The sudden and dramatic escalation of military tension in South America has forced a complex recalibration of Chinese foreign policy, as Beijing attempts to reconcile its long-standing doctrine of non-interference with the urgent need to protect billions of dollars in state and private investments. Following the weekend’s high-stakes U.S. military operation in Venezuela, which resulted in the ousting of President Nicolás Maduro, China has moved swiftly to position itself as a stabilizing counterweight to Western interventionism. However, beneath the veneer of diplomatic condemnation lies a pragmatic and deeply calculated effort to ensure that the change in Caracas does not result in a total loss of Chinese economic leverage in the region.

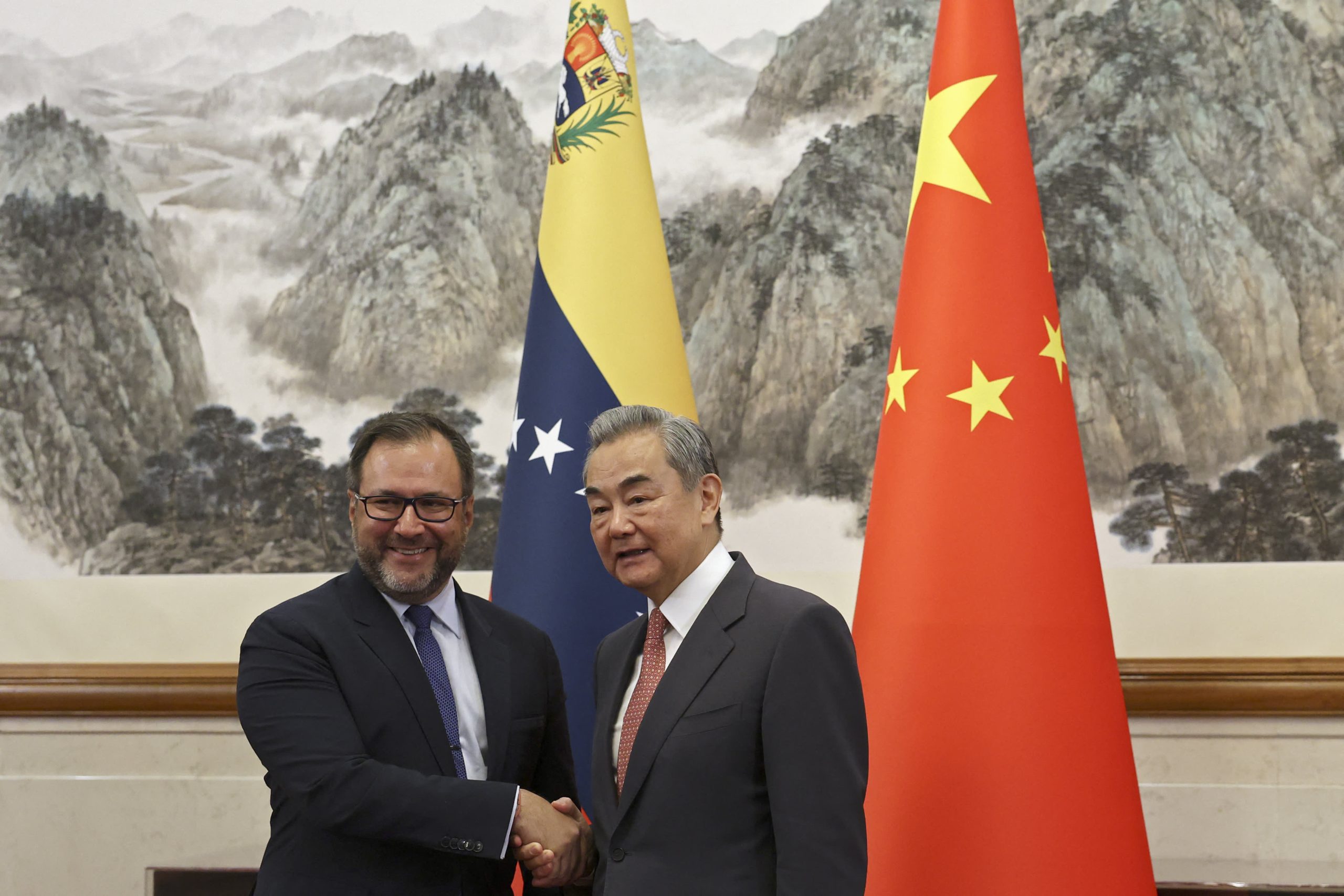

The official response from the Chinese Foreign Ministry was one of "shock and condemnation," a rhetorical stance consistent with Beijing’s historical opposition to regime change orchestrated by foreign powers. Foreign Ministry spokesperson Lin Jian emphasized that China maintains "positive communication and cooperation" with the Venezuelan state, asserting that the legality of Chinese interests would remain a priority regardless of the political upheaval. Yet, for global markets and geopolitical analysts, the more pressing question is how China will manage its massive financial exposure in a country that has served as its primary ideological and economic beachhead in South America for over two decades.

The economic footprint of the People’s Republic of China (PRC) in Venezuela is both vast and precarious. According to data from the Rhodium Group, Chinese entities—predominantly state-owned enterprises—have funneled approximately $4.8 billion into the country over the last 20 years. This figure, however, represents only the tip of the iceberg when considering the massive "loans-for-oil" programs that characterized the era of the late Hugo Chávez and the early years of the Maduro administration. At its peak, Venezuela was the largest recipient of Chinese development finance in Latin America, with total lending estimated by some trackers to have exceeded $60 billion since 2007. While much of that debt has been serviced through crude shipments, a significant portion remains outstanding, creating a high-stakes game of financial survival for Beijing’s policy banks.

