A decade after the groundbreaking success of S.S. Rajamouli’s Baahubali: The Beginning shattered linguistic barriers and redefined India’s cinematic landscape, the promise of a truly integrated "pan-India" film industry remains a complex, often unfulfilled, aspiration. While a select few southern productions, dubbed into Hindi, have achieved monumental box office triumphs, a growing number of releases are struggling to replicate this magic, revealing a more nuanced reality behind the initial euphoria. The vision of a seamless cross-cultural cinematic exchange, once heralded as a bridge between the diverse linguistic regions of India, now contends with audience fatigue, evolving distribution models, and the inherent challenges of translating deeply rooted narratives for a national audience.

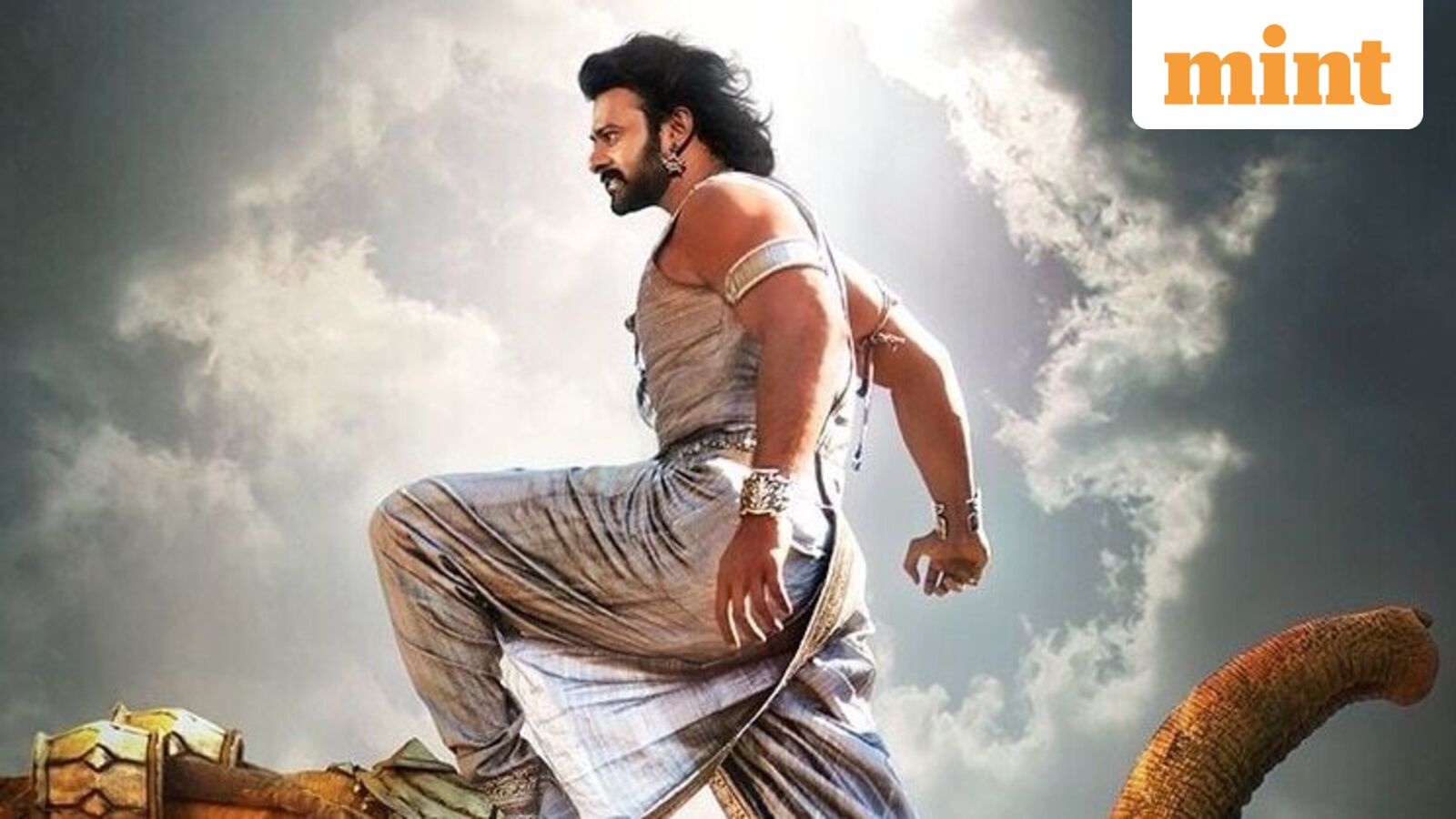

The genesis of the pan-India phenomenon can be traced to 2015, when Baahubali: The Beginning, a Telugu epic featuring a cast largely unknown in the Hindi belt, defied all expectations. Released just a week before a major Bollywood tentpole, it captivated North Indian audiences with its grand scale, mythological undertones, and compelling narrative, inspired by ancient Indian lore. The Hindi dubbed version alone garnered an unprecedented ₹5.15 crore on its opening day, escalating to over ₹46 crore in its first week and eventually accumulating nearly ₹120 crore during its theatrical run in the northern regions. This success was pivotal, not only for its financial metrics but for dismantling the long-held perception that dubbed southern films were niche, often relegated to satellite television with their distinct, sometimes exaggerated, theatricality. The sequel, Baahubali 2: The Conclusion, released in 2017, cemented this new paradigm, becoming the first Indian film to cross the staggering ₹1,000 crore mark globally across its multiple language versions, fueling a national obsession around its central mystery.

This transformative era opened the floodgates for a new wave of southern productions, primarily from the Telugu, Kannada, and Tamil industries, to target the Hindi-speaking market with ambitious, action-packed, and visually spectacular films. These offerings strategically filled a perceived void left by mainstream Hindi cinema, which, particularly post-2010, was increasingly seen as catering to urban, multiplex-centric audiences, often with experimental or niche content. Subsequent successes like Allu Arjun-starrer Pushpa: The Rise, which saw its Hindi dub earn over ₹108 crore, RRR with its ₹274.31 crore Hindi collection, and the Kannada franchises KGF and Kantara, further underscored the potential for cross-linguistic appeal. Pushpa 2: The Rule, for instance, went on to become one of the highest-grossing Hindi films, despite not being originally produced in the language, pulling in over ₹800 crore from its Hindi version alone.

