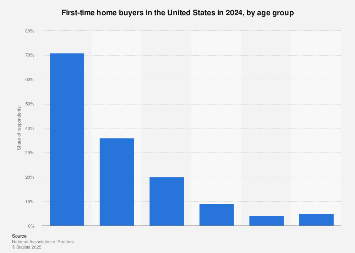

In the United States, the landscape of first-time homeownership is increasingly defined by the entry of younger generations, particularly Millennials and the nascent Gen Z cohort, into the property market. While precise nationwide figures for 2024 remain under detailed compilation, available data and market trends from preceding years highlight a significant proportion of younger adults engaging in their initial home purchases. For instance, in recent analyses, individuals aged 26 to 34 have consistently shown a substantial percentage of first-time buyers, often representing a majority within their age bracket’s home-buying activities. Concurrently, the 35 to 44 age group also comprises a considerable segment of first-time purchasers, though this demographic may also include individuals making subsequent, or "trade-up," purchases.

The pronounced presence of Gen Z (typically defined as those born between 1997 and 2012) and Millennials (born between 1981 and 1996) as first-time homebuyers is a predictable outcome of their life-stage positioning. These generations are navigating the critical early to mid-stages of their professional lives. For many, this involves establishing careers, pursuing higher education, or even a combination of both. This period is often characterized by financial pressures, notably the persistent burden of student loan debt, which can significantly impede the accumulation of capital required for substantial down payments. The average student loan debt in the U.S. has remained a significant economic factor, influencing major financial decisions for millions. Consequently, saving for a down payment on a starter home can be a protracted process, often spanning several years of diligent financial planning and sacrifice.

The economic reality for these younger demographics often necessitates a longer savings horizon before they can meet the financial thresholds for homeownership. A down payment, traditionally ranging from 3% to 20% of a home’s purchase price, represents a substantial sum. For a median-priced starter home, this can easily amount to tens of thousands of dollars, a figure that can be particularly daunting for those just entering the workforce or still servicing educational loans. This financial prerequisite underscores the strategic, long-term planning involved in their journey towards property ownership.

The typical trajectory for these first-time homeowners often involves residing in their initial property for an extended period. This commitment to a starter home, often acquired at a lower price point, allows them to build equity and establish a foothold in the housing market. Consequently, when these individuals eventually decide to move, they are likely to be transitioning to larger, more expensive "trade-up" homes. This progression is generally fueled by career advancement, increased earning potential, and a desire for more space or amenities. It also means that the pool of individuals selling their homes tends to skew towards older generations who have had more time to accumulate wealth and experience multiple property transactions.

The concept of a "trade-up" home purchase is a crucial element in understanding housing market dynamics. After several years of homeownership, individuals often find themselves in a financial position to upgrade. The income required to afford such a property is often a smaller percentage of their earnings compared to the initial hurdle of securing a starter home. This is because their established career paths generally lead to higher salaries, and the equity built in their first home can be leveraged towards the down payment on a more substantial residence. This cycle of buying, living, and then trading up is a cornerstone of a healthy real estate market, facilitating movement and enabling individuals to adapt their housing to their evolving life circumstances.

Globally, the challenges faced by first-time homebuyers in the U.S. are not unique. Many developed economies are witnessing similar demographic shifts, with younger generations grappling with affordability issues, student debt, and the need for substantial savings. In countries like Canada and Australia, for instance, rising housing prices have made it increasingly difficult for young adults to enter the market, leading to extended periods of renting and delayed homeownership. This has prompted various policy interventions, including first-time buyer grants and tax incentives, aimed at easing the financial burden. The United Kingdom, too, has seen discussions around intergenerational wealth transfer and the impact of housing affordability on younger cohorts.

The economic implications of these trends are multifaceted. A robust first-time homebuyer market signals economic vitality and contributes to broader economic growth through increased construction, real estate services, and related consumer spending. Conversely, prolonged difficulties in accessing homeownership can lead to a slowdown in these sectors and potentially exacerbate wealth inequality, as property ownership remains a significant avenue for wealth accumulation. The current interest rate environment also plays a critical role. Higher mortgage rates can increase the monthly cost of homeownership, making it even more challenging for first-time buyers to qualify for loans and manage their budgets, even if they have managed to save for a down payment.

Data from the National Association of Realtors (NAR) has historically indicated that the median age of first-time homebuyers has been gradually increasing, a trend that can be attributed to the aforementioned financial hurdles. While the exact percentage of first-time buyers by specific age groups in 2024 is still being analyzed, the underlying economic forces shaping these demographics remain consistent. The pursuit of the "American Dream" of homeownership, while enduring, is being reshaped by economic realities, requiring a strategic and often patient approach from younger generations. As these cohorts mature and their financial situations evolve, their impact on the housing market will continue to be a significant area of economic observation. The long-term effects will depend on a complex interplay of economic growth, wage inflation, housing supply, and evolving government policies designed to support aspiring homeowners.