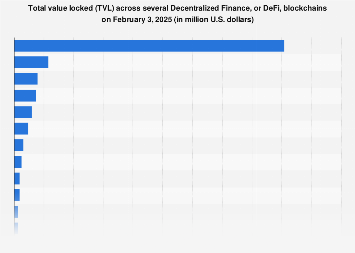

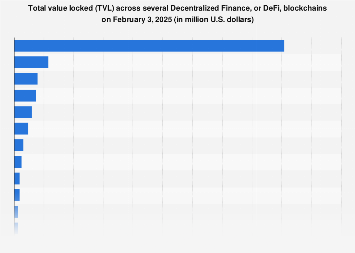

As of September 5, 2025, Ethereum continues to solidify its position as the undisputed leader in the burgeoning decentralized finance (DeFi) ecosystem, commanding a Total Value Locked (TVL) that dwarfs that of all other blockchains combined. TVL, a critical metric within the DeFi landscape, serves as the most proximate proxy for the overall market size and investor confidence in these decentralized protocols. The trajectory of the DeFi market throughout 2021, and indeed in the years leading up to 2025, has been characterized by exponential growth, with significant inflows of capital seeking the yield and accessibility offered by these novel financial instruments.

Ethereum’s foundational role in powering the vast majority of DeFi transactions and smart contracts has intrinsically linked its network’s performance and the price of its native cryptocurrency, Ether (ETH), to the health of the DeFi sector. Historical data from September 10, 2021, illustrates this correlation vividly, when an overnight price drop in ETH resulted in a substantial decrease of billions of U.S. dollars in Ethereum’s TVL. This event underscored the sensitivity of DeFi valuations to the underlying asset prices of the blockchains that host them, highlighting both the potential for rapid gains and the inherent volatility of the space.

The landscape of DeFi is not, however, a monolithic entity solely dependent on Ethereum. A growing number of alternative Layer 1 blockchains and Layer 2 scaling solutions have emerged, each vying for a share of the DeFi market by offering distinct advantages such as lower transaction fees, faster confirmation times, or specialized functionalities. These competing networks have fostered a dynamic environment where innovation is rapid, and the distribution of TVL is constantly evolving.

While precise, granular data for all 25 blockchains on September 5, 2025, requires subscription access, the overarching trend indicates a significant concentration of value on Ethereum. However, understanding the performance of these alternative chains is crucial for a comprehensive view of the DeFi market’s maturity and diversification. For instance, networks like Solana, Binance Smart Chain (now BNB Chain), Polygon, Avalanche, and Cardano have consistently attracted substantial capital, each building unique ecosystems of decentralized exchanges (DEXs), lending protocols, and yield farming opportunities.

The economic implications of this concentration are multifaceted. For Ethereum, its dominance translates into significant network fees, reinforcing its economic model and incentivizing further development and security upgrades. For developers and entrepreneurs, the large user base and liquidity on Ethereum provide a fertile ground for launching new DeFi applications, though the high gas fees can present a barrier to entry for smaller transactions and less sophisticated users.

Conversely, the growth of alternative blockchains suggests a healthy diversification strategy within the broader crypto and DeFi markets. These chains often cater to specific niches or offer cost-effective alternatives, democratizing access to DeFi services. The competition among these platforms drives innovation, pushing the boundaries of what is possible in decentralized finance and potentially leading to more efficient and accessible financial systems globally.

The statistical data, even with the anonymized figures, points to a clear hierarchy. Ethereum’s TVL, even if it has seen fluctuations, remains the benchmark against which all other platforms are measured. The sheer volume of economic activity, from trading and lending to staking and derivatives, occurring on Ethereum’s decentralized applications (dApps) contributes to its commanding position. This includes the total value of cryptocurrencies locked in smart contracts for various DeFi protocols, such as decentralized exchanges (DEXs), lending and borrowing platforms, stablecoin protocols, and yield aggregators.

The growth of the DeFi market has also attracted institutional interest, with various entities exploring the potential of decentralized finance for portfolio diversification, yield generation, and efficient capital deployment. This institutional adoption, while still in its nascent stages, could further accelerate the growth of TVL across all viable blockchains, potentially shifting market dynamics and fostering greater stability.

Looking ahead, the continued evolution of blockchain technology, including advancements in scalability, interoperability, and security, will play a pivotal role in shaping the future of DeFi. The development of cross-chain solutions, allowing for seamless asset transfer and interaction between different blockchains, could reduce the impact of single-chain dominance and create a more interconnected and efficient decentralized financial ecosystem.

The presence of multiple blockchains hosting significant DeFi activity signifies a maturing market that is no longer reliant on a single technological backbone. While Ethereum’s lead is substantial, the competitive landscape fosters innovation and provides users with a broader range of choices, catering to diverse needs and risk appetites. The ongoing race for market share among these platforms is a testament to the immense potential and rapid evolution of decentralized finance, promising a future where financial services are more accessible, transparent, and efficient for a global audience. The ability of these platforms to attract and retain locked value will be a key indicator of their long-term success and their contribution to the ongoing transformation of the financial industry.