However, the narrative of consistent triumph has proven to be less straightforward. For every KGF or Kantara, there are a multitude of films that fail to capture the imagination of the Hindi audience, often resulting in significant financial losses relative to their marketing investment. An analysis by media consulting firm Ormax in 2023 highlighted this disparity: out of 42 Hindi-dubbed southern films released theatrically between January 2020 and August 2023, only nine managed to surpass a lifetime box office collection of ₹15 crore in Hindi. This patchy payoff suggests that while the "pan-India" label signifies ambition, it doesn’t guarantee widespread acceptance.

Industry veterans point to several critical factors behind this uneven performance. Shobu Yarlagadda, co-founder and CEO of Arka Mediaworks, the production house behind the Baahubali films, notes that not every story possesses universal appeal. Many southern narratives are deeply entrenched in regional culture, making them challenging for audiences unfamiliar with those specific nuances to fully appreciate. The initial euphoria led many filmmakers to jump onto the pan-India bandwagon, often without adequately adapting their content or marketing strategies for the diverse northern markets. This has resulted in an overreliance on a formulaic blend of high-octane action and period dramas, leading to audience fatigue when films lack genuine innovation or a compelling, unique storyline.

The financial burden of expanding market reach is also substantial. For a film produced with a budget of ₹100 crore, an additional ₹20-25 crore can be earmarked solely for marketing and distribution in the Hindi belt. This includes engaging with national television shows, collaborating with Hindi-speaking social media influencers, extensive radio and outdoor advertising campaigns, and multi-city promotional tours spanning major urban centers from Chennai to Delhi. While top-tier productions like RRR and Pushpa can afford such extensive outreach, many mid-budget films find the cost prohibitive, especially when their stars lack strong recognition in the northern markets, making it difficult to drive initial footfalls organically. Shailesh Kapoor, CEO of Ormax Media, emphasizes that true breakthrough success in markets like Delhi, Punjab, and Uttar Pradesh requires a distinct marketing mix, which places immense financial pressure on producers.

