The Japanese equity market has entered a period of heightened volatility and renewed optimism as the race to succeed Prime Minister Fumio Kishida enters its final, decisive stage. For global investors, the focus has shifted from macroeconomic indicators to the internal politics of the Liberal Democratic Party (LDP), where the emergence of Sanae Takaichi as a leading contender has reignited a market phenomenon known as the "Takaichi trade." This speculative wave, characterized by a preference for a weaker yen and aggressive monetary accommodation, has propelled the Nikkei 225 and the broader Topix index to significant gains, reflecting a market that is increasingly betting on a return to the reflationary policies of the late Shinzo Abe.

The "Takaichi trade" is rooted in the Economic Security Minister’s vocal opposition to premature interest rate hikes by the Bank of Japan (BOJ). As a staunch proponent of "Abenomics," Takaichi has argued that the Japanese economy is not yet resilient enough to withstand the end of the ultra-easy money era. Her rhetoric suggests a potential clash with the BOJ’s current trajectory toward normalization, led by Governor Kazuo Ueda. For equity markets, Takaichi represents a "goldilocks" scenario: a leader who will prioritize growth through fiscal expansion and maintain the yen’s competitive edge by pressuring the central bank to keep borrowing costs near zero.

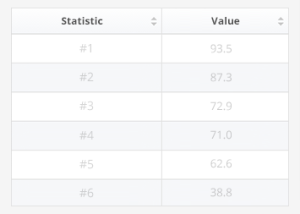

Market participants have reacted swiftly to the shifting political tides. In recent trading sessions, the Nikkei 225 surged by more than 2.5% in a single day as polling data suggested Takaichi was gaining momentum among LDP rank-and-file members. This rally was bolstered by a corresponding softening of the yen, which moved back toward the 145-per-dollar level after a period of sharp appreciation. For Japan’s export-heavy industrial giants—ranging from automotive leaders like Toyota to semiconductor equipment manufacturers like Tokyo Electron—a weaker currency remains a primary driver of repatriated earnings and upward revisions in profit guidance.

The current political landscape in Japan is a departure from the stability of the Kishida administration, which, while supportive of corporate governance reforms, was often perceived as ambivalent toward aggressive monetary stimulus. The LDP leadership election is not merely a personnel change but a referendum on the future of Japanese economic policy. Takaichi’s primary rivals, Shigeru Ishiba and Shinjiro Koizumi, offer starkly different visions. Ishiba, a veteran politician with deep roots in regional revitalization, has historically been viewed as a fiscal hawk who supports the BOJ’s independence and the normalization of interest rates. Koizumi, the charismatic son of a former Prime Minister, represents a younger generation that may prioritize structural labor market reforms over traditional monetary levers.

The divergence between these candidates has created a "binary outcome" for the markets. An Ishiba victory is widely expected to trigger a "reverse Takaichi trade," characterized by a sharp appreciation of the yen and a sell-off in Japanese equities as investors brace for higher taxes and tighter monetary conditions. Conversely, a Takaichi victory is seen as a green light for the "carry trade" to persist, where investors borrow in low-interest yen to invest in higher-yielding assets elsewhere, while simultaneously pumping liquidity into the domestic stock market.

The Bank of Japan finds itself in an increasingly precarious position amidst this political theater. Governor Ueda has spent much of the past year carefully preparing the markets for a departure from negative interest rate policies (NIRP) and the eventual tapering of Japanese Government Bond (JGB) purchases. However, the central bank’s independence is being tested by the political cycle. If the next Prime Minister is vocally opposed to rate hikes, the BOJ may face significant public and political pressure to pause its normalization path, even if inflationary pressures remain above the 2% target. Core inflation in Japan has remained stubbornly high, driven by rising service prices and the pass-through effects of previously high import costs, complicating the central bank’s mandate.

From a global perspective, the Japanese market remains an attractive destination for institutional capital, provided the policy environment remains predictable. The Tokyo Stock Exchange (TSE) has continued its push for better capital efficiency, urging companies to improve their price-to-book ratios and increase shareholder returns through buybacks and dividends. These structural tailwinds have helped the Nikkei reach historic highs earlier this year, but the recent political uncertainty has introduced a layer of "macro noise" that has forced many hedge funds and long-only investors to recalibrate their exposure.

Economic data further underscores the stakes of the current leadership transition. Japan’s GDP growth has been uneven, with private consumption showing signs of fragility despite robust corporate profits. The "wage-price spiral" that the government and the BOJ have long sought is beginning to take shape, with the most recent "shunto" wage negotiations resulting in the highest raises in three decades. However, if the next administration pursues a policy of aggressive fiscal spending without corresponding productivity gains, there is a risk that Japan could slide back into a cycle of "bad inflation"—where costs rise but real wages stagnate.

The "Takaichi trade" also carries significant implications for the Japanese bond market. JGB yields have been creeping upward in anticipation of further BOJ action, but a Takaichi win could see a "bull flattening" of the yield curve as the market prices in a prolonged period of suppressed short-term rates. This would be a boon for Japan’s mega-banks, such as Mitsubishi UFJ Financial Group (MUFG) and Sumitomo Mitsui Financial Group (SMFG), which have benefited from the widening net interest margins associated with the end of NIRP, but who also rely on a stable macroeconomic environment to drive loan growth.

Comparisons with global peers highlight the unique position of the Japanese market. While the U.S. Federal Reserve and the European Central Bank are contemplating or executing interest rate cuts to prevent a hard landing, Japan is the only major economy attempting to move in the opposite direction. This "policy divergence" has made the yen-dollar exchange rate the most watched currency pair in the world. If the LDP selects a leader who forces the BOJ to stay dovish while the Fed stays hawkish (or cuts less aggressively than expected), the yen could see another round of historic weakness, potentially testing the 160 level that triggered government intervention earlier this year.

Furthermore, the geopolitical dimension of the LDP race cannot be ignored. Takaichi is known for her hawkish stance on China and her support for increased defense spending. This aligns with a broader trend of "economic security" that has seen Japan tighten export controls on sensitive technologies and provide massive subsidies for domestic semiconductor fabrication, such as the Rapidus project and the TSMC plants in Kumamoto. Investors are increasingly factoring in these geopolitical premiums when valuing Japanese tech and defense stocks, sectors that would likely thrive under a Takaichi administration.

As the election date approaches, the consensus among analysts is that the Japanese market is currently in a "wait-and-see" mode, with the recent rally serving as a speculative front-running of a potential Takaichi victory. If the actual result deviates from this expectation, the market reaction could be swift and severe. The "Takaichi trade" is, at its heart, a bet on the persistence of the status quo—a belief that Japan is not yet ready to abandon the monetary experiments that have defined its economy for the last decade.

In conclusion, the surge in Japanese stocks serves as a reminder of how deeply intertwined politics and markets remain in the world’s fourth-largest economy. Whether the "Takaichi trade" proves to be a lasting shift or a fleeting speculative bubble depends on the internal machinations of the LDP. For now, the Nikkei’s ascent reflects a collective hope among investors that the era of easy money is not yet over, even as the fundamental forces of global inflation and central bank normalization suggest that a day of reckoning may eventually arrive. The coming weeks will determine whether Japan continues down the path of Abenomics 2.0 or embarks on a new, more fiscally disciplined chapter.