Copenhagen, Denmark – The future trajectory of electricity prices in Denmark, a nation at the forefront of renewable energy integration, is set to undergo significant fluctuations by 2026, presenting both opportunities and challenges for consumers, businesses, and the broader energy sector. While precise figures remain subject to evolving market dynamics and policy interventions, a confluence of factors suggests a period of heightened price volatility and strategic reorientation. Understanding these drivers is crucial for stakeholders navigating this complex landscape.

The Danish energy sector has long been a pioneer in transitioning towards a green economy, heavily investing in wind power and other renewable sources. This commitment has been instrumental in shaping the nation’s electricity generation mix, aiming to decarbonize its economy and reduce reliance on fossil fuels. However, the very success of this transition introduces new complexities into price determination. The intermittent nature of renewables, such as wind and solar, means that supply can fluctuate significantly based on weather conditions, directly impacting wholesale electricity prices. When wind speeds are low or the sun is not shining, Denmark, like other nations with high renewable penetration, becomes more reliant on other energy sources, including imports from neighboring countries, which can be more expensive.

Furthermore, the ongoing integration of renewable energy requires substantial investment in grid infrastructure. Upgrades to transmission and distribution networks are essential to accommodate the decentralized nature of renewable generation and to ensure grid stability. These infrastructure investments, while necessary for the long-term health of the energy system, often translate into increased costs that are eventually passed on to consumers through network charges, a component of the final electricity bill. The scale of these investments, coupled with the need for grid modernization to handle increased electrification across sectors like transport and heating, points towards upward pressure on the non-energy components of electricity prices.

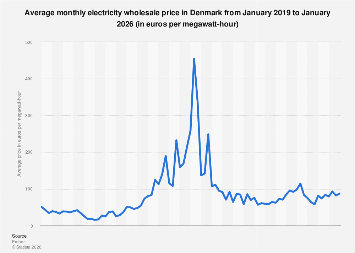

Global energy market trends also play a pivotal role. Denmark, as an open economy and an integral part of the European energy market, is heavily influenced by international commodity prices, geopolitical events, and the regulatory frameworks of its neighboring countries. Fluctuations in the price of natural gas, a key factor in marginal electricity pricing across Europe, can have a ripple effect on Danish electricity costs, even as the country reduces its own gas consumption. Supply chain disruptions, international tensions, and the pace of global decarbonization efforts all contribute to an unpredictable global energy commodity environment that will inevitably impact domestic prices.

The European Union’s ambitious climate goals, including the Green Deal, are driving regulatory changes that are likely to shape Denmark’s electricity market. Policies aimed at accelerating the phase-out of fossil fuels, increasing carbon pricing mechanisms, and promoting energy efficiency will influence both supply and demand dynamics. While these policies are designed to foster a sustainable energy future, they can also introduce short-term cost increases as the market adjusts. For instance, a more stringent carbon pricing regime would directly increase the cost of electricity generated from fossil fuel sources, thereby influencing the overall market price.

Looking specifically at the 2026 timeframe, several trends are particularly noteworthy. The continued expansion of offshore wind capacity, a cornerstone of Denmark’s energy strategy, is expected to contribute significantly to the country’s renewable energy supply. However, the operational costs and the eventual decommissioning of older facilities will also factor into the overall economic equation. Moreover, the development of energy storage solutions, such as batteries and potentially hydrogen storage, will become increasingly critical to mitigate the intermittency of renewables. The successful deployment and cost-effectiveness of these storage technologies will be a key determinant of price stability.

Market analysts and energy economists are closely monitoring the interplay of these factors. Projections suggest that while the average electricity price may see an upward trend in the medium term due to infrastructure investments and carbon pricing, the increasing share of low-marginal-cost renewables could exert downward pressure on wholesale electricity prices during periods of high renewable generation. This creates a scenario of increased price volatility, where consumers and businesses might experience more pronounced swings between high and low prices depending on real-time supply and demand conditions.

For Danish households, this translates into a need for greater energy efficiency and a potential shift towards dynamic pricing models that reward off-peak consumption. Smart metering technologies and demand-side management initiatives will be crucial in helping consumers optimize their electricity usage and mitigate the impact of price fluctuations. Government incentives for energy-saving measures and the adoption of electric vehicles and heat pumps, while contributing to long-term decarbonization, will also influence overall household electricity demand patterns.

Businesses, particularly energy-intensive industries, will face similar pressures. The cost of electricity is a significant operational expense, and increased price volatility can impact profitability and competitiveness. Strategic energy procurement, investment in on-site renewable generation, and the adoption of energy-efficient technologies will be essential for maintaining a competitive edge. Furthermore, the growing demand for green electricity from consumers and investors is creating new market opportunities for businesses that can demonstrate a commitment to sustainable energy practices.

The Danish government and regulatory bodies are actively working to address these evolving market conditions. Policies are being developed to ensure grid security and reliability, support the deployment of energy storage, and provide frameworks for fair pricing. The ongoing debate around energy taxation, subsidies for renewable energy, and the role of market liberalization will all contribute to shaping the final price consumers pay. The delicate balance between promoting renewable energy, ensuring affordability, and maintaining energy security remains a central challenge for policymakers.

Comparing Denmark’s situation to other European nations highlights its advanced stage in renewable energy integration. Countries with a lower share of renewables might experience different price dynamics, often more closely tied to fossil fuel prices. However, as the European energy transition accelerates, many nations are likely to face similar challenges related to grid modernization, intermittency management, and the integration of new technologies. Denmark’s experience, therefore, offers valuable lessons and insights for its European counterparts navigating the complex path towards a sustainable energy future.

In conclusion, the electricity price landscape in Denmark by 2026 is poised to be characterized by dynamic shifts driven by the continued expansion of renewables, necessary grid investments, global energy market volatility, and evolving climate policies. While the long-term outlook favors a cleaner energy system, the interim period will likely demand strategic adaptation from consumers, businesses, and policymakers alike to navigate the inherent price fluctuations and ensure a stable and affordable energy supply. The nation’s pioneering role in green energy positions it as a crucial case study for the global energy transition.