The Minnesota Wild’s anticipated payroll expenditures for the 2025 National Hockey League season are poised to reflect a complex interplay of player contracts, salary cap regulations, and the ever-increasing valuation of talent within professional hockey. While specific figures are subject to the fluid nature of contract negotiations, player performance, and potential trades, an analysis of current roster structures and projected market trends offers a comprehensive view of the financial landscape the franchise is navigating. This forward-looking assessment is crucial for understanding the team’s strategic positioning, its capacity for roster construction, and its overall economic health within the competitive NHL ecosystem.

The NHL operates under a strict salary cap system, designed to promote parity among its 32 franchises. This cap, which is adjusted annually based on league revenues, directly influences how teams manage their payroll. For the 2025 season, projections suggest the cap will continue its upward trajectory, driven by robust broadcast deals, expanding international markets, and growing fan engagement. This increase, while offering teams more flexibility, also contributes to the escalating cost of top-tier talent. Consequently, the Wild, like all other franchises, must meticulously balance the desire to acquire and retain elite players with the imperative of remaining compliant with the cap.

The Minnesota Wild’s current roster comprises a mix of established veterans, promising young talent, and mid-career professionals, each with contracts of varying lengths and financial commitments. Analyzing the aggregate value of these existing agreements provides a baseline for the 2025 payroll. Key players with significant cap hits will continue to anchor the team’s financial structure. The decisions made regarding contract extensions for these core players, as well as the acquisition of new talent through free agency or trades, will significantly shape the final payroll number. The team’s management will undoubtedly be engaged in strategic planning well in advance of the 2025 season, assessing which players represent long-term investments and which may be moved to optimize cap space and roster balance.

Beyond the immediate financial obligations, the projected payroll for the Wild must also account for potential bonuses, performance incentives, and the intricacies of buyout clauses. These elements, while sometimes less predictable, can add substantial figures to a team’s overall financial outlay. Furthermore, the league’s Collective Bargaining Agreement (CBA) outlines specific rules regarding player movement, contract structures, and salary cap accounting, all of which must be adhered to. Understanding these nuances is paramount for accurate financial forecasting.

The economic impact of NHL player salaries extends beyond the individual teams. High payrolls contribute to the league’s overall revenue generation through ticket sales, merchandise, and broadcast rights. The concentration of talent in specific markets can also lead to increased economic activity in those cities, from hospitality to local retail. However, for individual franchises, managing a high payroll presents a significant challenge. A substantial portion of a team’s operating budget is dedicated to player compensation, leaving less room for investment in other critical areas such as scouting, player development, arena infrastructure, or marketing initiatives.

Globally, the NHL’s salary structure is among the highest in professional sports. When compared to leagues in other major sports like soccer, basketball, or American football, NHL player salaries, particularly for top performers, are highly competitive. This global benchmark influences player expectations and the compensation demanded by agents. The Minnesota Wild, operating within this international talent market, must offer salaries that are attractive enough to secure and retain the caliber of players necessary to compete for championships.

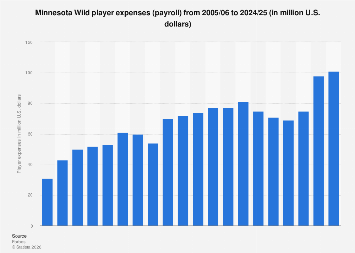

Market data from sports analytics firms specializing in professional sports economics consistently indicates a steady rise in player valuations across major leagues. These valuations are driven by a confluence of factors, including the individual player’s statistical performance, their impact on team success, their marketability, and the overall economic health of the league. For the Wild, this means that even maintaining a similar roster composition from one season to the next could result in an increased payroll due to annual salary increases or the expiration of entry-level contracts for promising young players who then command significantly higher salaries.

Expert insights from sports economists and financial analysts often highlight the delicate balance required for successful franchise management. While a high payroll can be indicative of a team’s commitment to acquiring top talent and a potential indicator of on-ice success, it is not a guarantee. Strategic allocation of resources, effective player development, and shrewd contract management are equally, if not more, important. The Wild’s financial strategy for 2025 will likely be a testament to their approach to these fundamental principles of sports management. The ability to navigate the salary cap effectively, identify undervalued assets, and foster a winning culture are all critical components that contribute to long-term success, irrespective of the absolute payroll figure.

The projected payroll for the Minnesota Wild in 2025, therefore, is more than just a numerical representation of player salaries. It is a reflection of the team’s strategic vision, its position within the competitive NHL landscape, and its capacity to meet the financial demands of a global professional sports market. As the league continues to evolve economically, understanding these financial underpinnings becomes increasingly vital for assessing the potential trajectory and competitive standing of franchises like the Minnesota Wild. The team’s ability to adapt to these evolving market dynamics will be a key determinant of its success in the seasons to come.