Suncor Energy, a prominent player in Canada’s energy sector, has been under increasing scrutiny regarding its annual greenhouse gas (GHG) emissions. As global efforts to combat climate change intensify, understanding the environmental impact of major industrial corporations is paramount. Suncor’s operational scale, primarily focused on oil sands extraction and refining, inherently places it among the significant contributors to GHG output within the Canadian economy. While precise, granular data often requires proprietary access, publicly available information and industry trends paint a comprehensive picture of the company’s environmental performance and the broader context of Canada’s energy emissions.

The challenge of quantifying corporate GHG emissions is multifaceted. It involves not only direct emissions from operations (Scope 1) but also indirect emissions from purchased energy (Scope 2) and those arising from the use and disposal of its products (Scope 3). For an integrated energy company like Suncor, which spans the entire value chain from extraction to refined products, these various scopes present a complex accounting exercise. The energy industry, particularly the extraction and processing of fossil fuels, is inherently carbon-intensive. The Canadian energy sector, as a whole, has historically been a significant source of national GHG emissions, with oil and gas being the largest contributing industry. Data from Environment and Climate Change Canada consistently highlights this, placing the sector at the forefront of national emissions profiles.

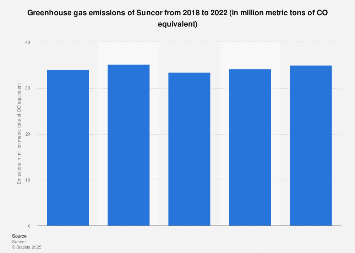

Suncor’s commitment to transparency, like many large corporations, is often reflected in its sustainability reports and disclosures to regulatory bodies. These reports typically provide an overview of their emissions performance, often focusing on Scope 1 and Scope 2 emissions. For instance, in recent years, large energy producers in Canada have been reporting GHG emissions in the range of millions of tonnes of carbon dioxide equivalent (MtCO2e) annually. While specific figures fluctuate based on production levels, operational efficiency, and market conditions, Suncor’s emissions are a significant component of the national energy sector’s total. Industry analysts often use these reported figures to benchmark companies against their peers and against national climate targets.

The economic implications of these emissions are substantial. Beyond the direct environmental cost, there are increasing regulatory pressures and market expectations that translate into financial risks and opportunities. Carbon pricing mechanisms, such as Canada’s federal carbon tax and provincial cap-and-trade systems, directly impact the cost of emitting GHGs. For companies like Suncor, this means that higher emissions translate into higher operational expenses. This has spurred investments in emissions reduction technologies, process improvements, and the exploration of lower-carbon energy sources. The global shift towards a low-carbon economy also influences investor sentiment. Funds increasingly favour companies with strong environmental, social, and governance (ESG) credentials, potentially impacting Suncor’s access to capital and its valuation.

Canada’s national climate targets, aligned with international agreements like the Paris Accord, aim to reduce emissions significantly by mid-century. The energy sector, being the largest emitter, is a critical focus area for achieving these goals. Provincial governments also play a key role, often implementing their own climate policies and emissions reduction strategies. This creates a complex regulatory landscape for companies operating across different jurisdictions within Canada. For Suncor, navigating these varying regulations and contributing to national targets requires strategic planning and substantial investment in decarbonization initiatives.

The technological frontier in reducing emissions from oil and gas operations is a dynamic space. Suncor, like its peers, is exploring and implementing various strategies. These include improving energy efficiency in extraction and processing, reducing methane leaks, and investing in carbon capture, utilization, and storage (CCUS) technologies. CCUS, in particular, is seen as a crucial pathway for decarbonizing heavy industrial processes, offering the potential to capture CO2 emissions before they enter the atmosphere. Furthermore, there is a growing interest in exploring hydrogen production, particularly blue hydrogen derived from natural gas with CCUS, and green hydrogen produced from renewable electricity, as potential future energy carriers.

Comparing Suncor’s emissions profile to international energy giants offers valuable perspective. Major oil and gas companies globally are facing similar pressures to reduce their carbon footprints. However, the specific context of oil sands extraction, which is generally more energy-intensive than conventional oil production, presents unique challenges. Countries with significant fossil fuel reserves often grapple with balancing energy security and economic development with climate commitments. The transition away from fossil fuels is a global imperative, and the pace of this transition varies significantly by region, influenced by factors such as economic reliance on fossil fuels, resource endowments, and political will.

The concept of "net-zero" emissions is becoming a guiding principle for many corporations. Achieving net-zero requires a combination of deep emissions reductions and the offsetting of any residual emissions through carbon removal or other credible mechanisms. For Suncor, this implies a long-term strategy that not only focuses on operational improvements but also on potential diversification into lower-carbon energy solutions and the responsible management of its existing asset base. The path to net-zero is not linear and involves continuous innovation, significant capital investment, and adaptation to evolving market and regulatory environments.

Stakeholder engagement is another critical element. Investors, customers, employees, Indigenous communities, and the public all have a vested interest in Suncor’s environmental performance. Proactive engagement, clear communication, and demonstrable progress in emissions reduction are essential for maintaining social license to operate and building trust. The narrative around energy production is evolving, and companies that can effectively demonstrate their commitment to a sustainable future are better positioned for long-term success.

In conclusion, Suncor Energy’s annual GHG emissions are a key indicator of its environmental performance within the broader context of Canada’s energy sector and global climate action. While precise data may be proprietary, industry analysis and corporate disclosures highlight the significant role of fossil fuel extraction and processing in the company’s environmental footprint. The increasing focus on decarbonization, driven by regulatory pressures, market expectations, and technological advancements, presents both challenges and opportunities for Suncor. Its ability to navigate these complexities, invest in sustainable solutions, and transparently report its progress will be critical in shaping its future and its contribution to a lower-carbon economy.