India’s prominent electronics manufacturers are embarking on a decisive strategic pivot, shifting focus from high-volume, low-margin assembly operations towards the design and production of specialized, high-value components. This transformative agenda, expected to accelerate significantly through 2026, is primarily driven by an aggressive inorganic growth strategy centered on strategic acquisitions of niche technology firms. The objective is clear: to enhance profitability, fortify market position, and restore investor confidence after a period of mixed stock market performance.

The impetus for this strategic reorientation stems from a stark reality confronting India’s top-tier electronics companies. While the sector has witnessed phenomenal growth in terms of sheer production volume and revenue, profit margins have remained conspicuously thin. A collective analysis of five leading Indian electronics manufacturers—Tata Electronics (a private entity), Dixon Technologies, Amber Enterprises, Kaynes Technology, and Syrma SGS—reveals a cumulative operating revenue of approximately ₹1.22 trillion (around $14.6 billion) in FY2025. Projections indicate this figure could surge by at least 30% year-on-year, reaching ₹1.6 trillion ($19.2 billion) in FY2026. However, this impressive top-line growth stands in sharp contrast to their consolidated net profit of merely ₹1,599 crore ($192 million) in FY2025, translating to a meagre 1.3% profit margin.

This lean profitability persists despite significant governmental support in the form of production-linked incentives (PLI) from the Ministry of Electronics and Information Technology (MeitY). These incentives, covering areas from smartphone manufacturing and IT hardware to semiconductor facilities and component production, have been instrumental in attracting investment and scaling up assembly capabilities. Yet, they haven’t inherently translated into robust bottom-line health for many players, underscoring the need for a deeper integration into the global electronics value chain. Globally, leading Electronic Manufacturing Services (EMS) providers typically operate at net margins between 3-5%, while specialized component manufacturers often command upwards of 10-15%, highlighting India’s current position at the lower end of the value spectrum.

The market has responded to this margin pressure. After a robust run, several major players experienced a cooling in investor sentiment throughout 2025. Dixon Technologies’ shares, for instance, saw a decline of 26%, Amber Enterprises fell by 13%, and Kaynes Technology witnessed a significant 45% drop in share price since January 1, 2025. In contrast, the benchmark 30-share BSE Sensex index rose by 8% during the same period, with only Syrma SGS bucking the trend with an 18% gain. This divergence underscores the market’s demand for sustainable, high-quality earnings rather than just volume growth driven by incentives. Analysts widely concur that 2026 will be a critical year for these companies to regain shareholder trust, with strategic acquisitions emerging as a primary pathway.

The rationale behind favoring acquisitions over organic research and development (R&D) is multifaceted and pragmatic. Harshit Kapadia, vice-president at brokerage Elara Capital, articulates this strategy, stating, "Investing a sizeable chunk of revenue into R&D, finding core engineering talent, building dedicated facilities, and securing robust access to funds and supply chains is inherently far riskier. Acquisitions, conversely, offer a less precarious route, providing immediate access to market-proven technologies and specialized expertise that can be integrated into existing product lines." This approach accelerates market entry into complex segments and mitigates the substantial capital and time investments associated with ground-up innovation in highly specialized fields.

