After an unprecedented period of rapid legislative and structural transformation in 2025, India’s insurance industry is now strategically positioning itself for a phase of consolidation and sustained expansion in the upcoming year. The sector, having navigated a global landscape marked by economic volatility and dynamic policy shifts, anticipates 2026 as a pivotal year to absorb the recent reforms, solidify operational efficiencies, and leverage new market opportunities. This outlook is underpinned by a rare confluence of domestic structural advantages, progressive regulatory frameworks, advanced digital infrastructure, and an increasingly favourable tax environment for retail protection products, all signaling a significant uplift in momentum across both life and non-life insurance segments from a relatively softer fiscal year 2025 base.

The year 2025 proved to be a watershed for the Indian insurance market, characterized by a series of landmark policy interventions designed to modernize and invigorate the industry. Among the most impactful changes were the introduction of the digital insurance marketplace Bima Sugam, the liberalization of foreign direct investment (FDI) to a full 100%, and the crucial Goods and Services Tax (GST) exemption on retail term and health insurance premiums. These measures, alongside the broader Insurance Laws amendments and refined policy surrender value norms implemented since late 2024, collectively lay the groundwork for a more accessible, competitive, and customer-centric insurance ecosystem.

The approval of 100% FDI under the amended Insurance Bill represents a monumental shift, poised to attract a substantial influx of global capital into India’s burgeoning insurance market. This policy move is not merely about capital injection; it is expected to intensify competition, bolster the nation’s reinsurance capacity, and significantly accelerate product innovation and technological adoption. Industry experts, such as Shruti Ladwa, partner and insurance leader at EY India, emphasize that relaxed merger and acquisition (M&A) norms accompanying these changes are likely to stimulate considerable consolidation activity throughout 2026. This greater foreign participation is anticipated to import global best practices, enhancing operational efficiency and underwriting sophistication, thereby aligning the Indian market more closely with international benchmarks. For a market with historically low penetration rates—around 4.2% of GDP compared to a global average of 7%—this capital infusion is critical for expanding reach and product diversity.

Concurrently, the rollout of Bima Sugam, India’s ambitious digital insurance marketplace, is set to revolutionize policy accessibility and administration. Envisioned as a unifying digital public infrastructure, akin to the highly successful Unified Payments Interface (UPI) for financial transactions, Bima Sugam aims to standardize the entire insurance lifecycle—from purchase and renewal to claims processing. Its core feature, the "Bima Pehchaan" identity, will aggregate KYC and policy records, significantly reducing duplication across insurers and intermediaries. This simplification is projected to drastically lower customer acquisition and service costs, streamline operations, and enhance transparency. Narendra Bharindwal, president of the Insurance Brokers Association of India (IBAI), optimistically suggests that if executed effectively, Bima Sugam could indeed become the "UPI-moment" for insurance by late 2026, profoundly expanding addressable demand and minimizing post-sale friction for policyholders and brokers alike.

Another cornerstone of the 2025 reforms was the exemption of retail term and health insurance policies from the GST regime, effective September 22. This move, designed to make essential insurance products more affordable, immediately reduced policy premiums, thereby stimulating consumer interest. While initial trends indicated a significant surge in Google search volumes and demand for certain retail plans in the immediate aftermath, some analysts caution against interpreting this as a solely sustained bump. Pallavi Malani, managing director and partner at BCG India, notes that while the initial spike in September and October eventually moderated, the GST exemption represents a "structural change" that will have a lasting, positive impact on industry penetration over the longer term, expected to extend well into the first half of 2026. This reduction in cost is anticipated to be a "permanent positive driver," as stated by EY India’s Ladwa, enabling higher volume sales that will ultimately offset the temporary margin impact faced by insurers due to the loss of input tax credit. The industry is actively working towards stabilizing product pricing, ticket sizes, and customer expectations to capitalize on this sustained demand.

