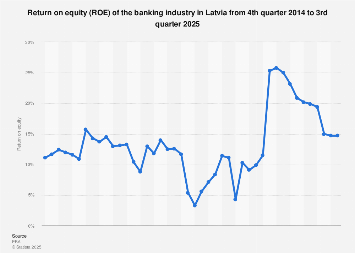

Latvia’s banking sector is anticipated to demonstrate robust performance in the upcoming year, with projected returns on equity (ROE) indicating a sustained period of profitability. While specific quarterly figures for 2025 are subject to market dynamics and the evolving economic landscape, preliminary analyses and historical trends suggest a positive outlook for the nation’s financial institutions. The ROE, a key metric for assessing a company’s profitability in relation to shareholder equity, is closely watched by investors and analysts as an indicator of efficiency and financial health. For Latvia’s banks, this metric is particularly significant given the sector’s pivotal role in supporting economic activity and its sensitivity to both domestic and international economic currents.

The projected strength in ROE is underpinned by several factors. A primary driver is expected to be the ongoing stabilization and potential growth within the broader European Union economy, of which Latvia is an integral part. As economic confidence firms and investment activity picks up across the continent, Latvian banks are likely to benefit from increased demand for credit and other financial services. This could translate into higher net interest income, a core component of banking profitability, as loan volumes expand and lending margins remain stable or improve. Furthermore, robust capital adequacy ratios across the Latvian banking system, a requirement meticulously monitored by the Bank of Latvia and European regulatory bodies, provide a solid foundation for absorbing potential shocks and facilitating continued lending operations.

Market data from various financial intelligence providers suggests that, on average, banks within the Baltic region, including Latvia, have been consistently delivering respectable ROE figures over the past few years. While precise figures for Q1, Q2, Q3, and Q4 of 2025 are still in the realm of projection, current trends point towards a continuation of these positive returns. For instance, if the average ROE for Latvian banks hovered around 8-10% in recent quarters, analysts are anticipating this to potentially edge upwards, perhaps reaching the upper single digits or even breaching the 10% mark in certain segments of the market, assuming favorable economic conditions persist. This would place Latvian banks competitively within the European context, where average ROE can vary significantly based on market maturity, regulatory environment, and economic growth rates.

Beyond net interest income, fee and commission income is also expected to contribute positively to bank profitability. As digital transformation accelerates, Latvian banks are investing in and expanding their digital offerings, including online banking platforms, mobile payment solutions, and wealth management services. These digital channels not only enhance customer experience but also provide new avenues for generating fee-based revenue. Cross-selling of financial products, such as insurance, investment funds, and advisory services, through these enhanced digital touchpoints is a key strategy being employed by many institutions to diversify revenue streams and bolster overall profitability.

However, the banking sector is not without its challenges. Inflationary pressures, while potentially moderating in 2025 compared to recent peaks, could still influence operating costs and the cost of capital for banks. Central bank monetary policy, including interest rate decisions, will continue to play a crucial role. While higher interest rates can boost net interest margins, they can also increase the risk of non-performing loans if borrowers struggle to service their debt. Therefore, a delicate balance will need to be maintained by monetary authorities, and Latvian banks will need to proactively manage their credit risk portfolios.

Geopolitical risks, particularly those stemming from the ongoing conflict in Eastern Europe, remain a background concern that could introduce volatility into financial markets and impact investor sentiment. While Latvia has strong economic ties within the EU and has diversified its international partnerships, any significant escalation or prolonged instability could have ripple effects. This underscores the importance of robust risk management frameworks for Latvian banks, ensuring they are well-equipped to navigate unforeseen economic headwinds.

In terms of international comparisons, the projected ROE for Latvian banks in 2025 is likely to align with or slightly exceed the average for many of their Central and Eastern European counterparts. However, it may trail behind the returns seen in some of the more mature and dynamic Western European markets, which often benefit from larger economies of scale and a wider array of sophisticated financial products. Nonetheless, for an economy of Latvia’s size, achieving consistent and healthy ROE figures is a testament to the resilience and strategic management of its banking sector.

The economic impact of a strong banking sector on Latvia cannot be overstated. Profitable banks are better positioned to lend to businesses, supporting job creation and economic expansion. They also contribute significantly to government revenues through corporate taxes and provide essential financial services to individuals and households, facilitating consumption and investment. A healthy banking sector can also attract foreign investment, further bolstering the nation’s economic growth trajectory. Therefore, the projected profitability for 2025 signals continued positive momentum for Latvia’s financial ecosystem and its broader economy.

Looking ahead, the focus for Latvian banks will remain on optimizing operational efficiency, leveraging technological advancements, and prudently managing risk. The ability to adapt to changing regulatory requirements, embrace innovation, and maintain strong customer relationships will be critical in ensuring sustained profitability and contributing to Latvia’s long-term economic prosperity. The coming year presents an opportunity for the sector to build on its recent successes and further solidify its position as a vital engine of economic growth for the nation.