India’s vibrant over-the-top (OTT) streaming market, once characterized by explosive growth fueled by affordable data and rising smartphone penetration, is now entering a more mature, yet intensely competitive, phase. With an estimated 601.2 million viewers, representing over 41% of the population, the country’s digital video landscape has seen remarkable expansion. However, the initial surge, particularly within metropolitan areas, has begun to decelerate, with growth rates moderating to 10% annually, a notable dip from the 13-14% observed in the preceding two years. This shift compels leading platforms like Netflix and JioHotstar to recalibrate their strategies, focusing acutely on regional markets, with South India emerging as the pivotal battleground for future subscriber acquisition and sustained engagement.

The strategic pivot towards India’s southern states is not merely a tactical adjustment but a fundamental recognition of a diverse and highly engaged audience base that holds the key to unlocking the next wave of growth. Unlike the pan-Indian content approach, which often prioritizes Hindi and English programming, a regional strategy taps into deeply entrenched linguistic and cultural identities. South Indian audiences, already well-accustomed to the consumption of dubbed films and a robust theatrical release ecosystem, represent a sophisticated demographic with a strong affinity for local storytelling. This cultural bedrock provides fertile ground for premium web originals in Tamil, Telugu, Malayalam, and Kannada, offering a viable pathway for OTT platforms to transcend the saturation points observed in major urban centers.

