India’s crucial power distribution companies (discoms), long burdened by chronic financial instability, have achieved a remarkable milestone, reporting a cumulative profit after tax of ₹2,701 crore for Fiscal Year 2025. This significant reversal marks a profound shift from the preceding year’s substantial loss of ₹25,553 crore, signalling a potential new dawn for a sector vital to the nation’s economic engine and ambitious energy transition goals. This turnaround, hailed by the Union power ministry as a "significant turning point," is largely attributed to a suite of targeted policy interventions by the central government, including the comprehensive Revamped Distribution Sector Scheme (RDSS) and stringent Late Payment Surcharge (LPS) Rules.

For decades, the financial health of India’s power distribution utilities has been a critical choke point in the nation’s energy value chain. Following the unbundling and corporatization of state electricity boards, discoms have grappled with an array of challenges, from high aggregate technical and commercial (AT&C) losses stemming from theft and billing inefficiencies, to an unsustainable gap between the average cost of supply (ACS) and average revenue realized (ARR), and ballooning outstanding dues to generation companies. This cumulative distress had led to a staggering debt of approximately ₹7 trillion across the sector, impeding investments in infrastructure, smart grid technologies, and the integration of renewable energy sources. The sector’s chronic underperformance not only strained state finances through subsidies but also posed a significant risk to the entire power ecosystem, impacting generators’ ability to invest and consumers’ access to reliable, quality power.

The recent financial performance indicates a substantial improvement in operational metrics. The aggregate technical & commercial (AT&C) losses, a key indicator of operational efficiency, have notably declined to 15.04% in FY25, down from 17.6% in FY24. Simultaneously, the ACS-ARR gap, which measures the financial viability of power sales, has narrowed considerably to a mere ₹0.06 per kilowatt-hour (kWh) in FY25, a dramatic improvement from ₹0.48 per kWh in the previous fiscal year. These figures suggest that policy reforms are beginning to yield tangible results in curbing leakages and improving revenue collection, moving closer to the profitability benchmark suggested by ratings agencies like ICRA, which previously indicated that an average tariff hike of 4.5% combined with AT&C losses below 15% would be essential for sustainable profitability.

A cornerstone of this financial rehabilitation has been the rigorous enforcement of the Electricity (Late Payment Surcharge) Rules. These rules have been instrumental in drastically reducing the outstanding dues owed by discoms to power generating companies. The ministry reports a staggering 96% reduction in these dues, plummeting from ₹1,39,947 crore in 2022 to a mere ₹4,927 crore by January 2026. This intervention has not only stabilized the cash flow for power producers but has also significantly improved payment cycles for distribution utilities, shortening them from an average of 178 days in FY2020-21 to a more manageable 113 days in FY2024-25. Such discipline throughout the payment chain instills confidence, encourages investment, and strengthens the financial backbone of the entire power sector.

Beyond immediate financial metrics, the government is looking to embed structural reforms for long-term sustainability. A Group of Ministers (GoM) dedicated to enhancing the financial viability of discoms has put forth proposals for a new scheme, advocating for asset monetization and public listing of shares. These measures aim to unlock latent value, introduce greater corporate governance, and facilitate access to capital markets for discoms, enabling them to invest in much-needed infrastructure upgrades and technology adoption. The GoM has also identified a substantial portion of the cumulative debt, pegging the unsustainable component at ₹2,74,120 crore, underscoring the need for comprehensive debt restructuring mechanisms to ensure these utilities can operate on a commercially viable basis.

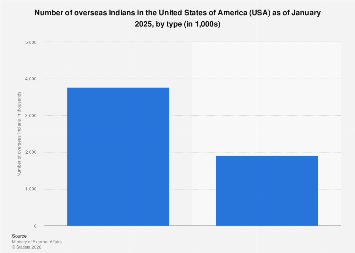

The strategic push towards privatization is another critical lever being employed to foster efficiency and attract private capital. With approximately 67 discoms operating across India, including 16 already under private management in regions like Delhi, Mumbai, Odisha, and Gujarat, the government is actively encouraging private participation. Uttar Pradesh, a state with significant power demand, is currently in the process of privatizing two of its discoms, Purvanchal Vidyut Vitran Nigam Ltd (PUVVNL) and Dakshinanchal Vidyut Vitran Nigam Ltd (DVVNL), attracting interest from major industrial conglomerates such as Adani Group, Tata Power Ltd, and Greenko Group. This follows the successful privatization of discoms in Union Territories like Chandigarh and Dadra and Nagar Haveli, demonstrating the Centre’s commitment to leveraging private sector expertise for better service delivery and financial performance. Earlier pioneers like Odisha, which privatized its distribution sector in 1999, and Delhi, which saw the entry of private players like BSES and Tata Power in 2002, have provided models for improved operational efficiency and consumer service.

The improved financial health of discoms is particularly crucial as India accelerates its energy transition. These utilities are at the forefront of integrating vast amounts of renewable energy into the national grid. However, the path is not without its complexities. Despite the increasing availability of cheaper renewable power, some discoms, particularly in states like Uttar Pradesh, Bihar, Assam, and West Bengal, have been observed signing power purchase agreements (PPAs) for coal-based power at tariffs averaging ₹6 per unit, which is often higher than the cost of renewable and hybrid alternatives. This apparent paradox is often driven by legacy contracts, grid stability requirements, and the need to manage peak demand efficiently. To address these challenges, discoms are increasingly exploring and issuing bids for Battery Energy Storage Systems (BESS), critical for storing intermittent solar and wind power, ensuring grid stability, and reducing power losses during peak demand periods. Their role will only intensify as India aims for ambitious renewable energy targets and requires an estimated $500 billion in cumulative investment in the power sector by 2032.

While the current financial turnaround is undoubtedly a positive development, experts caution that this momentum must be sustained through deeper, structural reforms. Sambitosh Mohapatra, a partner and leader for climate and energy at PwC India, emphasizes that "profitability should be a structural inflection point, driven by better billing efficiency, lower AT&C losses, subsidy discipline, and selective tariff rationalization; and should not be limited to an accounting exercise." He highlights the uneven progress across states, underscoring the necessity for continued reforms, including further privatization, to ensure consistent improvement. The path ahead requires cost-reflective tariffs coupled with targeted subsidies to protect vulnerable consumers, stronger governance frameworks, and the effective integration of renewables supported by advanced storage solutions and enhanced grid flexibility. This multi-pronged approach will be essential for India’s power distribution sector to not only maintain its financial health but also to become a robust enabler of the nation’s sustainable economic growth and its ambitious clean energy future.