The international foreign exchange markets experienced a notable shift this week as the US dollar retreated from recent highs, triggered by a resurgence of unconventional geopolitical rhetoric concerning the strategic status of Greenland. As investors recalibrate their portfolios in response to a potential return to "America First" territorial ambitions, the specter of the "sell America" trade has once again emerged, casting a shadow over the greenback’s perceived stability. This volatility highlights a growing sensitivity among global asset managers to the intersection of idiosyncratic political risk and the long-term structural integrity of the US-led financial order.

The immediate catalyst for the dollar’s softening was a series of high-profile comments suggesting a renewed interest in the acquisition of Greenland, the autonomous Danish territory that has long been a focal point of Arctic strategic competition. While such proposals were famously dismissed as "absurd" by the Danish government during the previous administration, their revival has signaled to the markets that the era of predictable, status-quo diplomacy may be facing another period of disruption. For currency traders, the issue is less about the literal real estate transaction and more about what the rhetoric represents: a departure from multilateral norms and a potential strain on relations with key European allies.

The Bloomberg Dollar Spot Index, which tracks the greenback against a basket of ten leading global currencies, reflected this unease by sliding approximately 0.4% in the wake of the news. This movement was mirrored by a slight softening in 10-year Treasury yields, as some investors sought the safety of gold and the Japanese yen over dollar-denominated assets. The "sell America" sentiment, a term coined by analysts to describe a broad-based withdrawal from US equities and currency due to domestic political instability, appears to be gaining traction among those who fear that erratic foreign policy could undermine the dollar’s role as the world’s primary reserve currency.

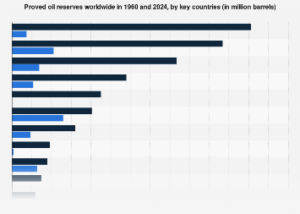

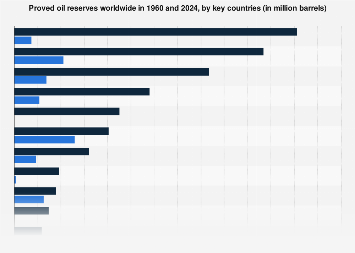

To understand the market’s visceral reaction, one must look at the strategic importance of the Arctic region. Greenland is not merely a frozen expanse; it is a critical frontier in the 21st-century race for resource security. The island holds some of the world’s most significant undeveloped deposits of rare earth minerals, including neodymium, praseodymium, and terbium—elements essential for the production of electric vehicle motors, wind turbines, and advanced military hardware. Currently, China controls over 80% of the global processing capacity for these minerals. A US push for Greenland is viewed by some strategists as a necessary move to decouple Western supply chains from Beijing. However, the aggressive manner in which this interest is expressed risks alienating the very European partners needed to form a unified economic front against Chinese dominance.

Economists note that the "geopolitical risk premium" is being priced back into the dollar. For decades, the US dollar has enjoyed "exorbitant privilege," a term used to describe the benefits the United States derives from having the world’s premier reserve currency. This status allows the US to run significant trade deficits and borrow at lower costs than its peers. However, this privilege is predicated on the perception of the US as a stable, predictable, and rule-abiding hegemon. When rhetoric shifts toward territorial acquisition or the questioning of established alliances like NATO—which is intrinsically linked to the Greenland defense infrastructure—that perception of stability begins to erode.

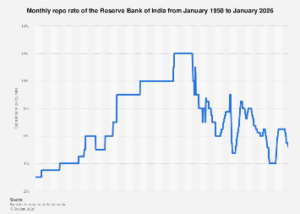

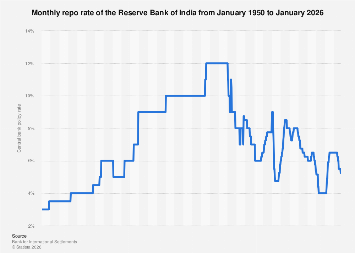

In the current macroeconomic environment, the dollar is already facing headwinds. The Federal Reserve’s ongoing battle with inflation and the delicate balancing act of maintaining high interest rates without triggering a recession has left the currency vulnerable. When political unpredictability is added to the mix, institutional investors often look toward diversification. We are seeing an uptick in interest in the "neutral" currencies of the G10, as well as a renewed debate over the "de-dollarization" efforts led by the BRICS nations. While the dollar remains the dominant force in global trade, accounting for nearly 90% of all foreign exchange transactions, the marginal shifts in sentiment can have outsized impacts on capital flows.