The center of this economic relationship is the energy sector. The China National Petroleum Corporation (CNPC) has spent years embedded in the Venezuelan landscape through complex joint ventures with Petróleos de Venezuela (PDVSA). These projects were designed to tap into the world’s largest proven oil reserves, providing China with a long-term hedge against Middle Eastern volatility. Even as recently as August, private Chinese firms showed a surprising appetite for risk; China Concord Resources Corp. announced a landmark $1 billion investment aimed at boosting production by 60,000 barrels per day. The current crisis places these capital-intensive projects in immediate jeopardy, as the legal and operational status of "Maduro-era" contracts may be called into question by any U.S.-backed transitional authority.

From a trade perspective, the immediate impact on China’s energy security is perhaps less dire than the headline figures might suggest. While China remains the top destination for Venezuelan crude, the South American nation accounted for only about 2% of China’s total crude oil and condensate imports in 2024. Data from the U.S. Energy Information Administration (EIA) indicates that Beijing has successfully diversified its portfolio, increasing its intake from Iran and Iraq even as Venezuelan output stagnated under years of mismanagement and sanctions. This statistical reality provides Beijing with a degree of "strategic patience." As Yue Su, principal economist for China at The Economist Intelligence Unit, noted, Venezuela carries "limited economic significance" in terms of immediate supply chain disruption, allowing China to prioritize its broader geopolitical narrative over a desperate scramble for barrels.

That narrative is centered on the concept of China as a "force for stability" in an increasingly chaotic international order. By criticizing what it labels as "bullying actions" and violations of sovereign integrity, Beijing is speaking directly to the "Global South." The message is clear: while the United States remains willing to use kinetic force to achieve political ends, China offers a model of partnership based on infrastructure, investment, and respect for internal governance. This soft-power play is particularly relevant in Latin America, where Beijing has successfully persuaded nations like Panama, Costa Rica, and the Dominican Republic to sever diplomatic ties with Taiwan in favor of the PRC.

The situation in Venezuela, however, carries an uncomfortable irony for Beijing regarding its own territorial ambitions. Analysts are closely watching how the "Venezuela precedent" might influence China’s thinking on Taiwan. The U.S. justification for the capture of Maduro—centered on drug trafficking charges and international legal frameworks—has reportedly led some in Beijing to consider the necessity of establishing their own robust legal justifications for potential future actions in the Taiwan Strait. If Washington can justify the removal of a foreign leader on the grounds of criminal activity or regional security, Beijing may look to codify similar "legal warfare" (legalism) strategies to frame its own regional assertions.

Despite the fire and fury of the Venezuelan crisis, China’s high-level diplomatic calendar has remained remarkably undisturbed, signaling a "business as usual" approach to global leadership. Even as the strike in Caracas unfolded, President Xi Jinping was hosting Michael Martin, the first Irish leader to visit China in 14 years, and preparing for a summit with South Korean President Lee Jae Myung. This juxtaposition is intended to project an image of a superpower that is unruffled by regional skirmishes, focused instead on long-term institutional building and trade.

The long-term economic impact of the U.S. intervention in Venezuela will likely be measured by the fate of the "Belt and Road" mindset in the Western Hemisphere. For years, China has operated under the assumption that economic interdependency would serve as a shield against political volatility. The collapse of the Maduro government, despite billions in Chinese support, serves as a stark reminder of the limits of "checkbook diplomacy." If a new Venezuelan government seeks to repudiate debts owed to Beijing or favors Western oil majors in the redistribution of PDVSA assets, it could trigger a more cautious era of Chinese overseas lending.

Furthermore, the regional spillover could be significant. China’s business interests in neighboring Brazil, Colombia, and Guyana are substantial. If the crisis leads to a prolonged period of regional instability or a massive new wave of migration, the "China-CELAC" (Community of Latin American and Caribbean States) forum, which Beijing has used to bypass U.S. influence, could see its progress stalled. Beijing’s insistence on a "non-interference" policy is being tested by the reality that, as a global creditor, it is inherently interfered with by the domestic politics of its debtors.

As the dust settles in Caracas, the focus for the Chinese Foreign Ministry will shift from public condemnation to quiet, back-channel negotiations. Historically, Beijing has shown a remarkable ability to work with successor regimes, provided its commercial contracts are honored. Whether it is in post-revolutionary Libya or shifting administrations in Southeast Asia, the PRC’s "ideological flexibility" is its greatest pragmatic tool. The priority remains the protection of Chinese nationals and the salvage of the $4.8 billion in direct investment.

Ultimately, the Venezuela episode may be remembered as a turning point in the geography of global power. As Nassim Nicholas Taleb has observed, the shift in the world’s economic center of gravity—with China moving from 6% to over 20% of global GDP in a decade and a half—suggests that the geopolitical theater is moving East. While Washington currently holds the military initiative in its "near abroad," the economic repercussions and the subsequent reconstruction of Venezuela will almost certainly require Chinese capital. In the coming decade, the resolution of such crises may not be dictated by who has the most advanced strike capabilities, but by who holds the debt and the contracts for the day after the conflict ends. For now, Beijing is content to wait, watch, and remind the world that while governments may fall, the ledger remains open.