The landscape of global trade is perpetually in flux, and the United States’ textile and apparel sector is experiencing a significant recalibration in its engagement with the Chinese market as 2024 unfolds. While definitive, up-to-the-minute figures for the entirety of 2024 remain in their nascent stages, emerging trends and historical data provide crucial insights into the evolving value of American textile and apparel imports by China. This analysis delves into the potential trajectory, influencing factors, and broader economic implications of this dynamic trade relationship.

Historically, China has been a dominant force in global textile and apparel manufacturing, leveraging its vast labor pool and established supply chains to produce goods for export worldwide. Consequently, the flow of finished textiles and apparel into China from other nations, particularly the United States, represents a distinct segment of bilateral trade, often driven by specific product categories, brand recognition, or niche market demands. Understanding the value of these imports requires a nuanced perspective, moving beyond the more commonly discussed export figures of Chinese manufactured goods to the U.S.

Several key factors are likely to shape the value of U.S. textile and apparel imports by China in 2024. Foremost among these is the broader geopolitical and economic climate. The protracted trade tensions between the U.S. and China, while potentially easing in certain areas, continue to cast a long shadow over bilateral commerce. Tariffs, non-tariff barriers, and evolving regulatory environments can directly impact the cost and feasibility of importing goods. For American textile and apparel producers looking to export to China, these factors necessitate careful strategic planning and risk assessment.

Consumer demand within China itself plays a pivotal role. As China’s middle class continues to expand and its disposable incomes rise, there is a growing appetite for premium, branded, and uniquely designed apparel. This often creates opportunities for foreign brands that can effectively position themselves within the Chinese market. The U.S. possesses a strong reputation for fashion innovation, quality craftsmanship, and established brands, which can be leveraged to capture a segment of this demand. However, this also means that the value of imports will be heavily influenced by the success of specific American brands in appealing to Chinese consumer preferences, which are themselves subject to rapid shifts and evolving trends.

The composition of these imports is also critical. The category of "textiles and apparel" is broad, encompassing everything from raw fabrics and yarns to finished garments, activewear, and high-fashion items. U.S. exports to China in this sector may lean towards specialized technical textiles, performance fabrics, or luxury apparel that cater to specific market niches where American manufacturing or design prowess is particularly recognized. For instance, U.S. companies that excel in producing high-performance athletic wear or sustainable textile solutions might find a receptive market in China, thereby contributing to the import value.

Furthermore, the impact of global supply chain diversification cannot be overstated. In recent years, many companies have sought to reduce their reliance on single manufacturing hubs. While China remains a cornerstone of global production, some brands and retailers may be exploring alternative sourcing locations. This could, in theory, slightly temper the growth of overall textile and apparel trade with China, but for U.S. exporters, it might also represent an opportunity if they can offer reliable and high-quality alternatives within the U.S. or other established manufacturing countries.

Economic indicators provide a valuable lens through which to project potential import values. The overall growth rate of the Chinese economy, coupled with consumer confidence indices and retail sales data, will offer clues about the purchasing power and willingness of Chinese consumers and businesses to acquire foreign-made textile and apparel products. If China’s economic growth remains robust, it is likely to support continued demand for imported goods. Conversely, any slowdown could lead to a more cautious import environment.

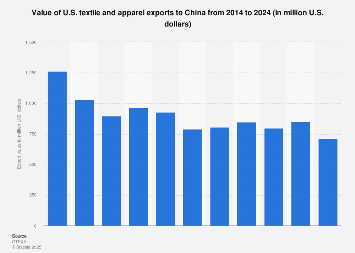

To contextualize the potential figures for 2024, it is instructive to look at recent historical data. For example, in the period leading up to 2024, the value of U.S. textile and apparel exports to China has fluctuated, influenced by trade policies and market dynamics. While specific, granular data for 2024 is still being compiled, analysis of trends from preceding years suggests a potential for moderate growth, contingent on the factors mentioned above. If U.S. brands and manufacturers can navigate the complexities of the Chinese market and offer compelling products, the import value could see a positive uptick.

Expert insights from trade analysts and industry associations often highlight the importance of agility and adaptability in the U.S.-China textile and apparel trade. "Success in the Chinese market for U.S. textile and apparel exporters hinges on a deep understanding of local consumer trends, effective digital marketing strategies, and the ability to adapt to evolving trade regulations," notes a senior trade economist specializing in Asian markets. "While challenges persist, the sheer size and dynamism of the Chinese consumer base present enduring opportunities for those who can meet its sophisticated demands."

The economic impact of these imports extends beyond the immediate transaction. For U.S. textile and apparel manufacturers, successful exports contribute to revenue generation, job creation, and investment in research and development. A strong export performance can bolster domestic manufacturing capabilities and enhance the global competitiveness of American brands. Conversely, for China, these imports contribute to consumer choice, support the development of its retail sector, and can foster innovation through exposure to foreign designs and technologies.

Looking ahead, the trajectory of U.S. textile and apparel imports by China in 2024 will likely be a complex interplay of macro-economic forces, geopolitical considerations, and the ever-evolving preferences of Chinese consumers. While precise figures will emerge over time, a proactive and informed approach by American businesses, focusing on quality, innovation, and market responsiveness, will be crucial in capitalizing on the opportunities within this significant global trading relationship. The ability to adapt to shifting market dynamics, leverage brand equity, and navigate the complexities of international trade will ultimately define the success of U.S. textile and apparel exports to China in the current year and beyond.