Another significant hurdle emerges from the evolving theatrical and digital release windows. National multiplex chains, including industry giants like PVR Inox and Cinepolis, have frequently refused to screen Hindi versions of certain southern films in North India due to disputes over the OTT (over-the-top) streaming window policy. Prior to the pandemic, an eight-week gap between theatrical release and OTT premiere was standard practice. However, many southern filmmakers, particularly in Tamil and Malayalam cinema, have opted for shorter windows, sometimes as brief as four weeks, to capitalize on lucrative streaming deals. This directly conflicts with exhibitors’ desire to maximize their theatrical run. For instance, films starring major actors like Vijay (e.g., Leo, The Greatest Of All Time) have forgone Hindi releases in the North after securing such streaming arrangements. Conversely, the Hindi version of Kantara: A Legend Chapter 1 was widely screened because its producers agreed to an eight-week exclusive theatrical window for the northern market, even as its southern language versions premiered on OTT earlier. For smaller films, where marketing costs in Hindi-speaking regions can sometimes exceed the production budget, producers often prioritize robust OTT sales and concentrate distribution efforts in their home states, where audience recovery is more assured. As Rahul Puri, Managing Director of Mukta Arts and Mukta A2 Cinemas, observes, while the OTT window is part of the problem, not every film is inherently designed for such broad crossover appeal.

The struggle for cross-cultural resonance is not unidirectional. While southern films contend with a capricious Hindi market, mainstream Bollywood productions have largely failed to penetrate deeply into South Indian territories. With the notable exception of Jawan, directed by Tamil filmmaker Atlee and featuring prominent southern actors Nayanthara and Vijay Sethupathi, recent Hindi blockbusters have struggled to secure significant box office numbers in Tamil Nadu, Kerala, Andhra Pradesh, Telangana, and Karnataka—regions that were once lucrative for films starring Bollywood stalwarts like Shah Rukh Khan and Salman Khan. For example, Shah Rukh Khan’s Pathaan, despite earning over ₹512 crore domestically, collected less than ₹18 crore from Tamil Nadu and Kerala combined, and approximately ₹38 crore from the Telugu-speaking states. Similarly, Ranbir Kapoor’s Animal, with a domestic haul exceeding ₹462 crore, saw only ₹6.81 crore from Tamil Nadu and Kerala, and about ₹40.22 crore from the Telugu states. Even the recent blockbuster Dhurandhar, which grossed over ₹860 crore domestically, managed only ₹52.61 crore from the Telugu states and just over ₹9 crore from Tamil Nadu and Kerala.

Trade experts attribute Bollywood’s southern predicament to a divergence in cinematic sensibilities. Southern audiences, particularly beyond the metropolitan hubs, organically prefer films in their native languages that cater to mass-market tastes, characterized by larger-than-life heroism, emotional melodrama, and energetic music. Bollywood, on the other hand, has increasingly focused on urban-centric narratives, experimental storylines, and a more refined commercial aesthetic. This shift has diminished the connection between Bollywood stars, who often appear overexposed or typecast to southern viewers, and the regional mass audience. Independent exhibitor Vishek Chauhan articulates this succinctly: "Bollywood may have been able to connect with the elite urban audiences in the south who follow Hindi, but the films don’t resonate with the psychographics and emotions of people beyond the big cities of Chennai, Hyderabad and Bengaluru. Viewers there already have their own supply of massy films." This creates a "double whammy," where Bollywood struggles to produce mass-market films that are distinct enough from southern offerings, leading to a lack of genuine appeal.

The future of the pan-India film model hinges on adaptation and innovation. For southern producers, the lesson is clear: mere dubbing and a substantial marketing budget are insufficient. The content must possess universal themes, strong emotional cores, and production quality that transcends linguistic boundaries, rather than relying solely on formulaic action. The success stories—Baahubali, KGF, Pushpa, Kantara, RRR—all shared a blend of unique vision, compelling storytelling, and technical excellence that resonated broadly. For Bollywood, the challenge lies in either re-discovering its mass appeal or strategically collaborating with southern talent to create genuinely multi-lingual productions that respect and integrate regional sensibilities from inception. As Indian audiences become more globally exposed and discerning, the cinematic landscape demands more than just translated dialogues; it requires a true convergence of creative visions to forge a sustainable and genuinely pan-Indian cinematic identity.