In the dynamic landscape of India’s burgeoning infrastructure and industrial sectors, the financial performance of key players like R R Kabel Limited becomes a critical barometer of economic health and growth. While precise, up-to-the-minute financial figures often reside behind subscription walls for specialized data providers, the broader trends and implications of a company like R R Kabel’s gross profit performance can be extrapolated and analyzed within the context of the wider Indian economy and global market forces. Gross profit, a fundamental indicator of a company’s operational efficiency and pricing power, provides crucial insights into its ability to generate revenue above and beyond the direct costs of producing its goods or services. For R R Kabel, a significant manufacturer of wires and cables, its gross profit margins are intrinsically linked to the demand from sectors such as power generation and distribution, telecommunications, construction, and manufacturing – all of which are experiencing robust expansion in India.

The Indian electrical cable industry is a substantial market, projected to witness significant growth driven by government initiatives like "Make in India," the ambitious expansion of renewable energy capacity, and the ongoing urbanization that fuels demand for both residential and commercial infrastructure. The nation’s commitment to increasing its power generation capacity, coupled with the ongoing need to upgrade and expand its transmission and distribution networks, creates a sustained demand for high-quality wires and cables. Furthermore, the rapid rollout of 5G technology and the expansion of broadband internet services necessitate substantial investment in optical fiber cables and related infrastructure, another key segment for R R Kabel. This escalating demand, when met with effective cost management and strategic pricing, directly translates into healthy gross profit figures.

Understanding the nuances of R R Kabel’s gross profit requires looking beyond a single year’s data point and examining its performance within industry benchmarks and its competitive positioning. Companies in the wires and cables sector typically operate with gross margins that can vary based on raw material costs (primarily copper and aluminum), product complexity, the intensity of competition, and their ability to pass on price fluctuations to end-users. Global commodity prices for metals, in particular, play a pivotal role. Fluctuations in the international prices of copper and aluminum can directly impact the cost of goods sold (COGS) for R R Kabel, thereby influencing its gross profit. A sustained period of high commodity prices, if not fully offset by increased selling prices or improved operational efficiencies, can exert downward pressure on gross margins. Conversely, periods of price stability or decline in raw materials, combined with strong demand, can lead to a significant uplift in profitability at the gross level.

Market data from various industry reports consistently points to a positive outlook for the Indian wires and cables market. For instance, projections often indicate a compound annual growth rate (CAGR) well into the double digits for the coming years. This growth is underpinned by a confluence of factors: increased electrification across rural and urban areas, the development of smart cities, the expansion of industrial corridors, and the ongoing modernization of the country’s power grid. R R Kabel, as a prominent domestic manufacturer with a well-established distribution network and a reputation for quality, is strategically positioned to capitalize on these growth opportunities. Its ability to secure large-scale contracts for major infrastructure projects, coupled with its presence in the retail segment catering to individual housing and smaller commercial projects, provides a diversified revenue stream that can help stabilize gross profit performance.

Analyzing the gross profit of R R Kabel also necessitates an understanding of its competitive landscape. The Indian market features both domestic giants and international players, leading to a competitive environment that can influence pricing strategies and, consequently, gross margins. Companies that can achieve economies of scale, optimize their supply chain, and innovate in product development—offering specialized cables for specific applications such as high-voltage transmission, fire-resistant cables, or data cables—are better positioned to maintain and enhance their gross profit margins. Efficiency in manufacturing processes, such as reducing wastage, improving energy consumption, and implementing advanced production techniques, are also critical determinants of gross profit.

Economically, the performance of companies like R R Kabel has broader implications. A healthy gross profit for a major industrial manufacturer signals robust demand for its products, which in turn supports employment within the company and its associated supply chains. It also indicates a capacity for reinvestment in research and development, infrastructure upgrades, and expansion, further contributing to economic growth. For investors, a consistent or improving gross profit trend is a key indicator of a company’s fundamental strength and its ability to generate sustainable profits. It forms the bedrock upon which operating profit, net profit, and ultimately shareholder value are built.

Globally, the trend towards electrification and the transition to renewable energy sources are universal drivers for the wires and cables sector. Countries worldwide are investing heavily in modernizing their power grids to accommodate intermittent renewable energy sources and to improve grid resilience. This global demand dynamic creates opportunities for Indian manufacturers to potentially explore export markets, although the primary focus for R R Kabel, like most large Indian corporations, remains the vast domestic market. However, international benchmarks in terms of technological advancement, product quality, and sustainability practices can influence domestic expectations and competitive pressures.

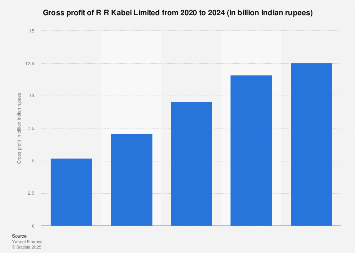

In conclusion, while specific financial data for R R Kabel’s gross profit in 2024 would provide a precise snapshot, the broader economic context of India’s infrastructure push, the global energy transition, and the dynamics of the electrical cable industry suggest a potentially favorable operating environment. The company’s ability to navigate raw material price volatility, maintain competitive pricing, and drive operational efficiencies will be key determinants of its gross profit performance. As India continues its rapid development trajectory, the demand for wires and cables is poised for sustained growth, presenting significant opportunities for R R Kabel to solidify its market position and achieve robust financial outcomes. The company’s strategic decisions in sourcing, manufacturing, and market penetration will ultimately shape its financial success in the coming years, with gross profit serving as a vital indicator of its operational health and market competitiveness.