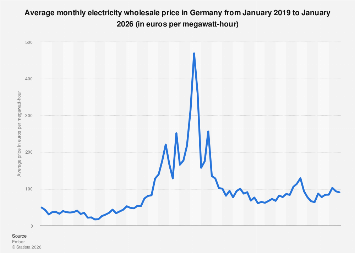

Electricity prices in Germany are projected to hover around a significant figure per megawatt-hour by November 2025, indicating a persistent elevated cost environment that has not yet fully receded to pre-pandemic benchmarks. This forecast underscores the complex and evolving landscape of the German energy sector, a critical player within the broader European economic framework. The nation’s ambitious energy transition, while making substantial strides in renewable energy deployment, continues to grapple with a confluence of factors influencing wholesale and retail electricity costs, impacting both industrial competitiveness and household budgets.

Recent data from early 2024 suggested a tentative recovery in German electricity prices, moving back towards pre-energy crisis levels. This period was characterized by a dynamic interplay of demand-side pressures and supply-side constraints. Increased heating demand during colder months, coupled with periods of reduced wind power generation and water scarcity impacting hydropower output, contributed to upward price pressures. Despite Germany’s commendable progress in expanding its renewable energy infrastructure, with renewables accounting for over 60 percent of gross electricity generation in 2024, the nation’s energy mix still exhibits a significant reliance on fossil fuels. Coal and natural gas collectively represented approximately 35 percent of the energy supply in the same year, rendering the German economy susceptible to the inherent volatility of global fuel commodity markets. This dependence creates a structural vulnerability, as fluctuations in international gas and coal prices can rapidly translate into domestic electricity cost increases.

The ramifications of this price volatility are acutely felt by German consumers. As of April 1, 2024, households subscribing to basic supplier contracts faced an average tariff of around 40 cents per kilowatt-hour, positioning them as the most expensive category compared to consumers opting for alternative providers or specialized contracts. An in-depth analysis of household electricity prices for 2023 revealed that the largest controllable components of consumer bills were attributed to supply and margin costs, along with energy procurement. These segments accounted for approximately 15 and 13 euro cents per kilowatt-hour, respectively. While a notable decrease from the peak prices witnessed in 2022 has been observed, the current cost levels remain substantially higher than those recorded prior to the recent energy crisis. This persistent premium highlights the ongoing challenges confronting Germany’s energy sector as it navigates the intricate and capital-intensive transition towards a predominantly renewable energy future.

The global context of electricity pricing reveals that Germany’s situation, while presenting unique challenges, is not entirely isolated. Many European nations have experienced similar price surges driven by geopolitical events, supply chain disruptions, and the accelerated shift towards decarbonization. However, Germany’s particular energy policy framework, including its reliance on a diversified but still partially fossil-fuel dependent generation mix, alongside significant investments in grid modernization and renewable capacity, shapes its price trajectory. For instance, countries with a more established nuclear energy presence or those heavily integrated into larger, more liquid European electricity markets may exhibit different price dynamics. The European Union’s wholesale electricity market, while designed to foster competition and price convergence, remains susceptible to national-level supply and demand imbalances.

Looking ahead, the outlook for German electricity prices is contingent upon a multitude of factors. The continued expansion and improved reliability of renewable energy sources, particularly solar and wind, are crucial. Enhancements in energy storage technologies, such as large-scale battery installations and the potential for green hydrogen, will be vital in mitigating the intermittency challenges associated with renewables. Furthermore, the pace at which Germany can reduce its dependence on imported fossil fuels, particularly natural gas, will significantly influence price stability. Government policies aimed at promoting energy efficiency, incentivizing demand-side management, and ensuring a robust and resilient grid infrastructure will play a pivotal role.

Economically, elevated electricity prices pose a considerable challenge for German industry, a cornerstone of the nation’s export-driven economy. High energy costs can erode profit margins, reduce international competitiveness, and potentially lead to decisions by energy-intensive industries to relocate or scale back operations. This has broader implications for employment and economic growth. For households, persistently high electricity bills can contribute to inflation, reduce disposable income, and disproportionately affect lower-income segments of the population. The social impact of energy costs is a significant consideration for policymakers, necessitating a delicate balance between environmental objectives and economic affordability.

The forecast for 2026, while still indicating elevated prices, suggests a gradual stabilization as the market adapts to new supply realities and the energy transition progresses. However, the path forward is unlikely to be linear. Unexpected geopolitical events, extreme weather patterns impacting generation capacity, and the pace of technological innovation in the energy sector can all introduce new variables. Continuous monitoring of market trends, investment in research and development, and agile policy responses will be essential for Germany to achieve its energy security and sustainability goals while ensuring that electricity remains accessible and affordable for its citizens and its vital industrial base. The ongoing commitment to phasing out fossil fuels and embracing cleaner energy sources remains the overarching objective, but the economic implications of this transition will continue to be a dominant theme in the nation’s economic discourse for years to come.