The European startup ecosystem demonstrated remarkable resilience and innovation throughout 2023, attracting significant venture capital despite a more cautious global economic climate. While the sheer volume of deals might have seen adjustments compared to the frenzied highs of previous years, the quality and scale of funding rounds for leading European ventures underscore a maturing and increasingly sophisticated market. Analysis of the year’s disclosed funding data reveals a concentration of capital flowing into sectors poised for substantial disruption and growth, including artificial intelligence, climate technology, and advanced enterprise solutions.

Several key trends emerged from the 2023 funding landscape. Firstly, there was a discernible shift towards later-stage funding for established companies with proven business models and clear paths to profitability, a contrast to the earlier focus on seed-stage, high-risk ventures. This suggests investors are seeking greater certainty and a faster return on investment. Secondly, the dominance of specific technology verticals continued, with AI-powered solutions across various industries, from healthcare to finance, commanding substantial attention. The drive towards sustainability also remained a powerful investment thesis, with cleantech and renewable energy startups consistently securing significant capital infusions.

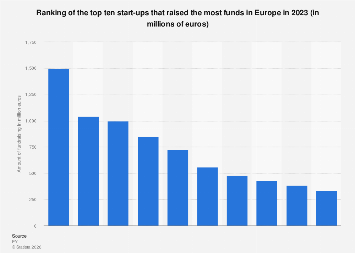

Looking at the top performers, a clear picture emerges of the sectors and companies capturing investor confidence. While exact rankings can fluctuate based on reporting methodologies and the timing of deal closures, a consistent group of European startups stood out for their substantial fundraising achievements in 2023. These companies represent the vanguard of European innovation, pushing boundaries in their respective fields and signaling strong future growth potential.

In the realm of artificial intelligence, several European companies have positioned themselves at the forefront of technological advancement. One prominent player, a generative AI firm based in the UK, reportedly secured a substantial funding round, reportedly in the hundreds of millions of euros. This capital is earmarked for accelerating product development, expanding its research capabilities, and scaling its global operations. The company’s proprietary large language models and focus on enterprise applications have made it a highly attractive proposition for investors seeking to capitalize on the AI revolution. Its success reflects a broader trend of significant investment in AI infrastructure and applications across the continent.

Another area witnessing intense investor interest is climate technology. A German startup specializing in advanced battery storage solutions for grid-scale applications raised a significant sum, positioning itself to play a crucial role in the global energy transition. The company’s innovative technology promises higher energy density and longer lifespans compared to existing solutions, addressing a critical bottleneck in the widespread adoption of renewable energy sources. The urgency of climate change and the growing demand for sustainable energy infrastructure have created a fertile ground for such ventures, attracting a diverse range of investors, from dedicated climate funds to traditional institutional players looking to diversify their portfolios.

In the fintech sector, a Swedish challenger bank offering a comprehensive suite of digital financial services to underserved demographics reportedly closed a major funding round. This capital injection is intended to fuel its expansion into new European markets, enhance its technological infrastructure, and broaden its product offerings, including more sophisticated investment and lending tools. The continued digitalization of financial services, coupled with a persistent demand for more accessible and user-friendly banking solutions, continues to make fintech an attractive investment avenue.

The enterprise software space also saw significant activity. A French company developing a sophisticated cybersecurity platform that utilizes AI to detect and neutralize advanced threats reportedly secured substantial funding. In an era of escalating cyber risks, businesses are increasingly prioritizing robust security solutions, making this startup’s innovative approach highly sought after. The company’s ability to offer predictive threat intelligence and real-time incident response has set it apart in a competitive market.

Beyond these specific sectors, the geographic distribution of top-funded startups highlights the continued strength of established innovation hubs. The United Kingdom, Germany, and France remain dominant forces, consistently producing companies that attract significant international capital. However, there is also a growing narrative of emerging hubs and increasing investment in startups from countries like the Netherlands, Spain, and the Nordic region, indicating a broader diversification of Europe’s venture capital landscape.

The impact of these large funding rounds extends beyond the individual companies. For the broader European economy, such investments signal confidence in the region’s ability to foster innovation and compete on a global scale. They contribute to job creation, drive technological advancement, and can lead to the development of new industries. Furthermore, successful exits from these high-growth companies, whether through IPOs or acquisitions, can generate substantial returns for investors, fueling further investment cycles.

However, it’s important to acknowledge the evolving macroeconomic context. Rising interest rates, geopolitical uncertainties, and a more discerning investor base have led to a recalibration of valuation expectations. While the top-tier startups continue to attract significant capital, the overall investment environment in 2023 was characterized by a greater emphasis on financial discipline, clear unit economics, and sustainable growth strategies. This shift, while potentially challenging for some, is ultimately beneficial for the long-term health and maturity of the European startup ecosystem.

Looking ahead, the momentum generated by these leading startups is likely to continue. The underlying drivers of innovation – digitalization, the urgent need for sustainable solutions, and the transformative potential of AI – remain powerful. As the global economy stabilizes and investor sentiment potentially improves, Europe is well-positioned to build upon the successes of 2023, with its vibrant startup scene poised to attract even greater investment and continue its trajectory as a global innovation powerhouse. The companies that have demonstrated their ability to secure substantial funding in this challenging year are likely to be the market leaders of tomorrow, shaping the future of technology and business across the continent and beyond.