India’s quick commerce sector stands at a pivotal juncture, having experienced an explosive period of growth that has fundamentally reshaped consumer expectations and retail dynamics. What began as a niche for urgent grocery needs has rapidly evolved into a comprehensive platform delivering everything from daily essentials and lifestyle products to high-end electronics within minutes. This remarkable expansion, however, masks an intensifying battle for market dominance and, critically, for a viable path to profitability, with the year 2026 anticipated to present an even more formidable landscape for incumbent players.

The trajectory of rapid delivery in India has been nothing short of meteoric. The segment witnessed an unprecedented surge in 2024 and 2025, propelled by expanding geographical reach beyond metropolitan hubs into Tier 2 and Tier 3 cities. This aggressive penetration was accompanied by a significant broadening of product assortments, pushing platforms beyond their initial focus on everyday groceries. Such rapid scaling, while impressive, necessitated substantial capital deployment, with companies burning significant cash to acquire and retain customers in a fiercely competitive environment. Data from domestic ratings firm Care Edge illustrates this boom, reporting that Indians placed orders worth approximately ₹64,000 crore on quick-commerce platforms like Blinkit and Instamart in FY25, marking more than a twofold increase from the previous fiscal year. Concurrently, platform revenues from fees surged to an estimated ₹10,500 crore in FY25, a dramatic rise from just ₹450 crore in FY22, underscoring the segment’s explosive growth since the pandemic-induced acceleration of digital adoption.

This hypergrowth phase has been fueled by massive capital infusions. Swiggy, a key player with its Instamart offering, recently secured ₹10,000 crore in fresh capital through a Qualified Institutional Placement (QIP) in December. This followed closely on the heels of Zepto, which raised a substantial $450 million in October, valuing the company at $7 billion, with participation from major institutional investors like the US-based pension fund California Public Employees’ Retirement System (CalPERS). Eternal, the parent company of Blinkit, has also continued to inject significant funds into its rapid delivery arm. Industry executives, including Madhav Kasturia, founder and CEO of hyperlocal delivery platform Zippee, emphasize that while capital sets the initial pace, it is meticulous execution that ultimately determines which players can convert operational density into consistent contribution profit week after week. This highlights a crucial shift from pure growth metrics to a more sustainable financial outlook.

The relentless pursuit of market share and speed has led to significant operational investments, particularly in the expansion of "dark stores"—small, local warehouses that are central to enabling ultra-fast deliveries. However, this strategy has come at a considerable cost. Losses for major players have widened, reflecting the intense cash burn associated with establishing and maintaining extensive dark store networks. For instance, Blinkit reported its highest cash burn in recent quarters, allocating approximately ₹1,038 crore (about 94% of its quarterly funds) to establish 272 dark stores during the July-September period. Similarly, Swiggy’s net loss widened to ₹1,092 crore, up from ₹626 crore in the year-ago period, primarily due to increased spending on Instamart. Analysts believe that curtailing this cash burn will remain challenging in the immediate future, as the sector is still in an aggressive customer acquisition phase, focusing on building a loyal user base.

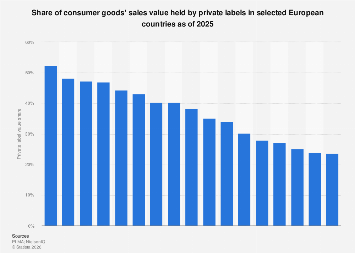

Despite the financial pressures, there are encouraging signs that quick commerce is transcending its initial novelty to become an entrenched consumer habit. Satish Meena, an analyst at market research firm Datum Intelligence, observes a growing trend where households are increasingly integrating quick commerce into their weekly planning, moving beyond mere last-minute convenience. This behavioral shift implies opportunities for platforms to optimize their product assortment and delivery timelines based on more predictable purchase patterns, enhancing efficiency and potentially reducing waste. The strategic expansion into high-margin, discretionary categories further supports this evolution. Beyond groceries, platforms have diversified into apparel, gifts, shoes, and even high-value items like iPhones and gaming consoles. The coming year is expected to see deeper penetration into critical categories such as pharmacy and the aggressive push of private label brands, building on the groundwork laid for non-grocery segments in 2025. Private labels, in particular, are seen as "the real engine" for improving margins and fostering repeat purchases, as noted by Zippee’s Kasturia. Categories like chronic medications, consumables, and essential goods are considered ideal fits for the quick commerce model, promising higher repeat rates and increased average order values (AOV). This suggests a maturing phase for quick commerce, characterized by more thoughtful growth strategies, improved operational planning, smoother logistics, and more balanced partnerships.

The rapid delivery segment is not only demonstrating impressive growth but is also significantly outpacing the overall online retail market, even posing a competitive threat to traditional brick-and-mortar kirana stores. According to a report by consultancy firm Bain & Co., quick commerce accounted for over two-thirds of all online grocery orders last year, with its total market share expanding fivefold since 2022 to reach an estimated $6-7 billion. This share is projected to climb even higher in the current year. Karan Taurani, an analyst at Elara Securities, highlights that quick commerce is actively fueling the broader e-commerce market, driving user expansion and regional penetration. While online sales in mature markets like the US grew by a modest 5-6% year-on-year, India continues to exhibit robust double-digit growth, with quick commerce acting as a key catalyst. This suggests that the digital commerce flywheel in India is outperforming global benchmarks, creating a unique and dynamic market.

However, the landscape is poised for a dramatic transformation with the imminent entry of e-commerce behemoths Amazon and Flipkart into the rapid delivery arena. Flipkart launched its instant delivery arm, "Minutes," late last year, with plans for aggressive expansion across major cities throughout the current year. Amazon followed suit with "Now," initiating services in select cities in June. These powerful new entrants bring formidable advantages: vast existing customer bases, extensive product catalogs, deep financial resources, and sophisticated supply chain expertise. Subramanian M.K., director of Velocity, an e-commerce enablement platform, anticipates that these major players will focus on broadening their product ranges, diversifying into new categories, expanding their offline presence, and significantly enhancing delivery speed and last-mile reliability in 2026.

The arrival of Amazon and Flipkart intensifies the pressure on existing quick commerce specialists. While these incumbents have mastered the "within minutes" delivery proposition, the e-commerce giants possess an inherent advantage in product assortment and customer loyalty. Success for all players, as Meena points out, will hinge on their ability to consistently deliver on the speed promise while leveraging their unique strengths. Brands are also adapting to this evolving landscape, increasingly prioritizing strengthening their owned sales channels, refining demand forecasting, distributing inventory across multiple locations, and collaborating with logistics partners capable of supporting decentralized warehousing and accelerated delivery. Digital-first brands, in particular, are doubling down on robust omnichannel execution, seeking deeper visibility into margins, greater control over customer data, and a more reliable logistics experience for their customers.

As the quick commerce sector matures, 2026 is expected to be a year of strategic refinement rather than unbridled expansion. The focus will shift towards operational excellence, sustainable unit economics, and differentiated customer experiences. The market may witness consolidation as smaller players struggle to compete with the financial might and logistical prowess of the larger entities. Ultimately, the ability to seamlessly integrate speed, variety, and profitability will determine the long-term winners in India’s highly competitive and rapidly evolving instant delivery market, transforming it from a hypergrowth phenomenon into a stable, yet still dynamic, pillar of modern retail.