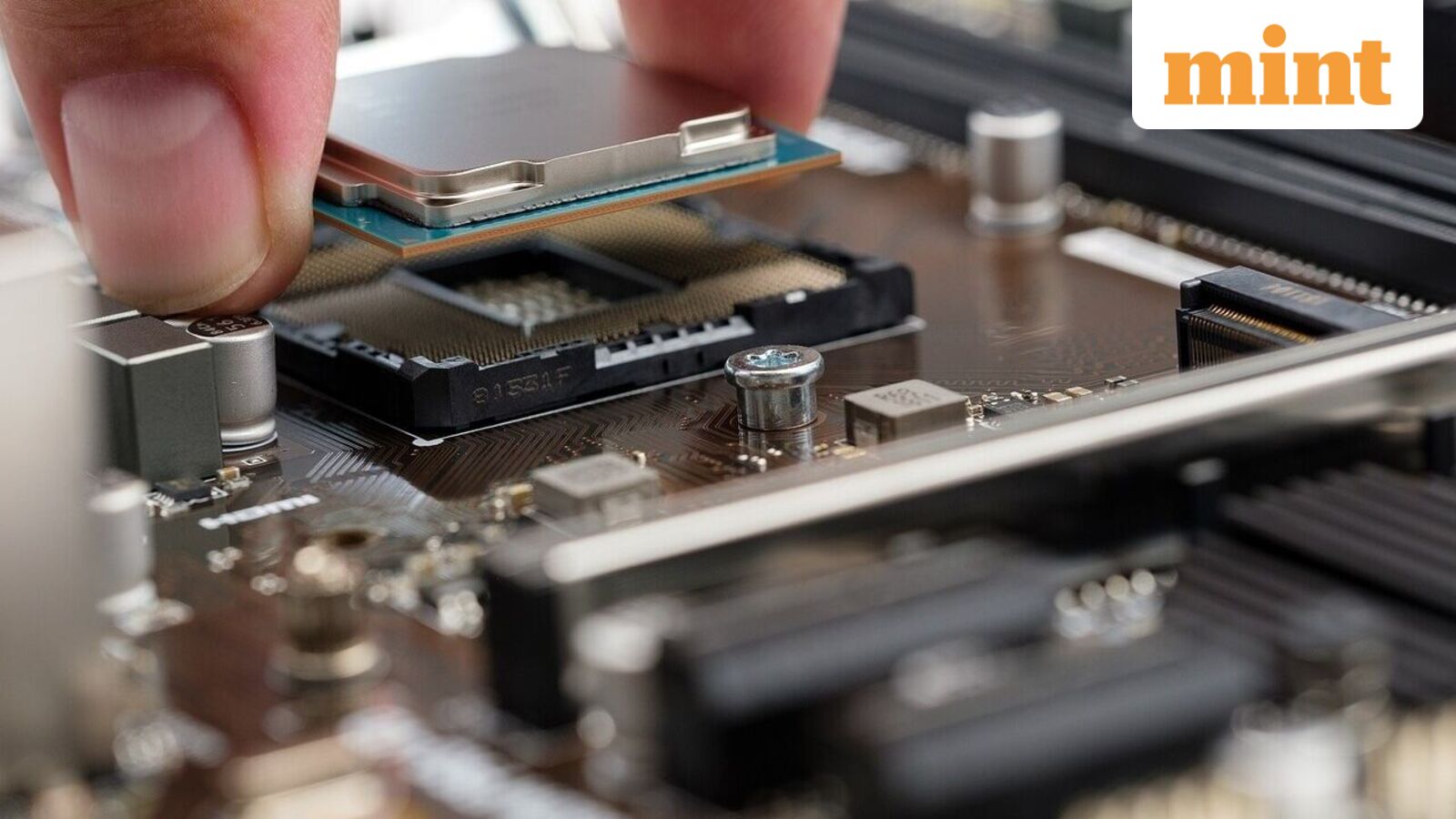

Evidence of this shift is already palpable. An analysis of exchange filings and annual reports reveals that since April 1st of the previous fiscal year, the five aforementioned companies have collectively announced or pursued at least 17 acquisitions. These inorganic expansions have strategically targeted diverse niche specializations, including the design of electronic components for laptops, manufacturing capabilities for smart meters, advanced printed circuit boards (PCBs), inverters, and even defence-grade electronics. This breadth indicates a comprehensive strategy to diversify revenue streams and embed deeper into critical industrial and consumer electronics segments.

Company executives echo this sentiment. Jasbir Singh Gujral, Managing Director of Syrma SGS, confirmed the active evaluation of multiple acquisition proposals, emphasizing that while nothing is finalized, expanding capabilities is central to increasing profitability. Saurabh Gupta, Director of Finance and Group CFO at Dixon Technologies, outlined a proactive approach towards strategic acquisitions in areas like PCB assemblies, automotive electronics, industrial electronics, and aerospace and defence electronics. This aligns with a broader national push for local sourcing and reduced import dependence in these critical sectors. Gupta highlighted the company’s openness to such opportunities "as long as they come organically and at decent valuations." While Kaynes Technology’s whole-time director and CFO, Jairam Sampath, initially stressed scaling existing strengths, he conceded that "if the prospects for a new opportunity are found to be great in developing long-term growth with good profitability, we may look at it."

The broader macroeconomic environment in India also lends significant support to this acquisition-led growth strategy. The "Make in India" initiative, coupled with specific programs like the India Semiconductor Mission, is creating an ecosystem conducive to advanced manufacturing. As initial chip packaging and testing facilities are slated to become operational in 2026, domestic EMS companies will find unprecedented opportunities to localize core sub-components. Ankush Wadhera, Managing Director and Partner at BCG India, highlights this synergy, explaining that "localizing circuitry, resistors, shells, coils, and wiring will offer significant margin and profit generation opportunities, while simultaneously helping electronics manufacturers scale their operations and contribute to domestic value realization from these chip plants."

India’s aspirations extend beyond merely meeting domestic demand. With a rapidly expanding consumer market and a burgeoning digital economy, the country is poised to become a global hub for electronics manufacturing and design. The global electronics market, projected to exceed $3 trillion by the end of the decade, presents immense export potential. By moving up the value chain through strategic acquisitions, Indian firms can reduce their reliance on imported components, strengthen supply chain resilience, and compete more effectively on the international stage. This shift also aligns with global geopolitical trends, where countries are increasingly seeking diversified and resilient supply chains, reducing over-reliance on single geographies for critical components.

The economic implications of this strategic pivot are profound. Higher-margin manufacturing translates to greater domestic value addition, contributing more significantly to the Gross Domestic Product (GDP). It fosters the creation of higher-skilled jobs, stimulating innovation and R&D within the country. Furthermore, by developing indigenous capabilities in critical components, India can enhance its technological sovereignty, reducing vulnerability to global supply chain disruptions and geopolitical pressures. This move is not just about corporate profitability; it’s a critical step in India’s journey to becoming a globally competitive manufacturing powerhouse and a leader in advanced electronics. The next few years will be instrumental in demonstrating whether this strategic shift, spearheaded by aggressive inorganic growth, can successfully transform India’s electronics sector from an assembly hub into a design and innovation leader.