loans; unlike mortgages or auto loans, there is no collateral for the bank to seize if a borrower defaults. Consequently, interest rates must cover the cost of funds, operational overhead, and the statistical probability of loss. In an era where the Federal Reserve’s benchmark rates have remained elevated to combat inflation, a 10% cap is viewed by many economists as mathematically unfeasible for all but the most affluent, low-risk borrowers.

Industry analysts suggest that the "Trump card" initiative may take the form of a public-private partnership, perhaps utilizing alternative data for credit scoring. Traditionally, FICO scores rely on debt repayment history. A modernized approach could include "permissioned data" such as rent payments, utility bills, and consistent cash flow patterns within checking accounts. By leveraging technology and data analytics, banks could potentially identify creditworthy individuals who have been overlooked by legacy systems, thereby expanding their customer base while satisfying the administration’s push for affordability.

The political optics of this shift are equally significant. For an administration that has built its brand on disrupting the status quo, the move toward a voluntary "Trump card" allows for a graceful de-escalation of a potential legal and legislative battle with the nation’s largest financial institutions. Rather than engaging in a protracted fight over usury thresholds—which would likely face constitutional challenges and stiff opposition in a divided Congress—the National Economic Council is opting for a "moral suasion" strategy. By framing the expansion of credit as a patriotic or pro-growth initiative, the White House puts the onus on bank CEOs to demonstrate their commitment to the American consumer.

Global comparisons provide a cautionary tale regarding the implementation of interest rate caps. In jurisdictions like the United Kingdom and various European Union member states, regulators have implemented various forms of price controls on high-cost short-term credit. While these measures have succeeded in curbing predatory lending practices, they have also led to a measurable decrease in the availability of small-dollar loans for high-risk populations. In the United States, several states have tried to implement their own usury laws, often resulting in "regulatory arbitrage" where lenders relocate their operations to states with more permissive environments, such as South Dakota or Delaware. A federal voluntary program would avoid these jurisdictional pitfalls while maintaining a level playing field across the national banking landscape.

The reaction from the financial community has been a mixture of cautious optimism and skepticism. While Hassett suggested that some bank CEOs are "on board" with the president’s vision, major industry players have remained tight-lipped regarding specific commitments. The logistical hurdles of launching a new line of credit products are substantial, requiring significant investments in marketing, risk modeling, and compliance infrastructure. Furthermore, banks must navigate the watchful eyes of shareholders who prioritize dividends and stock buybacks, which could be threatened if "Trump cards" lead to a surge in non-performing loans.

Market data indicates that the stakes for the American consumer have never been higher. Total credit card debt in the United States has surged past the $1.1 trillion mark, driven by a combination of resilient consumer spending and the rising cost of living. As households lean more heavily on credit to manage their monthly budgets, the gap between those with access to low-interest capital and those trapped in high-interest cycles continues to widen. If the "Trump card" initiative can successfully target the "sweet spot" identified by Hassett, it could provide a vital safety valve for millions of families, preventing them from falling into the hands of payday lenders or other fringe financial services.

Looking ahead, the success of this policy shift will depend on the specifics of the incentives offered to the banking sector. Economists speculate that the administration might offer regulatory relief or streamlined approval processes for banks that meet certain "inclusion" benchmarks. There is also the possibility of utilizing the Community Reinvestment Act (CRA) framework to encourage these voluntary credit expansions. By aligning the "Trump card" goals with existing regulatory requirements, the White House could provide a clear path for banks to comply with the spirit of the president’s mandate without compromising their fiduciary duties.

Ultimately, the pivot led by Kevin Hassett represents a strategic recalibration of populist economics in the face of institutional resistance. By moving away from the "stick" of mandatory rate caps and toward the "carrot" of voluntary market expansion, the National Economic Council is betting that the private sector can be coaxed into serving the broader public interest. Whether these "Trump cards" become a cornerstone of the American financial landscape or remain a rhetorical flourish in the ongoing negotiation between Washington and Wall Street remains to be seen. However, the shift underscores a fundamental truth of modern governance: in the complex ecosystem of global finance, the most enduring changes are often those that find a way to align political ambition with economic reality.