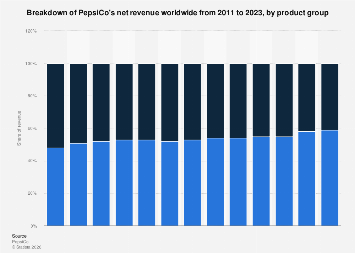

PepsiCo, a titan in the global food and beverage industry, demonstrated a robust financial performance in 2023, with its diverse portfolio of products driving significant revenue growth. The company’s strategic focus on innovation, market penetration, and consumer demand across various categories has cemented its position as a market leader. Examining the revenue breakdown by product segment offers critical insights into the company’s operational strengths and its ability to adapt to evolving consumer preferences and macroeconomic conditions.

The fiscal year 2023 saw PepsiCo’s various product lines contributing substantially to its overall financial success. While specific, granular revenue figures for each distinct product are proprietary and not publicly disclosed in real-time, industry analysis and investor reports provide a comprehensive understanding of the performance drivers. Key segments that consistently underpin PepsiCo’s revenue include its iconic beverage portfolio, its rapidly expanding snack division, and its increasingly important Quaker Oats business.

Within the beverage segment, the flagship Pepsi brand, alongside other popular offerings like Mountain Dew, Gatorade, and Aquafina, continues to be a cornerstone of the company’s sales. The global carbonated soft drink market, though mature in some regions, still exhibits growth, particularly in emerging economies. PepsiCo’s strategic investments in marketing, distribution, and product innovation, including the expansion of its zero-sugar and healthier beverage options, have been crucial in capturing and retaining market share. For instance, the global non-alcoholic beverage market, valued in the hundreds of billions of dollars, is characterized by intense competition, but PepsiCo’s strong brand equity and extensive distribution network allow it to command a significant portion of this market. The company’s ability to cater to a wide range of consumer needs, from refreshment and energy to hydration and functional benefits, is a testament to its diversified beverage strategy. Furthermore, the company’s performance in the ready-to-drink tea and coffee categories, through brands like Lipton (in partnership with Unilever in certain markets) and Starbucks ready-to-drink beverages, also contributes to the beverage division’s revenue.

The snack food division, spearheaded by the Frito-Lay brand, represents another powerhouse within PepsiCo’s revenue generation. Products such as Lay’s, Doritos, Cheetos, and Ruffles are ubiquitous in households worldwide. The snacking category has seen sustained growth globally, driven by changing lifestyles, increased snacking occasions, and a growing demand for convenience. PepsiCo’s leadership in this segment is attributable to its deep understanding of consumer taste preferences, its ability to innovate with new flavors and product formats, and its powerful go-to-market capabilities. The global savory snacks market alone is projected to continue its upward trajectory, with significant contributions from salty snacks, where PepsiCo holds a dominant position. The company’s strategic acquisitions and organic growth initiatives within this segment have further bolstered its revenue streams, enabling it to capitalize on the enduring appeal of convenient, flavorful snack options. The expansion into healthier snack alternatives, such as baked chips and lower-calorie options, also reflects a strategic adaptation to evolving health consciousness among consumers, thereby broadening its appeal.

The Quaker Oats segment, while perhaps smaller in absolute revenue compared to beverages and snacks, plays a vital role in PepsiCo’s diversification and its presence in the breakfast and wholesome foods market. Quaker Oats products, including oatmeal, granola bars, and other breakfast cereals, cater to a growing consumer demand for healthier, convenient, and nutritious food options. The global market for breakfast cereals and oats has seen steady growth, driven by increasing health awareness and the demand for quick meal solutions. PepsiCo’s investments in expanding the Quaker brand’s reach and product innovation, including the introduction of new flavors and functional benefits, have helped to sustain and grow this segment’s contribution to overall revenue. The company’s focus on plant-based ingredients and nutritional benefits aligns with broader global food trends, positioning Quaker as a key player in the healthy eating landscape.

Beyond these core segments, PepsiCo’s revenue is also influenced by its performance in other markets and product categories, including its presence in developing economies where demand for its products is growing. The company’s global footprint allows it to tap into diverse consumer bases and adapt its product offerings to local tastes and preferences, a strategy that is crucial for sustained international growth. For example, its beverage and snack offerings are often tailored to regional palates, further enhancing their market acceptance and revenue generation potential.

The economic environment in 2023 presented both opportunities and challenges for consumer goods companies like PepsiCo. Inflationary pressures on raw materials, labor, and transportation costs necessitated strategic pricing adjustments and operational efficiencies. PepsiCo’s ability to navigate these economic headwinds through effective supply chain management and pricing strategies was instrumental in maintaining its revenue momentum. Furthermore, global economic growth patterns, particularly in Asia, Latin America, and Africa, have been significant drivers of demand for PepsiCo’s products, contributing to its international revenue performance.

Looking ahead, PepsiCo’s strategy for continued revenue growth will likely involve a multi-pronged approach. Ongoing investment in research and development to launch innovative products that align with evolving consumer trends, such as plant-based foods, functional beverages, and sustainable packaging, will be paramount. Further penetration into emerging markets, leveraging its established brand recognition and distribution networks, will also be a key growth lever. The company’s commitment to digital transformation, enhancing its e-commerce capabilities and direct-to-consumer strategies, is expected to unlock new revenue streams and improve customer engagement. Moreover, a continued focus on operational excellence, cost management, and supply chain resilience will be essential to mitigate economic uncertainties and ensure sustained profitability across its diverse product portfolio. The interplay between its iconic beverage brands, its dominant snack division, and its growing presence in healthier food categories positions PepsiCo to continue its trajectory of robust revenue generation in the years to come, adapting to the dynamic global marketplace.