Beyond these headline reforms, a series of policyholder-centric measures are set to strengthen trust and foster greater inclusivity. These include the establishment of the Policyholders’ Education and Protection Fund (PEPF), enhanced data protection norms, refreshed rural and social sector obligations, and more customer-friendly surrender value guidelines. Pankaj Gupta, managing director and CEO of Pramerica Life Insurance, highlights the reinforcement of life insurance as a core pillar of household financial planning in India, driven by the steady expansion of the middle class and a heightened awareness of financial uncertainties. These collective measures are crucial for building consumer confidence, which is vital for a sector dependent on long-term commitments.

Looking ahead, the sector is also keenly anticipating a crucial regulatory shift from a solvency-based to a risk-based capital (RBC) regime. This modernization aligns India with global best practices, such as Solvency II in Europe, enabling insurers to better align capital requirements with their actual risk profiles. This transition is expected to spur the next phase of growth, particularly in India’s vast interior markets, by promoting more efficient capital allocation and encouraging robust risk management frameworks. Furthermore, the increased integration of data analytics, artificial intelligence (AI), and digital infrastructure is projected to significantly drive down operating costs and combat fraud, especially prevalent in health insurance claims. The industry also hopes for the introduction of value-added services in 2026, transforming insurance from a "push-only" product to one that creates "pull" through connected care models and preventative solutions for customers.

In terms of sectoral performance, health insurance is universally tipped to remain the primary engine of retail growth. The post-pandemic environment has significantly elevated awareness of health security, coupled with rising healthcare costs, making health insurance an indispensable component of financial planning. Rakesh Jain, executive director and CEO of IndusInd General Insurance, reported a 35-40% surge in demand for health plans following the GST cut, a trend he expects to persist. While life insurance growth may see a slower start due to the lingering impact of taxation changes on unit-linked insurance plans (ULIPs) and adjustments to surrender value norms, experts anticipate a rebound. New business premiums for life insurers are projected to grow by 12-18% through 2026, with general insurance seeing an increase from single digits in 2025 to "high-single/low-double-digit" growth, led by health and a resurgence in motor insurance. Favorable claims experience in motor insurance is contributing to buyer-friendly pricing, encouraging more policyholders to opt for optional automobile damage coverage beyond the compulsory third-party liability. However, standalone health insurers face the immediate challenge of absorbing margin impacts from GST changes, expected to normalize by June 2026.

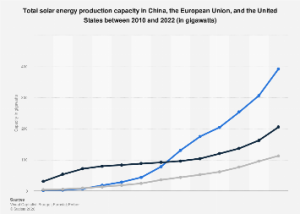

Beyond retail, commercial insurance is poised for a significant uplift, driven by India’s robust capital expenditure cycle, aggressive infrastructure build-out, and expanding manufacturing base. New demand drivers include rapidly growing sectors such as renewables, data centers, and an increasing corporate awareness towards sophisticated cyber threats. Ladwa notes that commercial lines will be a key growth engine, with insurers and brokers focusing on higher-ticket, more stable premium pools. This trend is already evident in the 6-20% year-to-date growth observed in business lines like fire, engineering, and liability insurance. Strong momentum is anticipated in specialized segments, including cyber liability, directors and officers (D&O) cover, trade credit, and parametric covers. Reinsurance capacity expansion, improved underwriting discipline, and greater use of data and risk engineering are expected to deepen and sophisticate the commercial insurance market, making it more resilient in 2026. While ample market capacity generally keeps pricing flat-to-decreasing across most commercial lines, property insurance stands as an exception, with changes to India’s rating system leading to double-digit premium increases.

The path ahead, while promising, is not without its challenges. Insurers must rapidly adapt to the new regulatory landscape, making substantial investments in technology and upskilling their workforce. The initial profitability pressures, particularly for health insurers post-GST and life insurers navigating product mix adjustments, will require strategic operational efficiencies and a relentless focus on volume growth. Yet, the overarching sentiment remains one of optimism. India’s insurance sector, with its low penetration, vast untapped potential, and a rapidly growing economy, is exceptionally well-positioned. The foundational reforms of 2025 have paved the way for a more stable, transparent, and innovative market. As the industry moves into 2026, the focus will be on effective implementation and leveraging these transformational changes to deliver sustainable growth and deepen financial inclusion across the nation.