The reaction from Copenhagen and Brussels has been one of weary concern. Danish officials have historically maintained that Greenland is "not for sale," emphasizing the island’s right to self-determination. From a business perspective, the friction between Washington and Copenhagen creates uncertainty for North Atlantic trade routes and fishing rights, which are vital components of the regional economy. Furthermore, the diplomatic strain threatens to complicate the European Union’s broader security architecture. If investors perceive that the US is willing to pressure its allies over territorial claims, they may begin to discount the reliability of US security guarantees, which are the bedrock of the global financial system’s stability.

Market data suggests that hedge funds and large-scale institutional players are increasingly hedging against "tail risks"—unlikely but high-impact events—associated with US political volatility. The cost of protecting against a sharp devaluation of the dollar has risen in the options market, indicating that traders are not dismissing the Greenland rhetoric as mere campaign trail bluster. Instead, they view it as a symptom of a broader trend toward isolationism and transactional diplomacy that could disrupt global trade agreements and international legal frameworks.

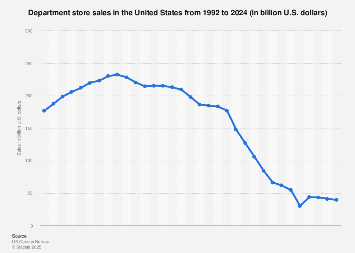

Beyond the currency markets, the "sell America" fears are permeating the broader investment landscape. The US fiscal trajectory, characterized by a burgeoning national debt that recently surpassed $34 trillion, is already a point of contention for credit rating agencies. When a nation’s political leadership introduces high-friction foreign policy goals, it exacerbates concerns about the government’s ability to focus on long-term fiscal sustainability. Analysts at several major investment banks have pointed out that the "political risk discount" applied to US assets is at its highest level in years, potentially deterring the foreign direct investment (FDI) that the US economy relies upon to fund its growth.

Comparatively, other regions are attempting to capitalize on this uncertainty. The Eurozone, despite its own internal challenges, has sought to present itself as a bastion of multilateralism and regulatory stability. While the Euro has struggled against the dollar’s interest rate advantage, a sustained period of US political volatility could close that gap. Similarly, emerging markets that have historically been sensitive to dollar strength are watching the current fluctuations with a mixture of hope and trepidation. A weaker dollar generally eases the debt-servicing burden for developing nations that have borrowed in greenbacks, but a volatile dollar creates a chaotic environment for global trade pricing.

The strategic value of Greenland also intersects with the climate crisis, adding another layer of economic complexity. As the Arctic ice sheet melts at an unprecedented rate, new shipping lanes are opening, potentially cutting the transit time between Asia and Europe by weeks. The nation that exerts influence over Greenland will have a significant say in the regulation and taxation of these new "Northern Sea Routes." If the US approach to this opportunity is perceived as unilateral or hostile, it could lead to a counter-coalition of nations—including Russia and China—working to bypass US-influenced waters entirely.

Ultimately, the dollar’s recent slip serves as a warning shot. It demonstrates that the global financial markets are no longer willing to decouple economic fundamentals from geopolitical conduct. The "America First" philosophy, while aimed at bolstering domestic industry and national security, carries with it an inherent cost in the form of market trust. For the dollar to maintain its hegemony, it must represent more than just the output of the world’s largest economy; it must represent a predictable and stable global order.

As the political cycle in the United States intensifies, the Greenland narrative is likely to remain a recurring theme, serving as a litmus test for investor confidence. If the rhetoric escalates, we may see a more pronounced shift toward a multipolar currency world, where the dollar’s dominance is challenged not by a single rival, but by a collective desire for stability away from the volatility of American domestic politics. For now, the "sell America" fears remain a potent force in the markets, reminding policymakers that in the interconnected world of global finance, words spoken in Washington have immediate and measurable consequences on the value of the wallet in every corner of the globe.