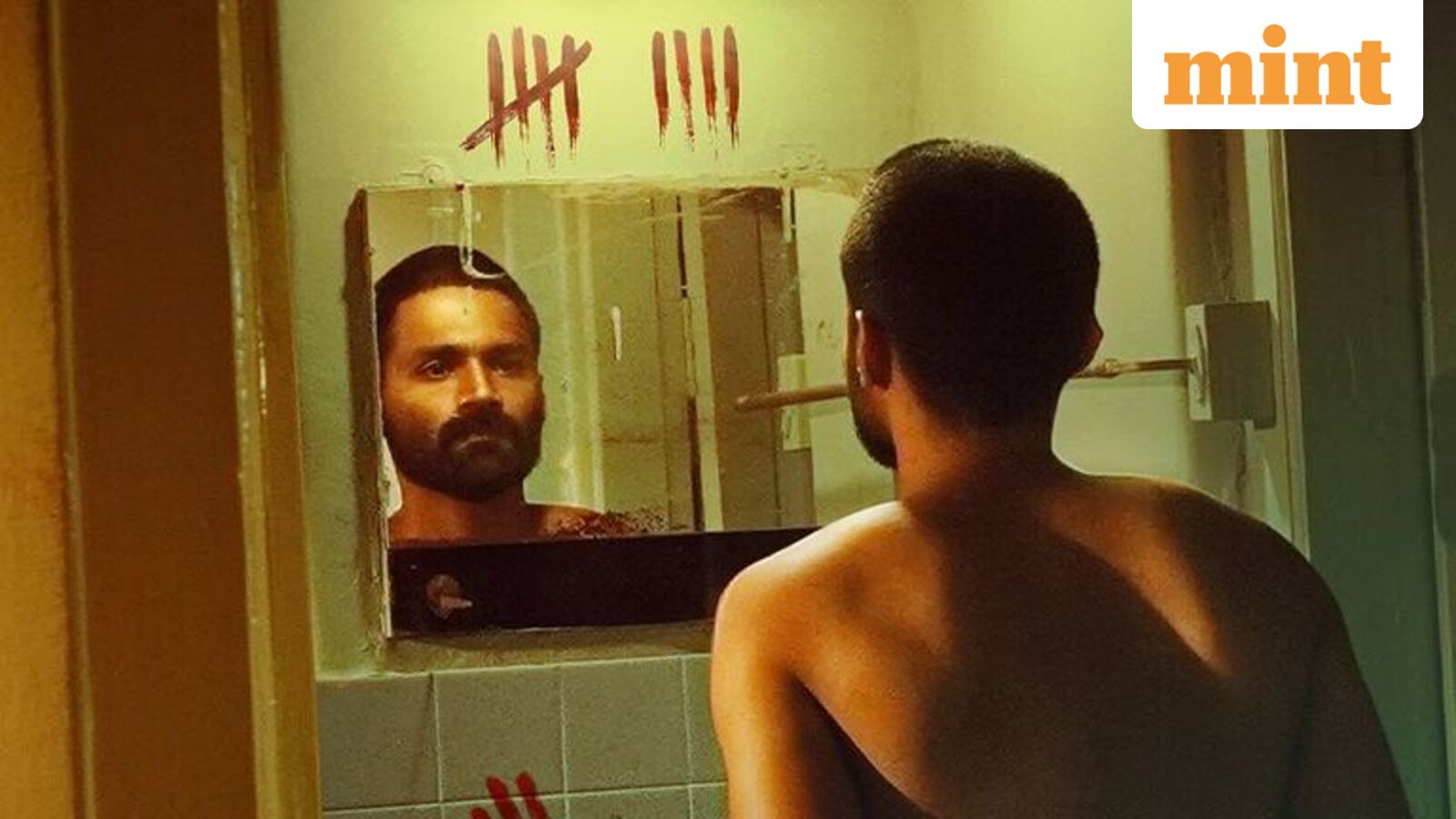

The sheer scale of investment underscores the gravity of this strategic shift. Netflix, for instance, in a move indicative of its global localization efforts, recently unveiled a slate of six new original films and series specifically tailored for Tamil and Telugu audiences. These include high-profile productions such as the psychological thriller Stephen and the cross-cultural drama Made In Korea, signaling a commitment to high-quality, culturally resonant narratives. Not to be outdone, JioHotstar, a dominant player within the Indian market and an integral part of Reliance Jio’s expansive digital ecosystem, has announced an ambitious plan to roll out 1,500 hours of fresh South Indian programming over the coming year. This initiative is backed by a substantial investment of ₹4,000 crore (approximately $480 million USD) over the next five years, aimed at bolstering the region’s content and creator ecosystem. Such significant capital deployment highlights the long-term vision these platforms hold for the southern market.

Industry insights reinforce the strategic rationale behind these investments. Data from JioHotstar reveals that its South vertical is outperforming other regions in key metrics such as subscription growth, retention rates, and large-screen viewing, which is crucial for monetization models that rely on sustained user engagement. Notably, audiences in smaller towns across South India exhibit exceptionally high levels of engagement, spending nearly 70% more time on the platform than their counterparts elsewhere in the country. This demographic also demonstrates a broader viewing palate, exploring 21% more genres than the national average, indicating a higher degree of curiosity and openness to diverse content. This robust engagement from tier-two and tier-three cities in the South is a significant differentiator, offering a counter-narrative to the slowing growth observed in more saturated urban markets.

The unifying power of content through dubbing and subtitling has fundamentally reshaped India’s fragmented linguistic landscape into a more cohesive market. As noted by Ashish Pherwani, M&E sector leader at EY India, the widespread adoption of these accessibility features means that "India has merged into one market, rather than a fragmented linguistic market." This allows South Indian content to reach a much larger, pan-Indian audience, enriching the national storytelling tapestry. Evidence of this trend is palpable across various platforms. On ZEE5, a prominent Indian streaming service, non-Hindi languages—encompassing Tamil, Telugu, Malayalam, and Kannada—account for nearly 50% of its total content consumption. Furthermore, the South Indian market has been a significant driver of premium viewing experiences, contributing a remarkable 46% of all 4K content consumption on ZEE5, underscoring the region’s demand for high-fidelity entertainment. With nearly 40% of ZEE5’s viewership originating from tier-two and tier-three markets, southern originals play a crucial role in maintaining engagement and mitigating churn in an increasingly crowded OTT ecosystem.

The appeal of South Indian content extends beyond mere linguistic reach. Neelesh Pednekar, co-founder and head of digital media at Social Pill, a marketing agency, points to the region’s inherent strengths in narrative and production. "The South has shown a higher appetite for experimental storytelling, strong genre content across crime, thrillers, mythology, and political drama, and consistent production quality," he states. This commitment to diverse, high-quality narratives resonates widely, with many South Indian productions already garnering national acclaim and viewership among Hindi and English-speaking audiences comfortable with dubbed or subtitled content. The path forward, Pednekar suggests, involves strategically rebranding these productions as "India originals" rather than solely "regional," coupled with smarter dubbing, stronger subtitling, national influencer amplification, and the inclusion of pan-India talent to unlock even wider viewership. This approach mirrors the global success of localized content, such as South Korea’s "Hallyu" wave, demonstrating the potential for regional stories to achieve international resonance.

While the strategic imperative to invest in South Indian content is clear, the landscape is not without its challenges. The escalating content spends do not automatically guarantee subscriber growth, as content saturation is becoming a pervasive issue across all markets. Raghavendra Hunsur, Chief Content Officer at ZEEL (Zee Entertainment Enterprises Ltd), cautions that "simply adding more titles will not move the needle unless they deepen cultural relevance and refresh audience excitement." The critical challenge for platforms is to craft southern originals that not only resonate deeply with local audiences but also strengthen the platform’s unique identity, foster habit-forming viewing behaviors, and actively counter churn in an ever-more competitive and fragmented streaming environment. The increasing cost of production, coupled with the need to constantly innovate and differentiate, places significant pressure on profitability, especially in a market characterized by diverse pricing sensitivities and the widespread availability of free content.

Looking ahead, the pivot to South India represents a sophisticated evolution in the Indian OTT strategy, moving beyond a "one-size-fits-all" approach to a nuanced, region-specific engagement model. This strategy promises not only to reignite subscriber growth but also to foster a richer, more diverse content ecosystem. The substantial investments are poised to invigorate local film industries, create employment opportunities for talent and technical crews, and ultimately elevate the overall production quality of Indian digital content. As platforms vie for the attention of the next hundred million subscribers, their success will hinge on their ability to consistently deliver authentic, high-quality, and culturally resonant stories that truly connect with the discerning audiences of South India, thereby setting a new benchmark for content strategy in one of the world’s most dynamic digital markets.