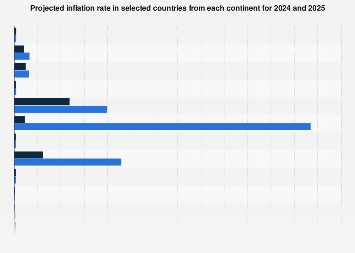

As global economies navigate a complex post-pandemic landscape, the specter of inflation continues to be a dominant concern for policymakers, businesses, and consumers alike. Projections for 2024 offer a mixed outlook, with significant variations across continents, reflecting divergent economic conditions, monetary policy responses, and geopolitical influences. Understanding these projected inflation rates is crucial for forecasting economic growth, investment decisions, and consumer purchasing power on a global scale.

In North America, the United States is anticipated to see a moderation in its inflation rate in 2024, moving closer to the Federal Reserve’s target of 2%. Projections suggest an average annual inflation rate in the vicinity of 2.5% to 3%. This cooling trend is attributed to the cumulative effect of aggressive interest rate hikes implemented by the Fed over the past two years, which have aimed to curb demand and stabilize prices. Supply chain disruptions, while still a factor, have shown signs of easing, further contributing to this disinflationary pressure. However, wage growth remains robust, posing a potential upside risk to inflation persistence. In Canada, a similar pattern is expected, with inflation projected to hover around 2.8% to 3.3%, influenced by similar global trends and domestic policy actions by the Bank of Canada. The strong labor market in both nations, while positive for economic activity, necessitates careful monitoring by central banks to avoid reigniting inflationary pressures.

South America presents a more varied inflationary environment. Argentina, grappling with chronic economic instability, is forecast to experience one of the highest inflation rates globally, potentially exceeding 100% in 2024. This hyperinflationary scenario is driven by a complex interplay of fiscal deficits, currency depreciation, and a lack of confidence in economic management. In contrast, Brazil, Latin America’s largest economy, is projected to see its inflation rate fall to around 4.5% to 5%, a significant decrease from the double-digit figures seen in recent years. The Central Bank of Brazil’s proactive monetary tightening has been instrumental in this anticipated decline. Chile and Colombia are also expected to experience moderating inflation, with rates anticipated to be in the 3% to 4% range, aligning with a broader regional trend of easing price pressures as global commodity prices stabilize and domestic demand cools.

Europe’s inflation trajectory in 2024 is largely shaped by the ongoing energy transition and the lingering effects of geopolitical tensions. The Eurozone is projected to witness a decline in its average inflation rate to approximately 2.7% to 3.2%. This moderation is a testament to the European Central Bank’s efforts to tighten monetary policy, alongside a significant decrease in energy prices compared to the peaks of 2022. However, underlying inflation, excluding volatile energy and food prices, remains a concern, indicating persistent price pressures in services and manufactured goods. In the United Kingdom, inflation is forecast to be slightly higher, around 3.5% to 4%, reflecting a more persistent wage-price spiral and a more deeply entrenched inflation psychology. Non-Eurozone countries like Switzerland are expected to maintain lower inflation rates, potentially around 1.5% to 2%, due to a strong currency and a more conservative monetary policy stance.

The African continent presents a diverse economic landscape, with inflation rates varying significantly from country to country. Many emerging African economies are expected to experience elevated inflation in 2024, with projections for some nations in Sub-Saharan Africa ranging from 6% to 10% or even higher. This is often driven by factors such as currency depreciation, import price shocks, and domestic supply constraints. Nigeria, for instance, is grappling with significant inflationary pressures, with projections suggesting rates could remain above 20%. In contrast, more developed economies on the continent, such as South Africa, are anticipated to see inflation moderate to around 5% to 5.5%, influenced by the South African Reserve Bank’s monetary policy. The reliance on imported goods and vulnerability to global commodity price fluctuations remain key drivers of inflation across many African nations.

Asia’s economic giants present a study in contrasts. China, the world’s second-largest economy, is projected to maintain a relatively low inflation rate, potentially around 1.5% to 2%, reflecting a slower pace of economic recovery and a focus on domestic demand stimulation. Deflationary pressures have been a more significant concern in recent periods, prompting policy interventions to boost consumption. India, on the other hand, is expected to see inflation hover around 5% to 5.5%, influenced by food price volatility and robust domestic demand. The Reserve Bank of India has been vigilant in managing inflation while supporting economic growth. In Southeast Asia, countries like Indonesia and the Philippines are projected to experience inflation in the 3.5% to 4.5% range, with central banks actively managing price stability. Japan, historically battling deflation, is expected to see a modest uptick in inflation, perhaps reaching 2% to 2.5%, driven by import costs and a gradual shift in corporate pricing behavior, though it remains significantly below many other developed economies.

Oceania, primarily represented by Australia and New Zealand, is forecast to experience moderating inflation in 2024. Australia’s inflation rate is projected to decline to around 3% to 3.5%, a welcome development after a period of elevated price pressures. The Reserve Bank of Australia’s monetary policy tightening is expected to continue its disinflationary effect. New Zealand is facing a similar trend, with inflation anticipated to fall to approximately 3.5% to 4%, though the pace of decline may be more gradual due to persistent domestic cost pressures.

The global inflation picture for 2024, therefore, is one of gradual disinflation in many advanced economies, with central banks working to bring rates back to target levels. However, significant regional disparities persist, with emerging markets and developing economies often facing more persistent and elevated inflationary challenges. These variations underscore the importance of tailored monetary and fiscal policies to address specific domestic economic conditions while remaining cognizant of global economic headwinds and tailwinds. The interplay of energy prices, supply chain resilience, geopolitical stability, and labor market dynamics will continue to shape the inflation trajectory throughout the year, impacting global economic growth and financial markets.