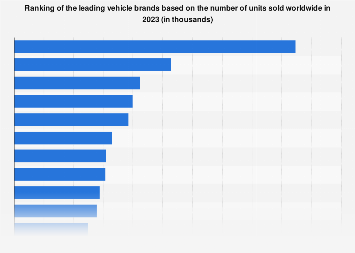

The automotive industry, a cornerstone of global manufacturing and economic activity, witnessed a dynamic performance in 2023, with several established brands continuing to dominate international sales charts. While specific sales figures often remain proprietary until released by individual manufacturers or compiled by market research firms, an analysis of available data and industry trends reveals a consistent hierarchy at the top. These leading automotive groups not only command significant market share but also exert considerable influence on technological innovation, supply chain dynamics, and consumer preferences worldwide. The year 2023 underscored the resilience and adaptability of these giants amidst ongoing economic fluctuations, evolving regulatory landscapes, and a pronounced shift towards electrification.

The dominance of a few select automotive conglomerates is a recurring theme in the global market. Brands under the umbrellas of Toyota Motor Corporation, Volkswagen Group, and Hyundai Motor Group have consistently featured at the forefront of sales volumes. Toyota, renowned for its commitment to reliability and fuel efficiency, particularly through its hybrid technologies, has long held a commanding position. In 2023, the Japanese giant likely continued to benefit from strong demand for its popular models like the RAV4 and Corolla, alongside its aggressive push into hybrid and electric vehicle (EV) development. Industry analysts suggest that Toyota’s strategic diversification, encompassing a wide range of vehicle types and powertrains, has provided a robust buffer against market volatility.

Volkswagen Group, a sprawling European powerhouse, also maintains a formidable presence. With a portfolio that spans iconic marques such as Volkswagen, Audi, Porsche, and Skoda, the group caters to a broad spectrum of consumer needs and price points. The strategic electrification of its lineup, spearheaded by the ID. series, has been a key focus, although traditional internal combustion engine (ICE) vehicles continue to drive substantial sales volumes, especially in its core European markets and China. The group’s ability to leverage shared platforms and manufacturing efficiencies across its diverse brands is a critical factor in its sustained market leadership.

The South Korean automotive duo, Hyundai Motor Group (encompassing Hyundai and Kia), has demonstrated remarkable growth and competitiveness in recent years. Their focus on design, technology, and value has resonated with consumers globally. In 2023, Hyundai and Kia likely saw continued strong sales, bolstered by their expanding range of electric vehicles, such as the Hyundai IONIQ 5 and Kia EV6, which have garnered critical acclaim and significant consumer interest. Their strategic investments in battery technology and charging infrastructure further solidify their position in the burgeoning EV market.

Beyond these top contenders, other global players have also played pivotal roles in shaping the 2023 automotive landscape. Stellantis, formed by the merger of Fiat Chrysler Automobiles and PSA Group, boasts a diverse collection of brands including Jeep, Ram, Peugeot, and Fiat. The group’s efforts to streamline operations and capitalize on synergies across its brands are crucial for its performance. General Motors (GM) and Ford, the American automotive stalwarts, continue to vie for market share, with GM’s strong performance in trucks and SUVs, particularly in North America, and Ford’s strategic investments in electric vehicles like the F-150 Lightning and Mustang Mach-E, shaping their competitive stance.

The Chinese automotive sector, a rapidly expanding force, has seen its domestic brands achieve significant sales growth, not only within China but also increasingly in international markets. Companies like BYD, which has aggressively transitioned to an all-electric and plug-in hybrid strategy, have emerged as major global players, challenging established automakers with innovative technology and competitive pricing. Geely, another prominent Chinese group, continues to expand its global footprint through its ownership of Volvo Cars and other brands. The sheer scale of the Chinese domestic market provides a powerful engine for growth, and its manufacturers are increasingly sophisticated in their product development and global expansion strategies.

Several factors contributed to the performance of these automotive giants in 2023. The easing of supply chain disruptions, particularly the semiconductor shortage that plagued the industry in preceding years, allowed for increased production volumes. However, persistent geopolitical tensions and inflationary pressures continued to influence consumer spending and manufacturing costs. The global push towards sustainability and decarbonization has undeniably accelerated the transition to electric vehicles. Automakers that had invested heavily in EV technology and infrastructure were better positioned to capture market share. This includes not only the development of new EV models but also the securing of raw materials for batteries and the expansion of charging networks.

Market data from various regions highlights distinct trends. In Europe, regulatory pressures favoring lower-emission vehicles continue to drive EV adoption. Germany, France, and the UK remain key markets for traditional brands, but the market share of EVs is steadily increasing. North America, particularly the United States, sees a strong demand for larger vehicles like SUVs and pickup trucks, a segment where American manufacturers have historically excelled. However, the introduction of more competitive EV alternatives is gradually shifting this dynamic. Asia, with China at its epicenter, represents the largest and fastest-growing automotive market globally. The region’s embrace of new technologies and its burgeoning middle class fuel consistent demand across all vehicle segments.

The economic impact of these sales figures is profound. The automotive industry is a significant employer, a major contributor to GDP, and a driver of innovation in materials science, software development, and advanced manufacturing. Fluctuations in automotive sales can have ripple effects throughout the global economy, influencing everything from commodity prices to employment levels in related sectors such as parts manufacturing, logistics, and retail. The transition to EVs also presents a complex economic challenge and opportunity, requiring substantial investment in new production facilities, retraining of the workforce, and the development of new supply chains for critical battery components.

Expert insights from industry analysts suggest that the competitive landscape will continue to evolve. The race to develop and deploy autonomous driving technology, alongside advancements in connectivity and in-car digital experiences, will become increasingly important differentiators. Furthermore, the concept of mobility as a service (MaaS) is gaining traction, potentially altering traditional car ownership models. Companies that can adapt to these changing consumer behaviors and technological paradigms will be best positioned for long-term success. The ability to navigate complex regulatory environments, manage global supply chains effectively, and meet the growing demand for sustainable transportation solutions will be critical determinants of market leadership in the years to come. The 2023 sales figures serve as a snapshot of an industry in constant flux, highlighting the enduring strength of established players while signaling the rise of new challengers and the transformative power of technological innovation.