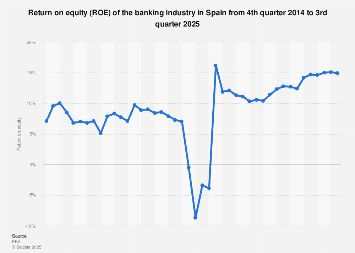

The Spanish banking sector is poised for a period of sustained profitability, with projections indicating a healthy and upward trend in Return on Equity (ROE) throughout 2025. This anticipated improvement, driven by a confluence of macroeconomic factors, strategic adjustments within the financial institutions, and evolving regulatory landscapes, signals a positive outlook for Spain’s largest banks. While specific quarterly figures are subject to the dynamic nature of financial markets, the overarching sentiment among analysts and industry observers points towards robust performance metrics for the year ahead.

The Return on Equity, a key indicator of a company’s profitability and efficiency in generating profits from shareholders’ investments, is closely monitored by investors and analysts alike. For the banking industry, ROE is particularly significant as it reflects the capacity of banks to leverage their capital effectively to generate returns. A consistently rising ROE suggests that Spanish banks are not only managing their assets prudently but are also adept at identifying and capitalizing on profitable opportunities within the current economic climate.

Several underlying factors are contributing to this optimistic forecast. Firstly, the European Central Bank’s (ECB) monetary policy, while potentially shifting, has provided a relatively stable interest rate environment. Although the era of ultra-low or negative interest rates is largely behind us, the current rates, which are higher than in recent years, allow banks to earn more on their lending activities. This is particularly beneficial for institutions heavily reliant on net interest income, a core revenue stream for traditional banking operations. Spain, as a significant member of the Eurozone, directly benefits from these broader monetary policy decisions.

Secondly, Spanish banks have undergone considerable restructuring and consolidation in recent years, a process that has streamlined operations, reduced costs, and enhanced efficiency. The drive to optimize branch networks, embrace digital transformation, and shed non-core assets has created leaner and more agile financial entities. This operational efficiency directly translates into improved profitability, as less capital is tied up in unproductive assets or administrative overheads. The benefits of these strategic initiatives are expected to fully materialize in 2025, bolstering ROE figures.

Furthermore, the Spanish economy itself is demonstrating resilience and growth. Forecasts from various international economic bodies, such as the International Monetary Fund (IMF) and the European Commission, have consistently pointed towards a positive GDP growth trajectory for Spain. A growing economy typically leads to increased demand for credit from both businesses and consumers, thereby expanding the lending opportunities for banks. Moreover, a healthier economy often correlates with lower non-performing loan (NPL) ratios, as borrowers are better positioned to meet their financial obligations. This reduction in credit risk further bolsters bank profitability and reduces the need for extensive provisioning.

The global banking landscape also offers a comparative perspective. While many European banks have faced headwinds from persistently low interest rates and intense competition, Spanish institutions appear to be navigating these challenges more effectively. Countries with similar economic profiles, such as Italy and Portugal, are also seeing improvements in their banking sectors, but Spain’s proactive approach to deleveraging and digital innovation places it in a strong competitive position. The average ROE for European banks has historically fluctuated, but a sustained upward trend in Spain would likely see its banks outperform regional averages. For instance, if the average ROE for large European banks hovers around 8-10%, Spanish banks achieving 12-15% or higher would represent a significant outperformance.

Market data from financial intelligence providers indicates that the net interest margins for Spanish banks have been widening. This is a direct consequence of the repricing of assets in line with higher benchmark rates. While deposit costs have also increased, the faster adjustment of lending rates has provided a boost to profitability. Moreover, fee and commission income, derived from services such as wealth management, investment banking, and payment processing, is also expected to remain a significant contributor. Diversification of revenue streams beyond traditional lending is a key strategy for resilience and growth.

Expert insights from financial analysts reinforce this positive outlook. Many have revised their earnings forecasts upwards for major Spanish banking groups, citing improved profitability metrics and a more favorable economic backdrop. For example, analysts at major investment banks have highlighted the robust capital adequacy ratios maintained by Spanish banks, which provide them with the capacity to absorb potential economic shocks and to continue lending and investing. The focus on digital banking is also yielding dividends, with banks investing in user-friendly mobile applications and online platforms that attract and retain customers, thereby reducing reliance on expensive physical branches.

The projected ROE figures for 2025 are not without their potential challenges. Inflationary pressures, while moderating in some regions, could still impact consumer spending and business investment. Geopolitical uncertainties and potential shifts in global trade dynamics could also introduce volatility. However, the Spanish banking sector has demonstrated a remarkable capacity to adapt and manage these risks. Regulatory bodies, such as the Bank of Spain and the European Banking Authority (EBA), have been diligent in overseeing the sector, ensuring that banks maintain strong capital buffers and adhere to prudent risk management practices.

Looking at specific segments of the market, large, diversified banking groups with strong retail franchises and significant international operations are expected to lead the pack in terms of ROE. Their ability to benefit from economies of scale, leverage technology across multiple business lines, and diversify their geographic exposure positions them well for sustained profitability. Smaller, more specialized institutions may face greater challenges in achieving the same level of returns, but strategic alliances and niche market focus can still offer avenues for success.

The implications of a strong ROE for the Spanish banking sector extend beyond the financial statements of the banks themselves. A healthy and profitable banking industry is a cornerstone of a strong economy. It facilitates investment, supports job creation, and provides the necessary capital for businesses to expand. For shareholders, an improving ROE translates into potentially higher dividend payouts and capital appreciation, making Spanish banks an attractive investment proposition. Moreover, the confidence instilled by a robust financial sector can attract foreign direct investment, further bolstering economic growth.

In conclusion, the outlook for the Spanish banking industry’s Return on Equity in 2025 is overwhelmingly positive. The convergence of favorable economic conditions, the fruits of strategic restructuring, and a resilient operational framework are setting the stage for a period of enhanced profitability. While the precise quarterly figures will undoubtedly be influenced by market dynamics, the underlying trends suggest a sector that is not only recovering but is poised for significant and sustained growth, reinforcing its vital role in the Spanish and broader European economic landscape.