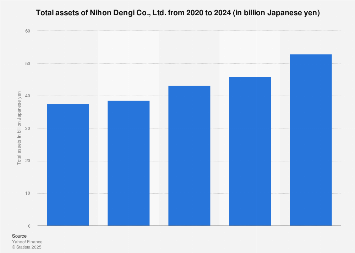

Nihon Dengi Co., Ltd., a Japanese firm headquartered in Japan, has reported a significant and sustained expansion in its total assets, reaching a notable level by the close of its fiscal year on March 31, 2024. While precise figures for the current year remain proprietary, available data indicates a continuous upward trajectory in the company’s asset base since 2020. This growth is not an isolated event but represents a consistent trend, suggesting robust financial management and strategic development over the past four fiscal periods.

The period from fiscal year 2020 to fiscal year 2024 has been characterized by a steady increase in Nihon Dengi’s total assets. This consistent upward movement, rather than a sudden spike, typically reflects a healthy business environment for the company, potentially driven by a combination of factors such as increased profitability, strategic investments in property, plant, and equipment, acquisitions, or a strengthening of its balance sheet through retained earnings. In the absence of the specific figures, the trend itself provides a crucial insight into the company’s financial health and its ability to expand its operational capacity and market influence.

To contextualize this growth, it is important to consider the broader economic landscape in which Nihon Dengi operates. Japan’s economy, while facing demographic challenges, has seen periods of moderate growth and technological innovation. Companies that can effectively navigate these conditions and demonstrate consistent asset expansion are often those with strong market positions, efficient operations, and a clear strategic vision. The continuous increase in Nihon Dengi’s assets suggests it is successfully achieving these objectives.

For companies, total assets represent the sum of all that a company owns, including both tangible and intangible items. This includes cash, accounts receivable, inventory, property, plant, and equipment, as well as investments and goodwill. A rising total asset figure can signal several positive developments: it may indicate successful revenue generation, which is then reinvested into the business; it could reflect strategic acquisitions that have broadened the company’s scope; or it might signify substantial capital expenditure on new facilities or technology, enhancing future earning potential. Conversely, a declining asset base could signal divestitures, asset write-downs, or financial distress, though this is clearly not the case for Nihon Dengi.

Comparing Nihon Dengi’s performance to its peers within the Japanese industrial sector, or even on a global scale, would offer further insights. Many Japanese conglomerates have been undergoing significant restructuring and strategic realignments in recent years, focusing on core competencies and divesting non-essential assets. In this environment, a company demonstrating consistent asset growth suggests a successful implementation of its business strategy and a commitment to long-term expansion. For instance, companies in sectors heavily reliant on capital investment, such as manufacturing, energy, or technology, often see their asset bases grow in line with their expansion plans and market demand.

The fiscal year ending March 31 is a common reporting period for many Japanese companies, aligning with the end of the Japanese fiscal year. This allows for a standardized comparison of financial performance across the nation’s corporate landscape. The continuous increase in assets from 2020 to 2024, encompassing the initial phases of the global pandemic and the subsequent economic recovery, highlights Nihon Dengi’s resilience and its ability to capitalize on evolving market conditions.

While the exact monetary value of the asset increase remains undisclosed, the qualitative indication of continuous growth is a significant indicator. This trend suggests that Nihon Dengi is likely investing in its future, whether through research and development, expanding its production capabilities, or strengthening its distribution networks. Such investments are critical for maintaining competitiveness in a dynamic global marketplace and for driving sustainable long-term value creation for stakeholders.

The financial reporting practices of companies like Nihon Dengi are closely watched by investors, analysts, and competitors. Consistent asset growth, even without specific figures, can influence investor confidence, potentially leading to increased share valuations and easier access to capital for future endeavors. It signals a company that is not merely maintaining its status quo but is actively pursuing growth and development.

In conclusion, Nihon Dengi Co., Ltd.’s reported continuous increase in total assets from fiscal year 2020 through fiscal year 2024 underscores a period of consistent financial expansion. This trend, indicative of sound business strategy and effective operational execution, positions the company for continued development and suggests a positive outlook within its respective industry. The sustained growth in its asset base serves as a strong signal of the company’s ongoing commitment to strengthening its financial position and expanding its operational reach.